- Over the last two years, nearly half of all permitted UK solar developments had co-located storage systems

- Apricum’s foresees the share of co-located projects significantly rising in the UK, and in markets where penetration is high and cannibalization and grid constraints pose growing risks

The long-standing UK consensus that “co-located storage doesn’t work” is rapidly crumbling. Over the last two years, nearly half of all permitted UK solar developments had co-located storage systems, marking a significant shift in the renewable energy landscape. In time, the co-location of storage may become the default development model for renewable energy. This article looks at the UK’s passing milestones and their drivers, as it holds lessons for other markets.

“Hybridization is finally spilling from PowerPoint to the countryside.”

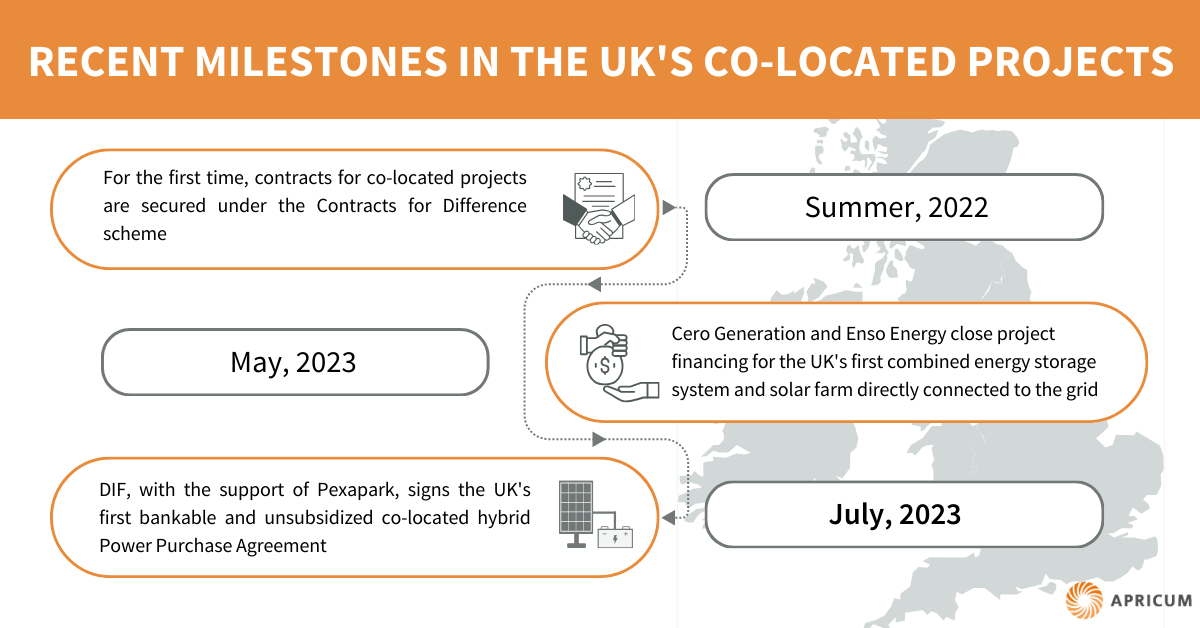

In the past 18 months, several crucial milestones have been achieved in storage co-location. Firstly, in the summer of 2022, co-located projects secured contracts under the Contracts for Difference (CfD) scheme, a notable development after the amendment allowing co-located storage within CfD contracts. Secondly, in May 2023, Cero Generation and Enso Energy closed project financing for the POI. The UK’s first combined energy storage system and solar farm directly connected to the grid.

More recently, in July, DIF, with the support of Pexapark, signed the UK’s first bankable and unsubsidized co-located hybrid Power Purchase Agreement (PPA) with Engie for a 55MW solar PV co-located with a 40MW storage asset. While specific to the UK, this trifecta of subsidy eligibility, project finance availability and PPA demand are a major step change to commercializing the aforementioned pipeline of supply. The typical scaling is even shifting from 20% of generation capacity to over 100% in a growing number of sites, and Apricum sees a growing number of large investors now preferring co-located projects.

