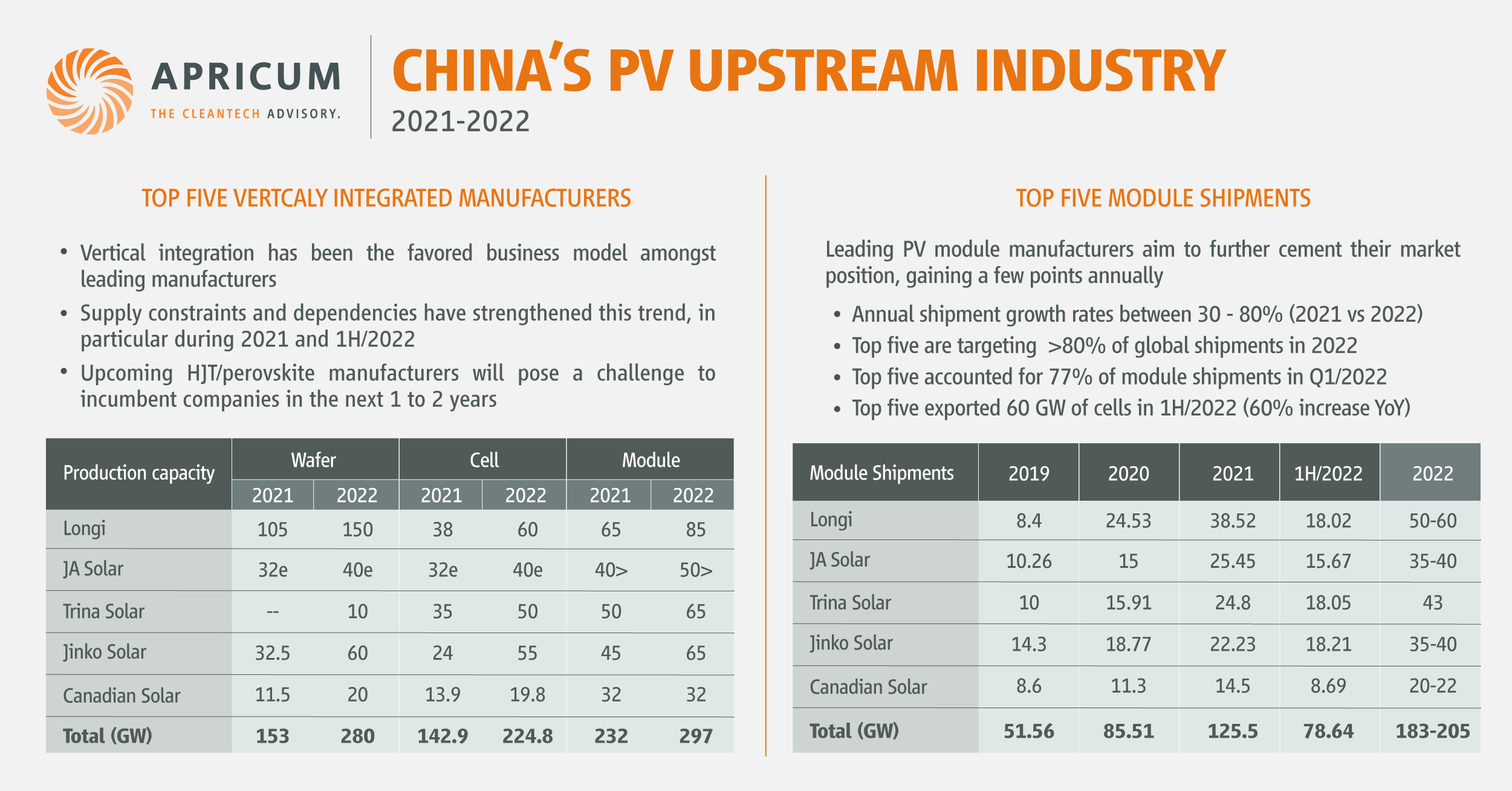

Over the past nine months, the growth rates of China’s solar PV industry, both up and downstream, have not failed to impress. In detail: production output of polysilicon, wafers, cells, and modules have all increased by more than 50% YoY. By June, module shipments of the top ten manufacturers crossed the 100 GW mark and by the end of September may have reached 140-150 GW (2021: 133 GW). Just five of these top ten have set shipment targets of between 183-205 GW. According to China’s PV Industry Association (CPIA), the export of solar modules has generated $35b, up 110% YoY as of October 2022.

