- Charge point operators’ (CPO) geographical expansion is relatively easier in the US than in Europe

- The US CPO market is concentrated, while the European CPO market is fragmented – representing major strategic and M&A opportunities

As of early 2024, in the US there are an estimated 3 million battery electric vehicles (BEVs) on the road and 150,000 public EV chargers. This equates to a 20:1 vehicle-per-charger ratio. In Europe, there are an estimated 6 million BEVs and 750,000 public EV chargers, translating into an 8:1 vehicle-per-charger ratio.[1] One may therefore conclude that the EV charge point operator (CPO) market is more mature in Europe than in the US. To what extent is this true?

CPO geographical expansion is relatively easier in the US than in Europe

The US currently benefits from a stronger top-down policy push. The 2021 Bipartisan Infrastructure Law allocated $7.5 billion towards EV charging infrastructure. The 2022 Inflation Reduction Act secured a $7,500 tax credit on EVs (which has been directly offered at point of sale since January 1, 2024) and a 30% tax credit on EV chargers. The federal government created a Joint Office of Energy and Transportation to set rules and standards for these funding applications. It focuses on road infrastructure deployed by the federal government such as the US Highway System and the Interstate Highway System. This provides consistency in rules and timing for CPOs looking to deploy fast charging infrastructure along US highways.

In contrast, Europe currently displays a less coherent policy. Although the European Green Deal was passed in 2020, member states apply its rules at their own pace and remain divided on related issues. France is adopting a stronger “anti-China” stance in an attempt to support its local economy: since January 1, 2024, its green bonus (€5,000 EV purchase incentive) has essentially excluded any vehicles made in China (Chinese automakers have largely reduced EV purchase prices by a similar amount since then, questioning the effectiveness of this policy).

Germany successfully had the EU exempt e-fuels from 2035 ban on new sales of combustion engine cars, in an effort to protect the status quo of its legacy automaker industry. The UK’s withdrawal from the EU (effective since January 2020) adds another major policymaker for CPOs to follow and engage with.

Similarly, long-term tenders for fast EV charging station concessions happen at the country level in Europe. Although the Netherlands has been releasing tenders and selecting CPOs for fast charging stations along highways since 2013, France only did so in 2020–2022 and Germany recently concluded a major tender in 2023. CPOs therefore need to engage with each European country individually. In the US, although the actual funding application process was done at the state level, several states followed the same template, and the timing and rules were set by the federal government, making it relatively easier for CPOs to submit applications and prioritize locations.

Securing contracts with private site hosts follows a similar pattern to securing contracts with public site hosts. For example, in the US, McDonald’s has mostly procured with ChargePoint [2] and Blink [3] to deploy EV chargers at their locations across the country . In Europe, it has procured with a different CPO in each country and at different times: with Vattenfall in the Netherlands[4], with InstaVolt in the UK [5], with Izivia in France [6], and with Endesa X in Spain [7].

Finally, other obvious factors make expanding geographically across the US easier than across Europe. The US has a single official language and currency. Conversely in Europe, business development, call center, and other market-facing departments need to have staff speaking all major languages of countries served and targeted by the CPO. Operating in a multi-currency environment requires a more sophisticated backend payment system and introduces foreign exchange risk in the CPO’s corporate financials.

