- Integration of solar carports and EV charging platforms is revealing pathways to sustainable transport and compelling economic advantages for businesses

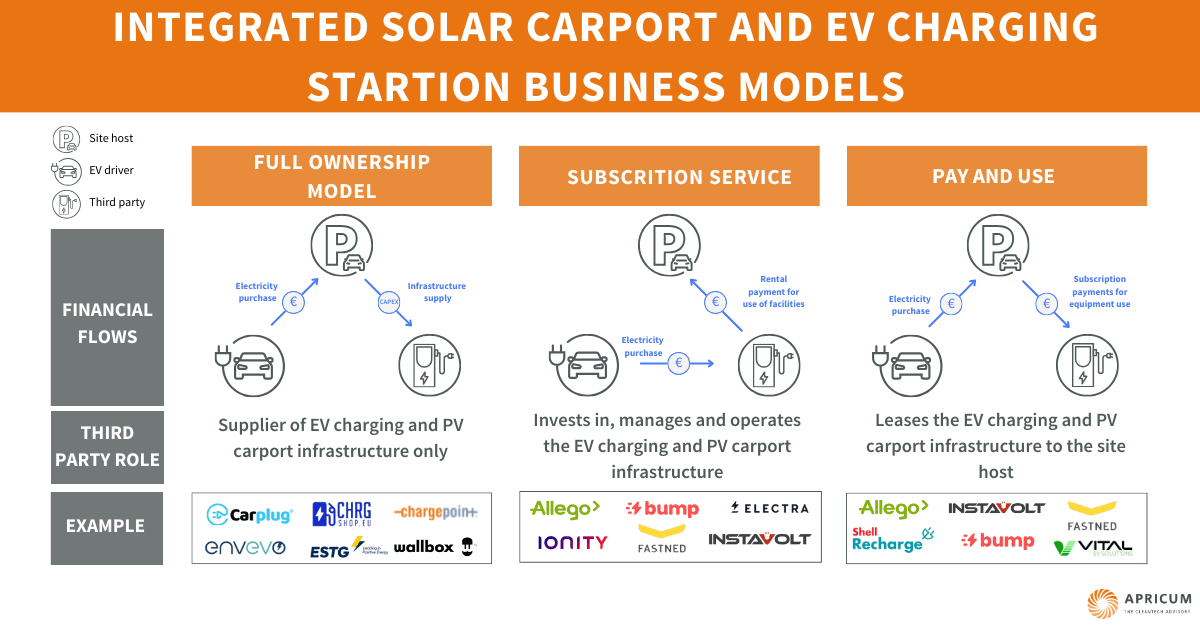

- Apricum identifies three distinctive business plans guiding stakeholders in this nascent sector