Equally striking are the upstream-related production capacity expansion plans. An example is polysilicon: in 2021 China was home to 530,000 tons and, provided all company announcements will be realized, could potentially amount to 1.1 to 1.2 million tons, 2.2 to 2.5 million tons, and 3 to 4 million tons by 2022, 2023 and 2024 respectively. At the same time, wafer, cell, and module production capacity could each reach 550-600 GW by December 2022.

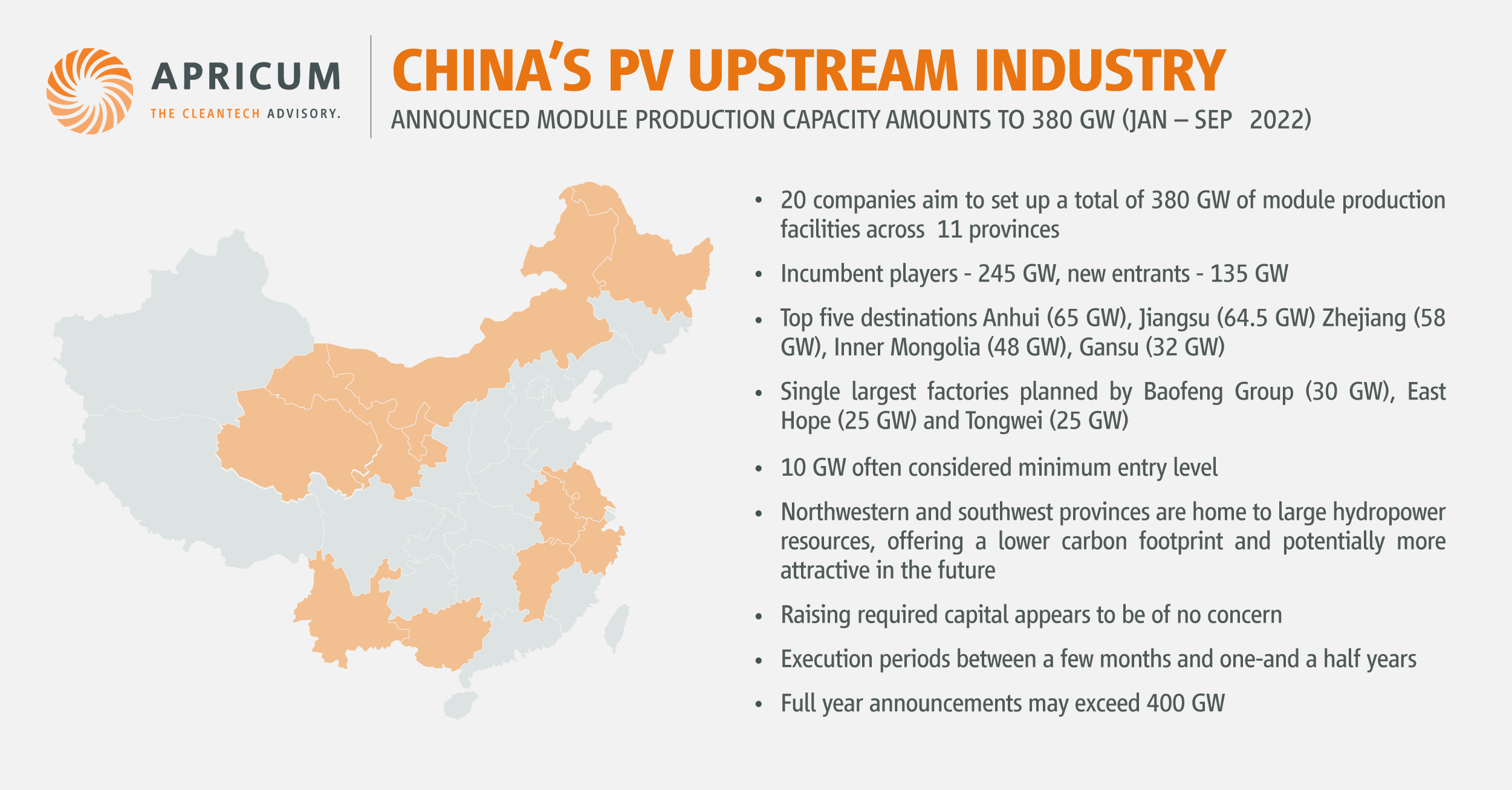

Furthermore, since January 2022, 20 companies have disclosed plans to increase module production to a total of 380 GW within the next few months or up to one and a half years. New entrants often consider a 10 GW factory as the minimum entry level, in order to be competitive. The single largest fabrications are projected by Baofeng (30 GW), East Hope (25 GW) and Tongwei (25 GW). During the same period roughly two dozen companies revealed their respective TOPCon cell expansion plans, combined aiming at approximately 224 GW. Unlike module manufacturers, new entrants start with low single-digit capacities of 2-3 GW. The largest fabrications planned by Mubang High-Tech is 20 GW, with Royal Group planning for 20 GW and Jolywood 16 GW.