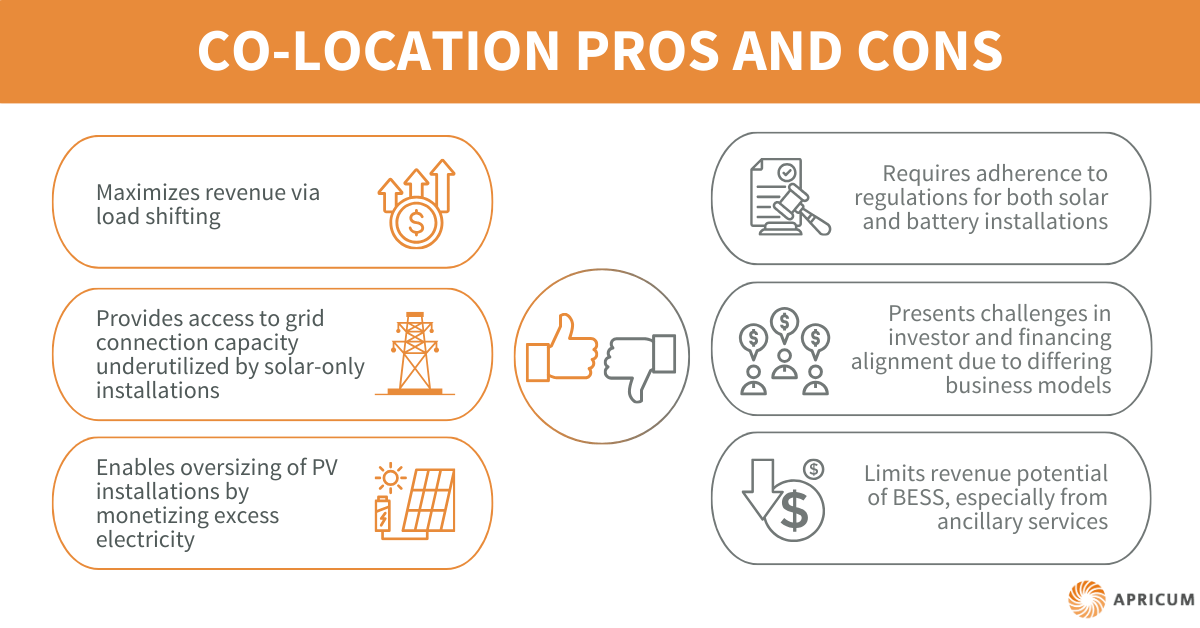

As the appetite for co-located sites grows, driven by their benefits, several challenges need addressing to ensure widespread adoption.

Benefits of co-location

Resolving cannibalization

At a generic systems level, as the penetration of renewables accelerates, each incremental project is more exposed to cannibalization impacts. High penetration markets therefore have the greatest need to mitigate cannibalization impacts, and load-shifting via the co-location of storage is one tool to do this. Storage protects long-term asset value and is increasingly seen as enhancing the value of PV projects.

Grid connection sharing

Long lead times for permitting and grid connection have been significant barriers to renewable deployment, not just in the UK but across Europe. While solar-only projects often use less than 20% of grid connection capacity, co-located projects allow storage to utilize some of the unused 80% capacity to access additional revenue streams. In some cases, these revenues mitigate the capital cost of the storage system.

Over-scaling production capacity

Battery-coupled projects are preferred by solar developers as excess electricity, which cannot be exported to the grid due to constraints, can still be monetized via storage. Moreover, if the system is DC-coupled (i.e., battery is connected to solar on the DC side and only one inverter is used, compared to separate solar and battery inverters for the AC-coupled system), storage can prevent excess clipping of the electricity production by a solar inverter. In both cases, co-location allows the oversizing of generation capacity, thus maximizing revenues from the industry’s principal constraint – grid connections.