Introduction

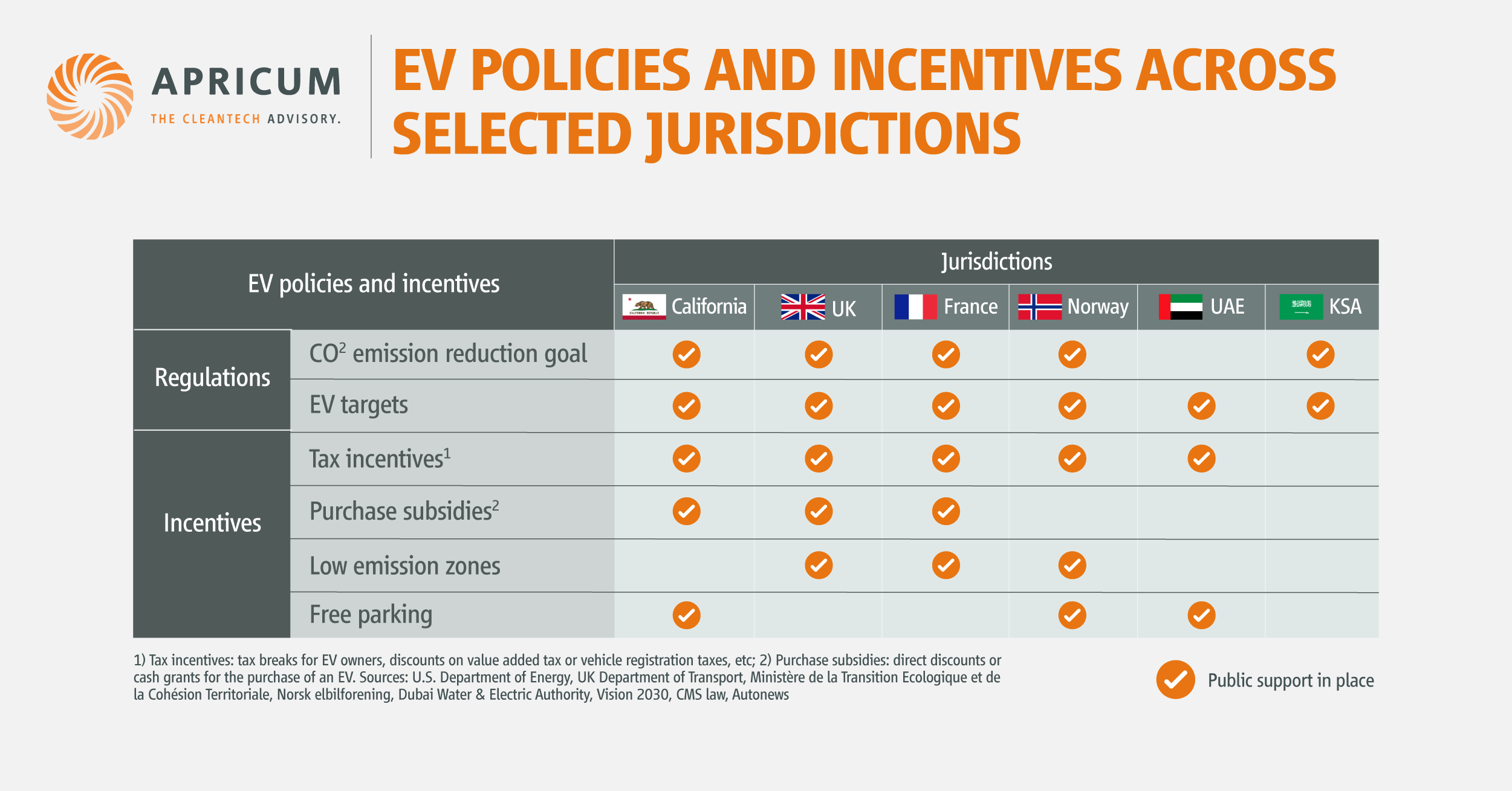

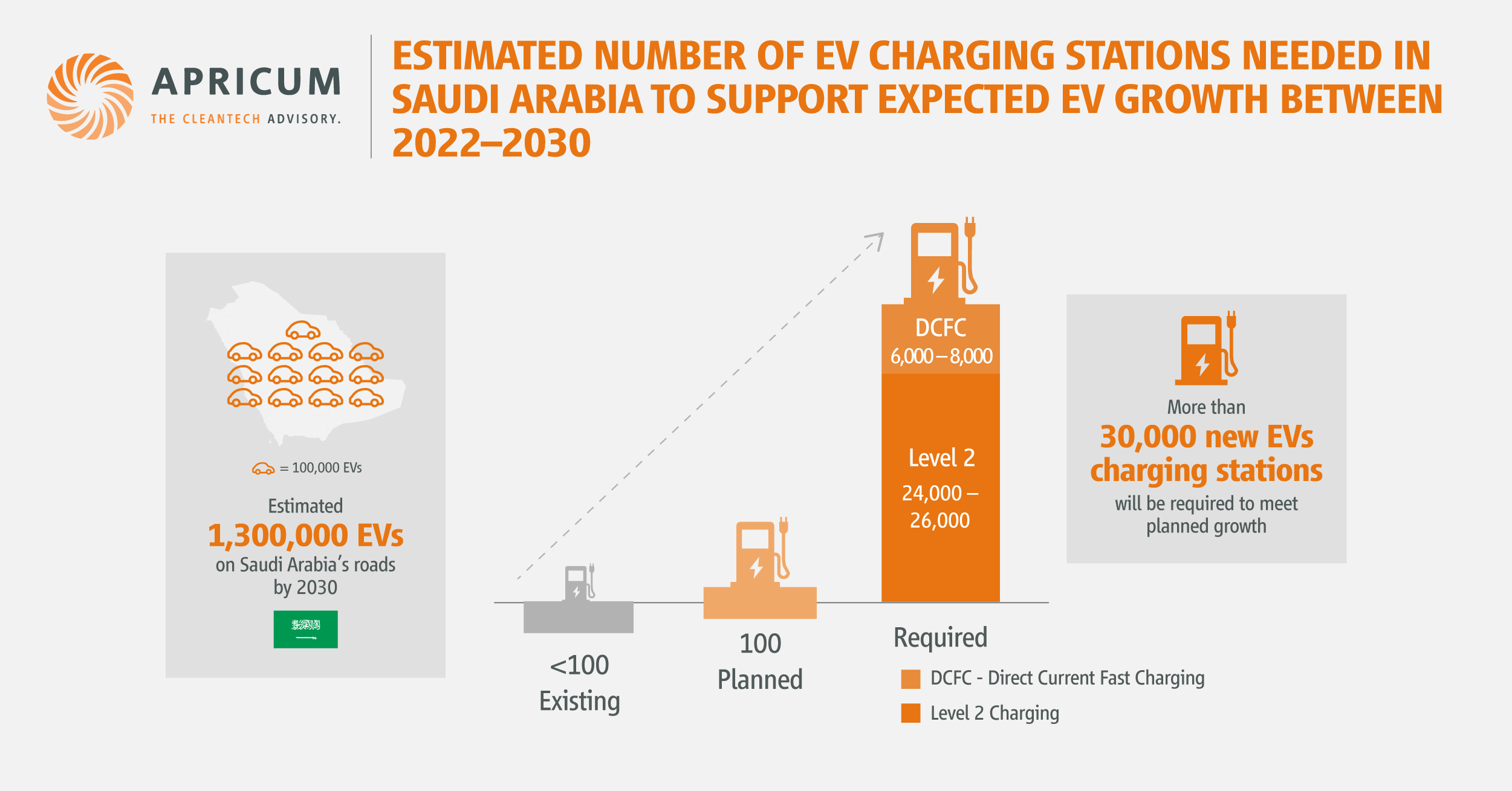

In March 2023, France enacted significant legislation mandating the installation of solar carports in outdoor parking lots covering an area exceeding 1,500 square meters.[1] This pivotal move echoes similar laws implemented in six German states (Bundesländer).[2] These directives complement existing regulations governing the installation of charging infrastructure and align with the EU’s goal to end the sale of internal combustion engine vehicles by 2035.[3] The transition toward sustainable transportation has significantly amplified the demand for an extensive EV charging infrastructure.[4] Concurrently, the heightened emphasis on renewable energy sources has fostered an expanded deployment of photovoltaic (PV) systems across diverse sectors.[5] The convergence of these sustainable technologies —PV systems and EV charging stations— stands as a promising solution. Not only does it address the escalating need for charging facilities, but it also harnesses clean, renewable energy to (at least partially) power these stations.

The transition toward sustainable transportation has significantly amplified the demand for an extensive EV charging infrastructure

Solar carports and EV charging stations

The integration of solar carports with EV charging stations provides monetary and non-monetary benefits. The main monetary benefits relate to reduced electricity consumption (through on-site power generation) and electricity sales (to EV drivers and electricity grid operators). Other monetary benefits can include the sale of fuel credits depending on the country. Additionally, depending on geographies and jurisdictions, the site host can benefit from governmental incentives that promote the adoption of such sustainable infrastructure.