Regarding domestic demand for solar PV, both central and provincial government entities have been fairly proactive in approving substantial project pipelines since the onset of the 14th Five-Year-Plan in 2021. So far, the former has approved two batches of so-called GW-Bases featuring hybrid plants mainly consisting of solar PV and wind. The first batch of 97 GW plants received approval in late 2021 and they are planned to reach grid-connection by December 2023. The second batch (455 GW) got its green light in spring 2022 with an aim to be ready by 2030 and in early October 2022, China’s National Energy Administration (NEA) officially requested applications for a third batch. Although details are still a bit sketchy, it appears that the focus on pure power generation is gearing towards a greater emphasis on using locally-generated renewable power to produce green hydrogen, amongst other uses.

Moreover, in August of 2021 the NEA initiated a new pilot program specifically designed to promote the deployment of distributed solar PV. Accordingly, by the end of 2023, no fewer than 50%, 40%, 30%, 20% of existing government, public, commercial, and rural buildings across 676 counties shall have a solar rooftop system. Assuming 120-150 MW per county, total demand deriving from this program alone could be in the order of between 80 and 100 GW by the end of 2023. However, estimates suggest that only 20 GW have been installed to date. Nevertheless, momentum is strong, reflected by the fact that 63% out of 1H/2022 (30.88 GW) installations are made up by C&I and residential PV systems. Apricum’s full year estimates for distributed PV is between 40 and 50 GW.

In order to complement national policies, since the fall of 2021 dozens of local jurisdictions have published even more ambitious policies like the Province of Zhejiang which has set a minimum rooftop coverage target for both new public buildings and new factories at 30%, whereas the Chongqing municipality even targets 50% by 2025. Several industrial parks specifically address C&I installations often aiming at 80% by 2024.

One exception is Jiashan County, Zhejiang Province which requires all new factories with a rooftop space larger than 1,000 sqm to have a rooftop system in place. In numerous cases these local jurisdictions offer single one-time hardware procurement subsidies or a feed-in-tariff. The latter for usually two to three years.