The US CPO market is concentrated, while the European CPO market is fragmented

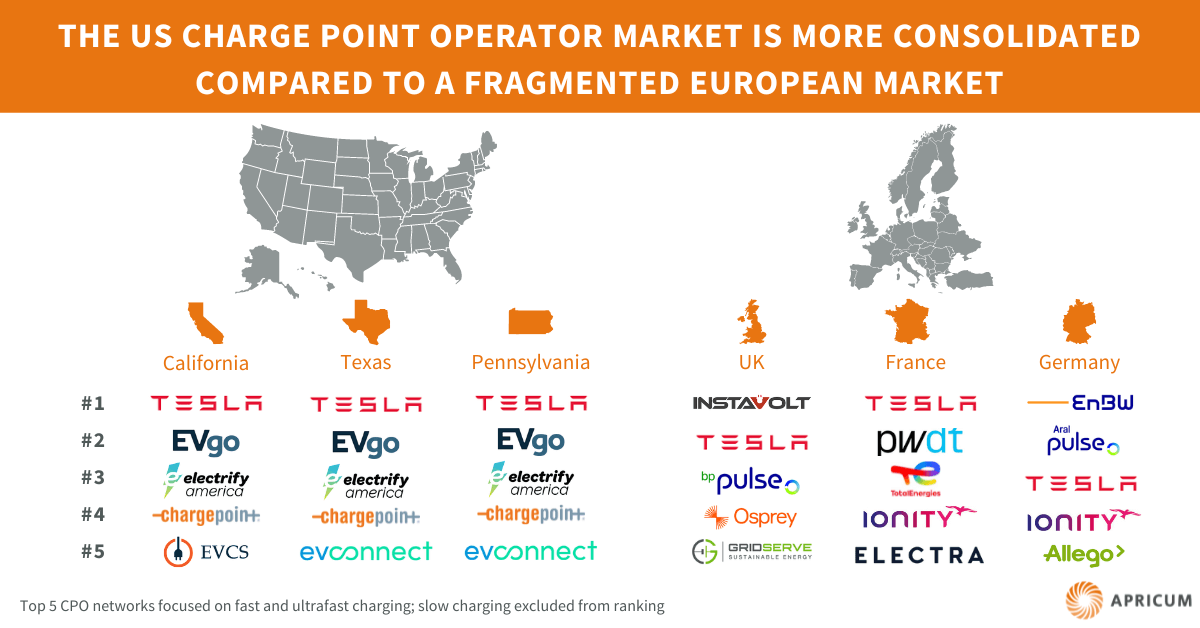

Comparing the fast-charging CPO landscape in the US vs. Europe gives a highly contrasted picture (doing so with the slow charging landscape gives a similarly contrasted picture, with different CPOs leading the way). In the US, Tesla currently holds a >50% market share, with few players making up the remainder of the market. The top 4 fast charging CPOs in California, Texas and Pennsylvania are the same: Tesla, EVgo, Electrify America and ChargePoint. One needs to go down to the #5 player to start seeing some differences: the #5 player in California is EVCS, while the #5 player in Texas and Pennsylvania is Schneider Electric-owned EV Connect.

Conducting the same exercise in Europe highlights a higher fragmentation. The top 5 fast charging CPOs in the UK are EQT-owned InstaVolt, Tesla, BP Pulse, Cube Infrastructure-based Osprey and Gridserve (backed by Infracapital, TPG Rise, and Mitsubishi). The top 5 players in France are Tesla, Antin-backed Power Dot, TotalEnergies, Ionity (a joint venture of several automakers) and Electra (backed by several large pension funds and private equity firms). The top 5 players in Germany are EnBW, Aral Pulse (part of BP), Tesla, Ionity and Meridiam-owned Allego.

In the US, market concentration is expected to reduce as the $5 billion National Electric Vehicle Infrastructure (NEVI) Formula Program part of the Bipartisan Infrastructure Law allocates funding to multiple CPOs beyond the historical market leaders. In Europe, the market fragmentation picture varies significantly from country to country. In Germany, over 100 CPOs operate at least 100 public EV chargers (see our recently published article on the German market here). More mature countries are more concentrated. For instance, in Norway, where BEV sales penetration is over 80%, Infracapital-owned Recharge holds a 25% market share in fast charging.

The level of market fragmentation in Europe provides an opportunity for CPOs and investors. As explained in our recently published article here, we see a wave a consolidation coming. This will result in a more consistent and improved customer experience for EV drivers. This will also allow winning CPOs to achieve economies of scale and successfully transition from being a country leader to being a European leader. This may not necessarily take the form of a CPO acquiring another one. We can expect local leaders to merge with one another, creating a regional leader and allowing their respective shareholders to achieve their expected return on investment.

How Apricum can help

Apricum is a strategy consulting and investment banking boutique focused on the energy transition. What differentiates us is the depth of our sectorial expertise – we have a dozen PhDs on staff across energy transition technologies. Our services in green mobility include growth strategy (strategy review, business plan, go-to-market strategy), commercial due diligence (buy- and sell-side) and financial advisory (capital raise, sell- and buy-side M&A). Over 15 years we have delivered over 400 successful projects in 30 countries. If you would like to learn more about how we can support your company in entering or expanding your activities in green mobility, please contact Nikolai Dobrott.

[1] Apricum estimates based on International Energy Agency, Alternative Fuels Data Center, European Alternative Fuels Observatory

[2] https://investorplace.com/2023/08/blnk-stock-alert-blink-charging-signs-deal-to-bring-ev-charging-to-mcdonalds/

[3] https://www.chargepoint.com/about/news/mcdonalds-and-novacharge-deploy-chargepoint-network-ev-charging-stations

[4] https://incharge.vattenfall.de/wissens-hub/articles/mcdonald-s-vattenfall-schnellladestationen-fuer-eine-gruenere-zukunft

[5] https://www.mcdonalds.com/gb/en-gb/newsroom/article/ev_rollout.html

[6] https://www.electrive.com/2023/11/22/izivia-will-install-2000-high-power-charge-points-at-mcdonalds-in-france/

[7] https://www.endesa.com/en/press/press-room/news/energy-transition/electric-mobility/endesa-x-way-has-operating-more-200-recharge-points-hundred-mcdonalds-restaurants

This article was written by former staff members Alex Metz and Philipp Braukmann.