- IPPs must adapt their business models to stay competitive in a market with changing rules

- Successful players are transforming from subsidy-dependent project owners to customer-focused energy producers

Independent Power Producers (IPPs) stand among the key architects of the energy transition. However, the rules of the game have changed. The skills required of an IPP in this decade are radically different to those of five years ago. IPPs now face the imperative of adapting their business models and cultivating new skills to protect their returns. In this article, we cover the prominent shifts that the IPP business is undergoing and explore the new capabilities to address them.

“Halfway through their journey, IPPs have found that the goalposts have been moved, and they are now forced to adapt their business models to this dynamic environment.”

Moving goalposts

When most developers elected to become IPPs, the IPP model was simple: single technology project execution, delivering to a given country’s subsidy mechanisms. Returns were predictable and post Commercial Operation Date risks were low. However, the risk landscape shifted radically as subsidies were phased out. New risks at either end of the asset lifecycle have required IPPs to develop new skills.

First, at the front end of the asset lifecycle, most IPPs now converge around the integrated IPP model which includes project development activities. Development remains a fruitful business, but construction leaves IPPs increasingly exposed to supply chain and engineering procurement contract risks, exacerbated by power purchase agreements (PPA) commitments at financial close.

Second, at the other end of the generation chain, asset managers are now tasked with selling energy in open markets, either through PPAs or merchant trading. It is projected that between 2023 and 2024, 40% of solar and wind capacity in the U.S. and Europe will be procured via these market-driven mechanisms.[1] The number of PPA deals, and especially commercial PPA deals, has consistently grown over the last five years and is expected to continue to do so in the future and the volume of merchant exposure continues to rise (one third of the respondents of the Pexapark 2023 Renewables Industry Survey expect merchant exposure in their portfolio to raise to 30-50% by 2027. [2],[3],[4]

This market-based business model differs significantly. Successfully structuring PPA contracts and managing merchant exposure through trading desks is notably more challenging than subsidy harvesting. The focal point of an IPP’s ability to extract premia has shifted from selecting and developing projects to serving customer needs. This marks a shift from IPPs as project owners to IPPs as customer-facing manufacturing companies. The risk profile has evolved, with revenues now being uncertain and accompanied by volume, price and cannibalization risks.

Even within the market-based model, the definition of success is rapidly evolving. PPA buyers have historically been highly sophisticated driving prices down. Premia are reserved for complex products, such as 24/7 PPAs that enable to decarbonize 100% of the energy supply (for example, Google’s recent PPA contracts in Belgium and the Netherlands. [5] Here, the value is in delivery of a service, not volume. Intermittent generation special purpose vehicles are wholly incapable of providing these premium services, which require hybrid portfolios comprising of multi-technology assets and sophisticated trading operations. Durations of PPAs are also reducing as energy markets become more dynamic, falling from 17 to 11 years on average between 2012 and 2022. [6] Shorter-term agreements necessitate IPPs to be agile in responding to market conditions and optimizing project financing.

All this, on top of increasing competition (as ever more developers move into asset ownership) and a rising cost of capital, means that IPPs have found that halfway through their journey, the goalposts have been moved, and they are now forced to adapt their business models to this dynamic environment.

Building capabilities for success

To stay competitive and preserve margins, IPPs need to develop a new skillset to adapt to the changed business model. We believe the most important of these to be supply chain management, PPA origination and structuring, merchant trading, risk management, technology diversification, financial structuring and asset digitization.

Supply Chain Management: Integration of project development activities into the IPP value chain exposes the companies to supply chain risks. Growing share of hybrid projects also creates additional complexity by multiplying the size of supplier portfolio. Moreover, keeping with the theme of moving goalposts, the newly added teams of supply chain managers will have to navigate evolving regulations (like local content) in each country of operation.

PPA Origination and Negotiation: In the new market-based renewables landscape, mastering the art of PPA origination, structuring and negotiation is paramount. IPPs must possess the balance sheet, as well as credibility and structuring skills to tailor agreements to both sophisticated and unsophisticated buyers, balancing risk and reward to attract creditors and ensure long-term visibility. While evolving PPA demand offers the advantage of attracting a larger pool of potential buyers, particularly from the corporate sector, they also introduce heightened risk for the PPA provider (i.e., the IPP) and the project financiers on whom they rely. Structuring deals to shield the business from these risks demands a specialized toolkit which IPPs did not previously have.