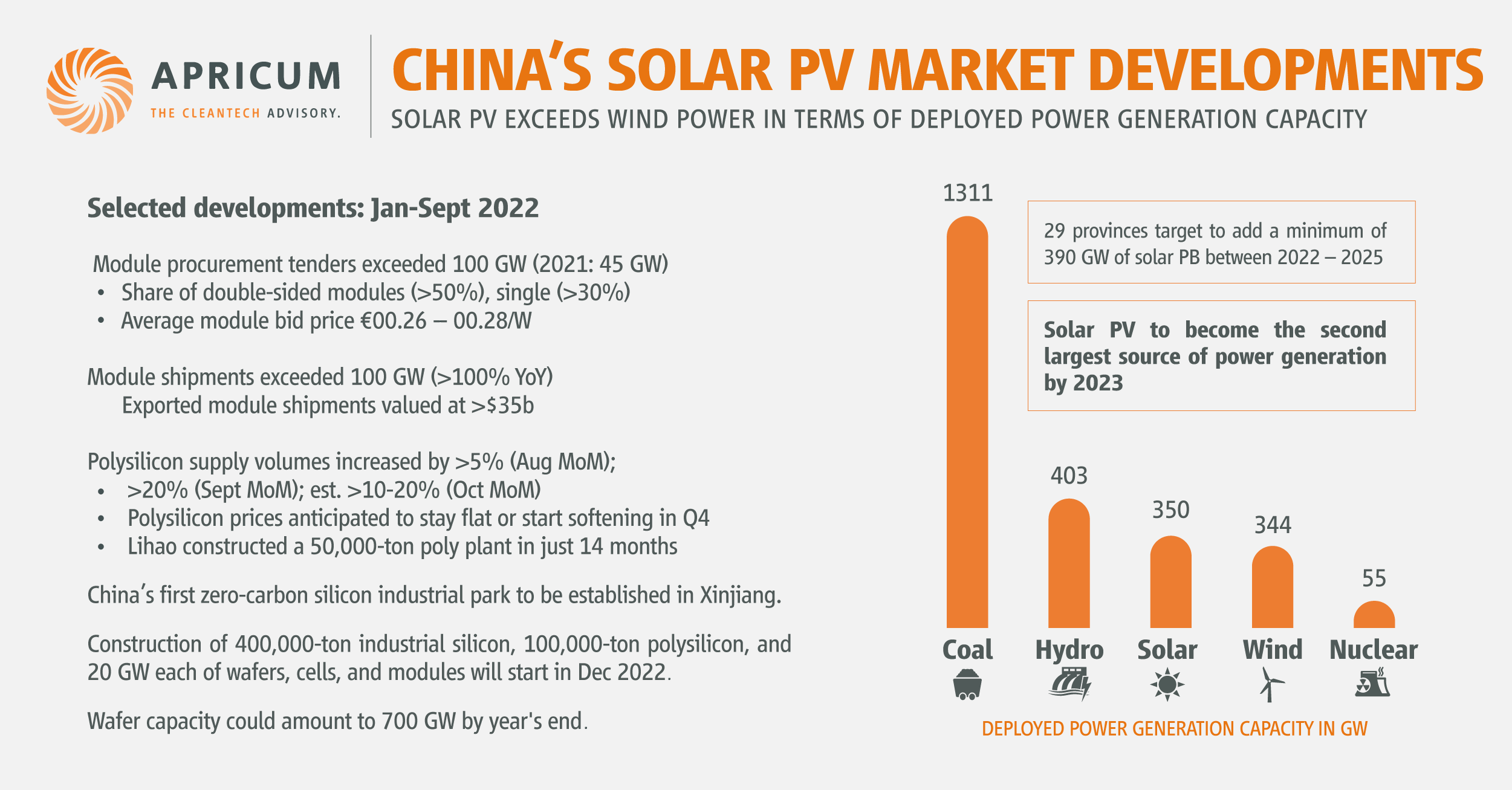

If the NEA’s 14th Five-Year-Plan for Renewable Energy Development (2021-2025) lacked a clear-cut solar PV deployment target, provincial plans are more concrete. Twenty-nine provinces have released their official plans and accordingly are aiming to add a total of 390 GW by 2025. If 2021 installations were to be ignored, because a decent amount of last year’s projects were carried over from previous years, this translates into roughly 97 additional GW annually through 2025.

In the context of the above, according to NEA, in the first nine months of 2022 a total of 52.6 GW has been installed, representing an increase of 132% YoY. By late September 2022, cumulative solar PV installations exceeded the 350 GW mark, thus overtaking wind installations by a margin of approximately 5-6 GW. In Apricum’s view, solar PV will become China’s second-largest source of power generation by mid-2023, surpassing hydropower which currently totals 403 GW.

China’s 14th Five-Year-Plan (2021-2025) – An Age of Ambition and Innovation

Ever since October 2020 when China’s president Xi Jinping announced that China aims to achieve carbon peaking and carbon neutrality by 2030 and 2060 respectively, on all administrative levels renewable energy has been seen as the next growth engine and the means to structurally upgrade the prevailing industry infrastructure across the country, as well to ensure these climate change related commitments can be honored over the longer term.

As of October 2022, the State Council, national ministries, and provincial governments have successively issued more than 60 policies, featuring carbon peaking action plans covering fields like energy, industry, transportation, and urban/rural affairs. There have also been additional energy sector related plans like the 14th Five Year Plan for Renewable Energy Development, the 14th Five-Year Implementation Plan for New-type Energy Storage Development, or the Medium and Long-term Development Plan for Hydrogen Energy Industry (2021- 2035).