[6] These projects also provide non-monetary benefits. Solar carports offer weather protection from precipitation and direct sun. Co-located solar carports and EV charging stations can also help the site host reduce its carbon footprint and bolster its sustainability reputation.

Several factors can affect how much a site host can benefit economically from combining solar carports with EV charging stations:

- EV charging station electricity sales: The amount of revenue generated will depend on the number of EV drivers charging at the parking lot and the average amount of electricity purchased by EV drivers. High-traffic sites can typically expect higher charging station utilization rate.

- Solar PV yield: The amount of electricity that can be generated will depend on technical characteristics of the PV system (such as cell efficiency of the modules and the number of modules) and their exposure to solar irradiation (which depends on latitude and weather conditions).

- On-site facility electricity load: The amount of solar PV electricity generated on-site may exceed the amount of electricity used to charge EVs, especially at times of the day when EV charging station utilization is low. Excess generation may be used to serve electricity load at adjacent facilities, thereby reducing the site host’s electricity bill. In case there is excess electricity left after serving local load, the remaining amount may be sold back to the grid (at a price that is typically lower than retail rates).

- Co-located battery energy storage system: Batteries can help regulate the consumption of electricity and optimize the generation of revenues, however, depending on the case, the benefits of a battery energy storage system may not outweigh its significant upfront cost.