Merchant Trading: With the rising volume of expected energy generation not contracted via PPAs, it is typically monetized though liquid electricity markets. Merchant trading has proven its attractions but requires specialist desks to navigate dynamic pricing, hedging strategies and market fluctuations to optimize revenue generation. Many IPPs have already established their own trading teams: for example, Sunnic Lighthouse GmbH handles the trading activity for the electricity produced by the portfolio of its parent company, Enerparc.

Risk Management: Supply chain risk, interest rate risk, foreign exchange risk, merchant price risk, customer risk – these staples of commercial operations for most of the last century are relatively recent to IPPs. None is individually challenging, but cumulatively they require a retooling of IPPs operational teams. Effective risk management is critical in unsubsidized markets. This applies to both the contracted and merchant generation. Instead of assessing each asset individually, IPPs must adopt a portfolio approach, identifying correlations in price and volume between assets. This necessitates the adoption of risk assessment models and improvements in data access and forecasting capabilities to evaluate risks accurately.

Technology Diversification: The need for resilient and adaptable portfolios also requires IPPs to develop expertise in creating and managing a broadening mix of renewable energy technologies to meet the growing need for predictable (i.e., hybridized) renewable energy supply from offtake customers. Portfolio risk management now has a role beyond just trading, extending to project development activities: a pure solar developer does little to mitigate its generation risk.

Financial Structuring: As the cost of capital increases and traditional loans or leverage ratios become less attractive, the need to develop strong financial structuring capabilities is ever more pressing. Finding the right mix of traditional equity, debt, grants, as well as alternative instruments such as development financing, mezzanine funding and green bonds can help IPPs enhance investment returns, or at the very least, stretch their equity to deliver their volume growth ambitions.