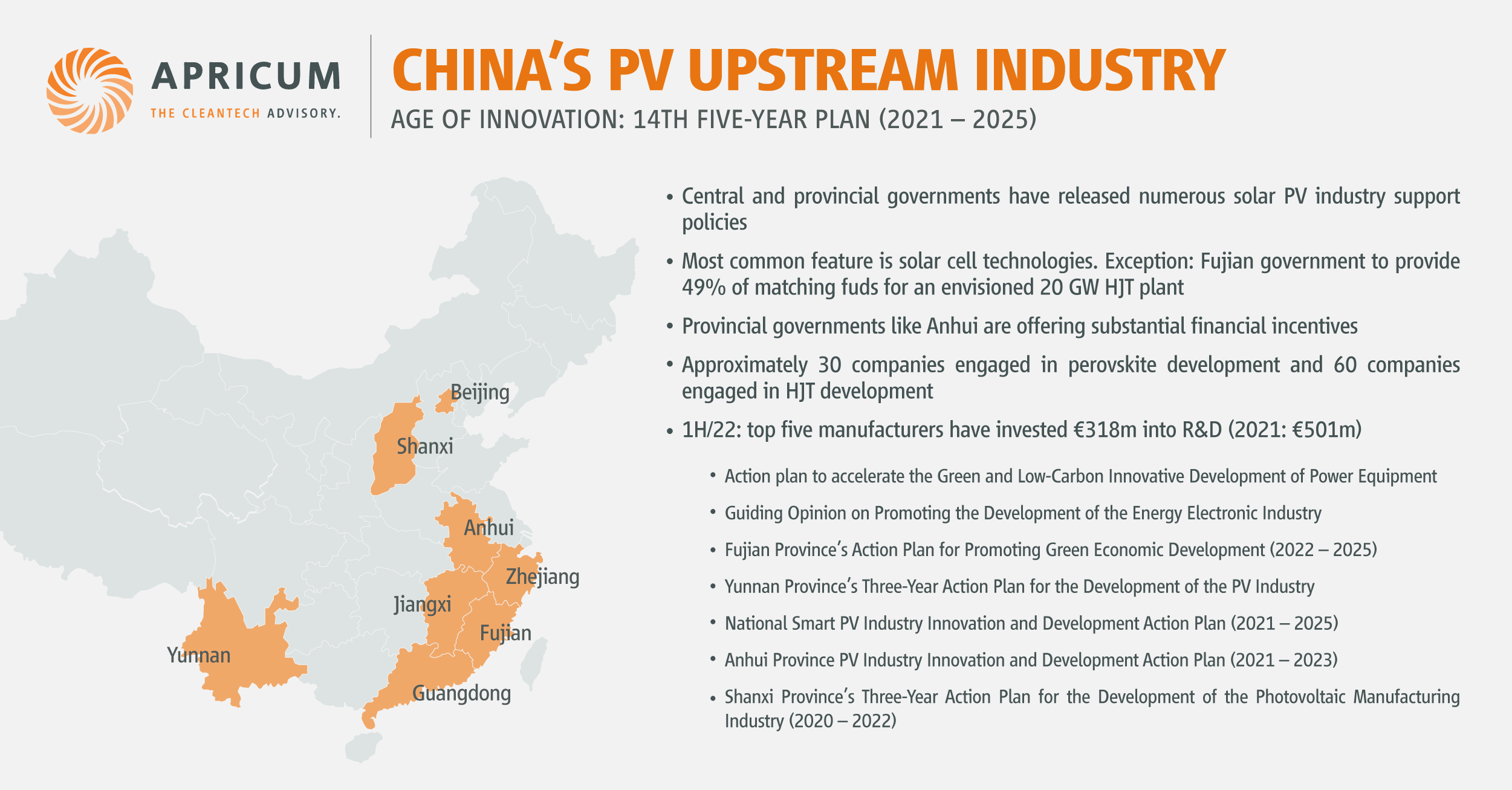

However, possibly due to changes of the international political environment and compared to previous Five-Year-Plan periods, solar PV related indigenous innovation and technological advancements appear to have gained in importance, reflected by numerous policies like the National Smart PV Industry Innovation and Development Action Plan (2021-2025), the 14th Five-Year Plan for Industrial Green Development, Guiding Opinion on Promoting the Development of its Energy Industry, the 14th Five-Year Plan for Scientific and Technological Innovation in the Energy Sector or the Action Plan to Accelerate the Green and Low-Carbon Innovative Development of Power Equipment. Recycling solar panels has gained national attention too, being specifically addressed in the Implementation Plan for Accelerating the Comprehensive Utilization of Industrial Resources and the 14th Five-Year Plan of Circular Economy Development.

Overall, unlike previous Five-Year plans, what sets these above-mentioned plans apart are their increased level of detail, often specifically elaborating each part of the value chain. Current and future types of cell technologies appear to have also received special attention.