Potential drawbacks and challenges of co-location

Planning and permitting process

Co-located projects require adherence to regulations for both solar and battery installations, adding complexity to obtaining permits within an already challenging process. Furthermore, if a solar developer, having already obtained a grid permit, decides to add storage capacity to the project, the connection date may be delayed. Nevertheless, as more co-located projects come online favorable changes in regulations and permitting processes are expected.

Deal structuring

Solar and storage projects have contrasting commercial models. PV projects offer long-term secure revenues, while battery storage projects operate in the merchant market, with 85-95% of revenues from ancillary services to the grid. Investors in these two types of contracts typically had divergent risk tolerance, which impeded investment. Splitting the contracts with different parties creates operational challenges and disputes over grid connection.

Additionally, debt funding remains challenging due to the relatively novel nature of co-located ventures, as financial institutions perceived them as higher risks, leading to higher interest rates, lower returns and limited investor interest. This is now changing as merchant risk tolerance thresholds increase, and particularly as utilities and energy players displace financial investors as the principal acquirors of solar asserts – they bring higher merchant appetite and less reliance on project finance. Further, the examples of hybrid PPAs and project financing for co-located projects mentioned earlier demonstrate that these offtake and funding challenges are starting to be overcome – even for financial investors. The hybrid PPA contracts are also expected to move from separate contractual agreements for renewable generation and storage assets (like the aforementioned PPA signed by DIF) towards a single blended contracts, supporting 24/7 green energy supply.

Constraints on battery storage revenues

BESS developers may be hesitant about co-locating with solar generation due to the merchant revenue impact. Grid constraints mean solar electricity export is prioritized, which can limit the battery’s revenue potential from ancillary services such as frequency response. And efficient DC-coupled connections further limit the ability to perform ancillary services. As a result, investors and buyers often prefer AC couplings. Finding the right trade-offs and tuning trading algorithms accordingly becomes crucial to minimize losses.

Technical challenges

The technical integration of storage systems with solar sites demands meticulous engineering expertise, which increases development time and costs. For example, grid constraints may prevent solar and storage capacity from exporting simultaneously beyond certain limits to avoid fines from distribution network operators. To comply, exports should be controlled and limited by hardware and software on the site

Conclusion

To date, only eight co-located projects are online in the UK. However, for the reasons outlined above, it is Apricum’s profound belief that the share of co-located projects will significantly rise in the future, in the UK, and across renewable energies’ traditional markets where penetration is high and cannibalization and grid constraints pose growing risks. For example, in Spain increasing cannibalization and supportive governmental policies (€150 million in grants were awarded for energy storage co-located with renewables in 2022) is already driving investors to look into co-located projects. Germany has also introduced a subsidy scheme favoring hybrid projects (e.g., solar-plus-storage project commissioned by Enerparc in April 2023) – therefore signaling a positive future for co-location.

Developers venturing into co-located projects face significantly more complexity – both within permitting and contracting, financing and technology planning. Strengthening contract structuring and risk management capabilities will be imperative to fully realize the benefits of co-location. But these upfront investments create more resilient and valuable long-term assets.

This increased complexity spreads to transactions too: monetizing co-located development assets requires a more sophisticated vendor – or broker – than can sell vanilla standalone project rights. The pool of competent advisors (and buyers) is narrower. This depth of modelling, engineering and financing competence distinguishes Apricum’s service, and we expect to play a growing role in transacting co-located assets, in the UK and across Europe.

How Apricum can help

Driving the energy transition forward for 15 years, Apricum is the transaction and strategy advisory firm exclusively dedicated to renewable energy and cleantech. With offices in Berlin, London, Dubai and Paris and a local presence in 11 countries, Apricum has over 70 employees. Our investment bankers leverage Apricum’s deep industry expertise in our consulting and engineering teams for companies, investors and public institutions. Apricum is sought for corporate finance, project finance, mergers and acquisitions, joint ventures, fundraising, due diligence, project advisory and bespoke pipeline acquisitions. If you would like to learn more about how our services can support you in the energy storage space, reach out to Apricum Partner Florian Mayr. For guidance and support in the renewable energy transaction advisory space, contact Partner Charles Lesser.

(Article previously appeared in the October edition of PV Magazine)