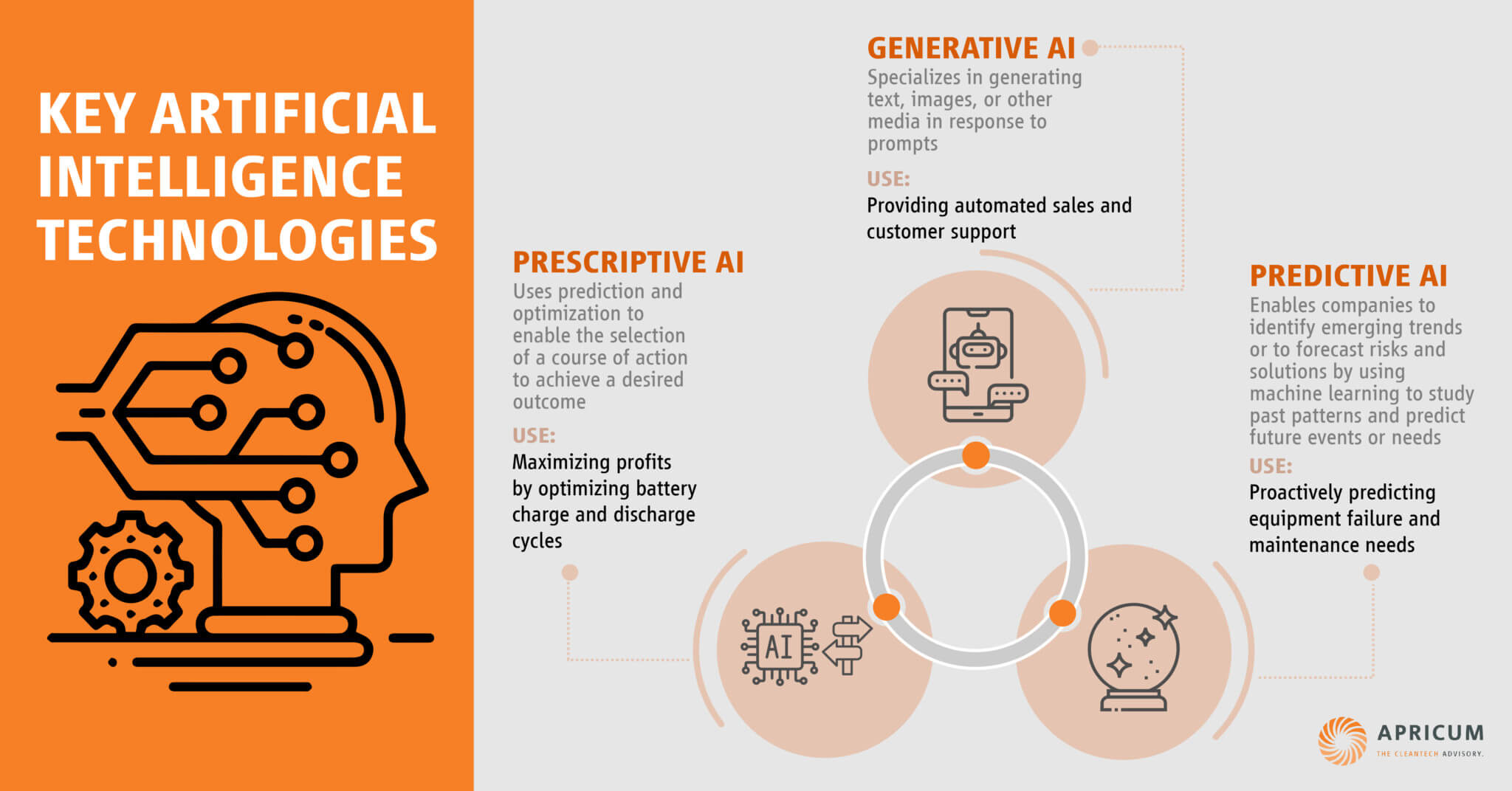

Asset Digitization: Access to high-quality granular data is an important enabler for addressing multiple challenges IPPs face: from providing better reporting to the PPA offtakers to enhancing energy yield, minimizing operational and insurance costs and predicting risks. Companies need to develop technology relationships and functions to collect, process and analyze data, as well as efficiently manage any data gaps (for example, through specialized software).

Example: Encavis

Encavis is a German-based IPP with most of the renewable energy portfolio revenue historically coming from feed-in-tariffs and long-term PPAs. To achieve its goal of operational portfolio growth and margin increase, the company decided in 2021 to revise its operating model and structure. This included the creation of three new departments dedicated to the new business model:

- PPA Origination, handling PPA contracts

- Energy Portfolio Management, overlooking merchant trading

- Energy Risk Management, tasked with analyzing risk exposure

Conclusion

All IPPs realize their environment has transformed, but most are too busy with delivery to take the time to assess and adapt to the changing landscape. The cumulative change from a single technology project company collecting subsidies to a multi-technology risk manager delivering energy services is profound, and requires profound changes to adapt, ideally before margin is leaked and inefficiencies are locked in.

From various engagements helping IPPs adapt and restore profitability, Apricum has learned that to succeed in the post-subsidy era, IPPs must equip themselves with a more comprehensive set of skills and capabilities, including supply chain management, PPA origination, merchant trading, technology diversification, risk management, financial structuring and data management practices. Indeed, this has now become a core service at Apricum. By mastering these skills, IPPs can not only navigate the challenges of the changing environment to the satisfaction of shareholders, but also differentiate themselves in an increasingly crowded field, as leaders in driving a clean, reliable and resilient energy generation system. One thing is clear: when the rules of the game change, strategies must adapt too. The challenge for management is finding the urgency and energy to refocus before performance suffers.

How Apricum can help

Apricum is a global transaction and strategy advisory firm dedicated to renewable energy and cleantech. We offer the alternative energy industry an integrated suite of growth-oriented consulting services for companies and investors. Backed up by the energy storage field’s top minds, deep local networks, and proven financial experience, we can maximize the value of your participation in the global energy market. Let us prepare and execute your next business transaction or design a specialized high-impact business model that drives the energy transition while creating growth and profitability for your organization and its stakeholders. If you would like to learn more about how we can enable your organization to compete and win in the booming renewable energy space reach out to Charles Lesser.

[1] https://www.iea.org/reports/renewable-energy-market-update-june-2023/are-market-forces-overtaking-policy-measures-as-the-driving-force-behind-wind-and-solar-pv

[2] https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/030223-interview-european-ppa-market-could-see-record-deals-in-2023-pexapark

[3] https://www.iea.org/reports/renewable-energy-market-update-june-2023/are-market-forces-overtaking-policy-measures-as-the-driving-force-behind-wind-and-solar-pv

[4] https://pexapark.com/renewables-industry-survey-report-2023/

[5] https://blog.google/around-the-globe/google-europe/clean-energy-progress/