In addition to national level policy announcements, provinces like Anhui, Fujian, Shanxi, Yunnan or Guangdong have issued provincial solar PV industry development actions plans. The latest example is the Province of Guangdong releasing the nation’s first provincial level Silicon Energy Industry Development Action Plan 2022-2025.

The aim is to develop and cultivate an entire silicon energy-based energy ecosystem. By 2025, the provincial silicon energy industry is expected to generate RMB 200b (€28b) of annual turnover. By then, the annual turnover of three to five companies shall exceed RMB 10b (€1.4b) each. Against this backdrop, the nation’s first Zero-Carbon Silicon-Based Industrial Park will be constructed in the Autonomous Region of Xinjiang. Once established, (no specific date) the park shall host 400,000 tons of industrial silicon, 100,000 tons of polysilicon and 20 GW each of wafer, cell, and module production capacities.

In the context of innovation and R&D spending, 2022 could be a record year. Leading companies like Canadian Solar, JA Solar, Jinko Solar, Longi, and Trina Solar have jointly invested up to €318m in the first six months, around €200m less than 2021’s €500m.

Fiscal, Financing and Taxation

Obviously, ambitious plans require some form of fiscal support either provided by the state and/or private sector. In this context, in late August 2022, the State Taxation Administration issued its Guidelines for Preferential Tax & Fees Policies to Support Green Development. Out of 56 designated policies, a handful specifically addressed solar PV.

Two weeks later, the Ministry of Finance (MOF) released a notice regarding the Fiscal and Taxation Support Plan for Promoting Ecological Protection and High-Quality Development in the Yellow River Basin amongst others, explicitly mentioning the solar PV industry. The Yellow River Basin covers Gansu, Henan, Inner Mongolia, Ningxia, Qinghai, Shaanxi, and Shanxi Province. These provinces are home to China’s largest coal mining operations and a few years ago were singled out as the being the center of China’s envisaged industrial transformation.

However, the lion’s share of capital is being raised by the private sector and, in order to offer market stakeholders more attractive investment opportunities, the Shanghai Stock Exchange (SSE) and China Security Index Co. Ltd. (CSI) officially launched the SSE Photovoltaic Industry Index and SSE Solar Energy Index on October 11, 2022. The SSE PV Industry Index features 30 companies, whereas the SSE Solar Energy Index features 38.

A gradually changing industrial landscape

Given these overall industry dynamics, the emergence of dozens of new solar PV manufacturers is hardly a surprise. TOPCon and HJT are at the heart of these undertakings, but increasingly perovskite-based cell-technologies have been identified and included in numerous industrial policies on both the national and provincial level. Reportedly, TOPCon related expansion plans exceed 220 GW, whereas HJT is nearing the 150 GW mark. As an example, recently one HJT company conducted an online pitch and, according to them, almost 800 people joined the call.

In the near term, the overall industrial landscape won’t fundamentally change. Incumbent companies are further consolidating their market positions through backward/forward integration. By and large, vertical integration remains their favored business model, which in times of external supply constraints or external supply dependencies has gained even more weight. Notable examples are Trina Solar and Canadian Solar. The former, announced plans in June 2022 to invest 300,000 tons a year into industrial silicon and 150,000 tons a year into polysilicon by 2025. The latter revealed plans to invest approximately €8b and 250,000 tons of industrial silicon a year and 200,000 tons of polysilicon a year in August of the same year.

Traditionally, the provinces of Jiangsu, Zhejiang and the Greater Shanghai Area were considered the heartland of China’s solar PV manufacturing. However, policy incentives to ensure that locally produced solar panels have an even smaller carbon footprint, thus complying with anticipated regulatory requirements of certain export markets in future, Western Provinces, notably Sichuan and Yunnan (both home to substantial hydropower) and Gansu, Inner Mongolia and Qinghai (all home to considerable wind/solar PV power generation capacities) have still managed to attract billions of upstream related investments in the past 12-18 months. Trina Solar and Canadian Solar, have both chosen Qinghai Province for production sites.