Apricum classified four categories of commercial and industrial players poised to benefit from such projects:

- Retail and entertainment venues: sports arenas, museums and monuments, shopping malls and centers, amusement parks, hotels and resorts, convention/ exhibition centers and concert halls/ theaters.

- Medical and educational centers: schools, universities and hospitals

- Transportation hubs: airports, seaports, train stations and highway rest areas

- Large professional areas: large office buildings, industrial complexes, logistics warehouses, car dealerships and rental offices and government buildings

The ideal candidate for such a project should be a site host that can benefit the most from the above criteria. Therefore, it would be a facility that has a large majority of its electricity needs during daytime and has a high potential for the sale of electricity through EV chargers. According to Apricum’s analysis, the best candidates are retail and entertainment venues that operate mostly during the day, followed by large professional areas frequented by predominantly EV drivers or facilities that house EV fleet operators.

C&I business plans and market players

In the realm of solar carport and EV charging station integration, three primary business models have emerged, each offering unique advantages and implications for stakeholders involved.

Full ownership: The full ownership model entails the site host undertaking the entirety of the capital expenditure, assuming ownership of the infrastructure, and enjoying the complete benefits derived from the project. This approach grants the site host autonomy in decision-making and full control over operations, offering long-term benefits and direct revenue streams from energy sales and savings. However, it requires a significant upfront investment and assumes the responsibility of sourcing, financing, maintenance and operations, potentially posing financial and logistical challenges.

Pay and use: In contrast, the pay and use model involves a service provider investing in the infrastructure, assuming operational control, and selling the generated energy to both the site host and EV drivers. Under this model, the service provider pays rent for utilizing the parking lot space (this rent may have a fixed and a variable component, e.g., based on EV charging station utilization). This approach offers a reduced financial burden for the site host, transferring ownership and operational responsibilities to the service provider. The site host benefits from reduced upfront costs but relinquishes control over infrastructure ownership and operations, relying on the service provider for energy provisions.

Subscription model: Another alternative is the subscription model, wherein the site host leases the project infrastructure from a service provider, gaining access to the benefits while paying a periodic fee. Here, the service provider retains ownership and operational responsibilities, offering the site host access to the infrastructure without the burden of capital expenditure. This model provides flexibility in cost management for the site host, although it may involve higher overall costs due to subscription fees and a lack of ownership benefits.

Selecting the ideal business model for solar carport and EV charging station projects remains a pivotal decision, contingent upon project-specific conditions and stakeholder preferences. The suitability of each model varies based on factors such as capital availability, risk tolerance, operational control and desired financial outcomes.

Summary

Three different stakeholders can benefit from integrating solar carports with EV charging stations. First, investors, particularly infrastructure funds, can capitalize on this promising convergence and gain exposure to a futureproofed infrastructure blending solar PV and EV charging. Second, solar PV developers and producers should consider integrating EV charging into their offerings and act as a one-stop shop for site hosts. Similarly, EV charge point operators should explore strategic partnerships with solar PV developers and producers. Third, digital energy players should develop comprehensive solutions spanning across solar carports and EV charging, ensuring seamless integration, efficient operations, and optimized performance related to on-site monitoring, control and management.

How Apricum can help

Apricum can help investors, solar PV developers and producers, EV charge point operators, and digital energy players figure out how to position themselves in this new convergence. We can support growth strategy (strategy review, business model design, go-to-market strategy), commercial due diligence (buy- and sell-side), and financial advisory (capital raise, sell- and buy-side M&A). We have worked with some of the largest and most pioneering players in North America and Europe. If you would like to learn more about how we can support your company in entering or expanding your activities in the electric vehicle space, please contact the head of our green mobility practice, Director Alex Metz.

Visit our Green Mobility page for more information about our strategy consulting capabilities in the EV space

[1] Loi n° 2023-175 du 10 mars 2023 relative à l’accélération de la production d’énergies renouvelables

[2] Inter Solar Europe: Huge Untapped Potential: Parking Lot PV

[3] European Commission: Fit for 55: EU reaches new milestone to make all new cars and vans zero-emission from 2035

[4] European Environment Agency: New registrations of electric vehicles in Europe

[5] Energy monitor: EU solar deployment rate soars by almost 50% in 2022 – report

[6] European Commission: European Alternative Fuels Observatory