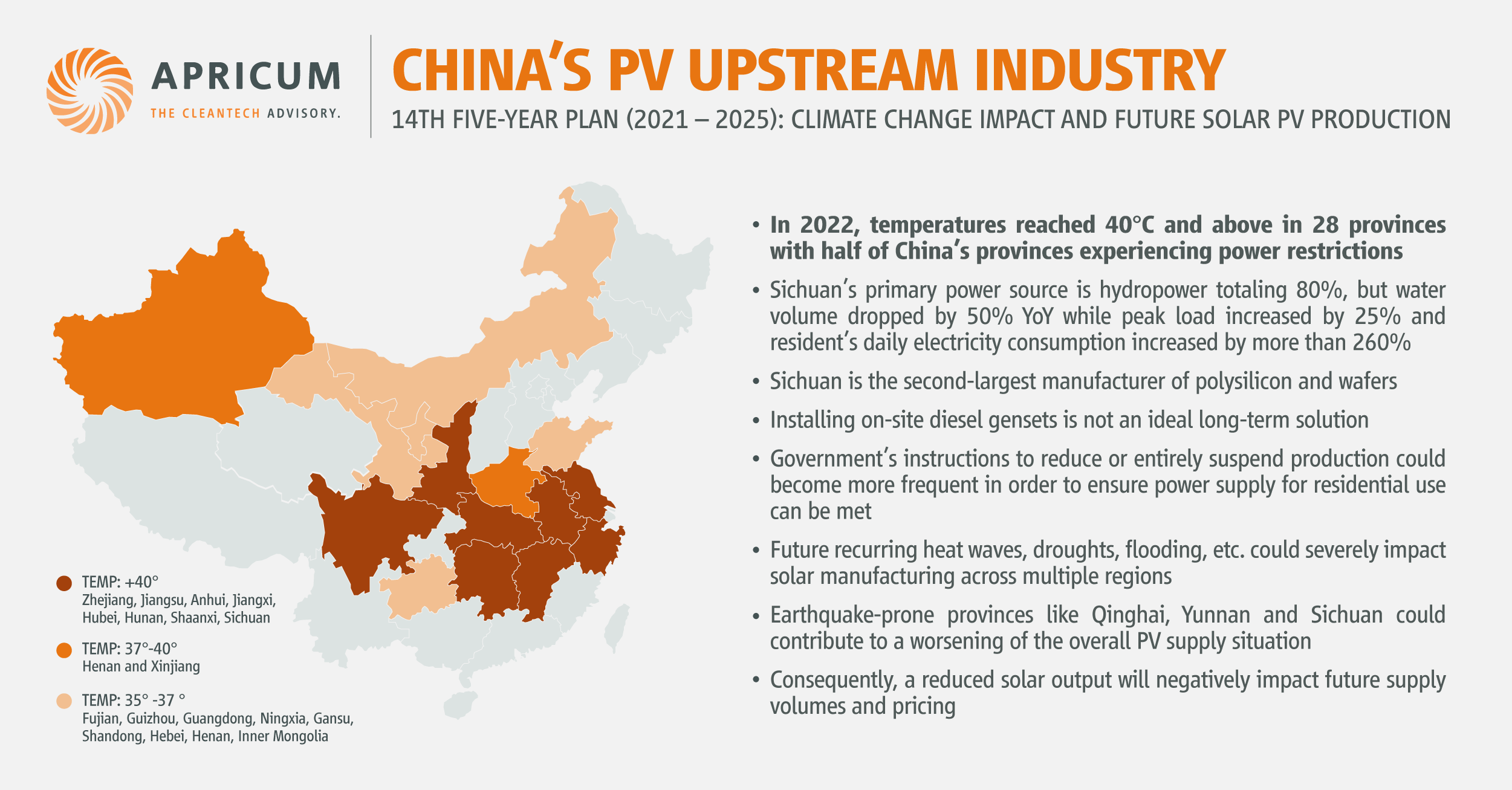

Climate change impacts on future solar PV production

Between June and August 2022, China experienced a severe heatwave affecting almost the entire country. According to weather historians, it was the most severe heat wave recorded anywhere in the world to date. By mid-August, the heatwave broke the 2013 record of 62 days in a row. The heatwave exacerbated a drought whereas northern China witnessed unusually heavy rainfall. Consequently, national and local governments required industrial production to be reduced or entirely suspended for a certain period of time and power restrictions were imposed in Anhui, Jiangsu, Sichuan, and Zhejiang – all major PV manufacturing hubs. In the case of Sichuan Province, these restrictions impacted an estimated 200,000 tons poly, at least 70 GW of wafer, and more than 40 GW of cell production capacity.

If such extreme weather events become normal or an annual recurrence in future, the probability that they will cause disruptions to the solar supply chain is considered rather high. To make matters worse, provinces like Sichuan, Qinghai or Yunnan are prone to earthquakes. In early September a 6.8 magnitude earthquake struck Luding County, just approximately 220 km from the provincial capital Chengdu. A 7.3 magnitude earthquake in Qinghai early January also caused a slight, although only short-term, increase in wafer prices.

Summary and near-term market outlook

In a nutshell, China has upped the ante at all fronts. Ambitious in terms of local deployment in the years and decades to come, China plans to ensure that its carbon commitments will be met in future. Approved multiple GW-large project pipelines, a strong focus on distributed generated power, industry specific carbon reduction plans, an upgrading/transforming of former major coal bases, and a massive enlargement of its national grid infrastructure among other measures, will drive demand for solar PV to new heights. In this context, the State-Owned Asset Supervision and Administration Commission (SASAC) just released a note instructing its State-Owned-Enterprises (SOEs) to finalize their respective carbon peaking roadmaps by the end of the year. On that note, since January 2022, these SOEs have issued module procurement tenders totaling +124 GW compared to 45 GW in 2021.

Equally important is innovation. As of October 2022, Chinese solar manufacturers have significantly benefitted from the economy of scale effect of its GW factories, which are unmatched anywhere in the world. Launched in the early 2000s, the so-called “Strategic Emerging Industry” policy helped China become the world’s largest solar manufacturer. Nevertheless, departing from a rather quantity-driven development path, the Top Runner Program launched in 2015 featured certain cell/module efficiency criteria, consequently requiring companies to focus more on innovation instead of just scale. Today, taking numerous industrial policies into account, industrial development driven by indigenous innovation is not only designed to maintain a technological edge, but also to further consolidate the industry’s global pole position.

In a larger context, the solar PV industry does fit into what China’s economic planners initiated in May 2020, the so-called Dual Circulation Economy, which in effect meant that China would become increasingly self-reliant across multiple sectors of its economy. This major policy was flanked by decisions made in the course of the 5th Plenum in the fall of 2020 that signaled a shift from integrating and assimilating foreign innovations to investing and fostering home-grown innovations with the ultimate goal of achieving greater technological independence.

As expected, in his address at the current 20th Communist Party Congress on October 16, China’s president Xi Jinping emphasized the importance of technological innovation. However, he also made strong indications that the state, not the private sector, would guide such key initiatives – unlike five years ago, when he stressed the need for having a “market-oriented system for technological innovations”. Needless to say, the immediate impact of such a re-orientation has yet to be assessed.

Nevertheless, the past one to two years a few SOEs, either on their own or in partnership with privately owned companies, have already extended their reach into the solar upstream realm. One of the most prominent examples is the State Power Investment Corporation (SPIC), considered China’s largest power utility. At present, the company has close to 50 GW of operational solar PV assets, aiming at 80 GW by 2025. Since late 2019, the same company has begun developing and producing PERC, TOPCon and IBC solar cell technologies. Its debut on the international stage as an IBC module manufacturer took place in Europe in May 2022.

During his speech on October 16th 2022, Xi Jinping also strongly reiterated the importance of national security, especially regarding food and energy. The latter implies that the country’s ongoing green transformation is anticipated to benefit from future industrial policies, which shall include more fiscal support and subsidies.

In early June 2022, the National Energy Administration (NEA) announced that it expects of no less than 108 GW of solar PV power generation capacity to be added in 2022. If realized, it would almost double last year’s record installation of 54.93 GW. A prime contributor to this obviously ambitious target will be distributed PV, notably C&I and residential, as well the so-called “GW-Bases”.

By the end of September 2022, 52.6 GW had been added, therefore approximately 48% short of NEA’s envisaged target. However, restrictions as a result of China’s zero-COVID policy may jeopardize its realization. Overall, a fairly complex and dynamic situation has considerably limited market visibility, consequently, AECEA maintains its earlier assessment of 80-90 GW in 2022, representing an increase of 45-63% YoY.

HOW APRICUM CAN SUPPORT

Apricum provides advisory services along the entire solar value chain, leveraging a unique blend of expert strategy consulting, investment banking proficiency and deep technology & market know-how. Our insight and guidance help drive the global renewable energy transition by answering the key strategic questions faced by both established market players and new entrants with market assessments, strategy and business model development and review, competitive screenings, fund raising, M&A (sell-side, buy-side), due diligences and project finance. If you are interested in learning more about how we can support your business, contact Apricum Managing Partner Nikolai Dobrott.