By 2025, roughly 11 million electric vehicles (EVs) are expected to be sold worldwide, corresponding to 11% of predicted annual global light duty vehicle sales. [1] The emergence of EVs, however, is not only shaking up the automotive industry. Through the increased electrification of the transport sector, a growing link to the power market is being established, leading to new opportunities and challenges for stationary energy storage players.

At Apricum, we see three major trends arising from the increasing convergence of the transport and power segments, namely:

- Vehicle-to-grid

- Battery buffered charging stations

- Second-life batteries

In the second of a three-part series on each individual trend, we investigate the emerging market opportunity from battery buffered charging stations and the attractiveness for stationary storage players.

Battery buffered charging stations – a new major demand driver for stationary storage?

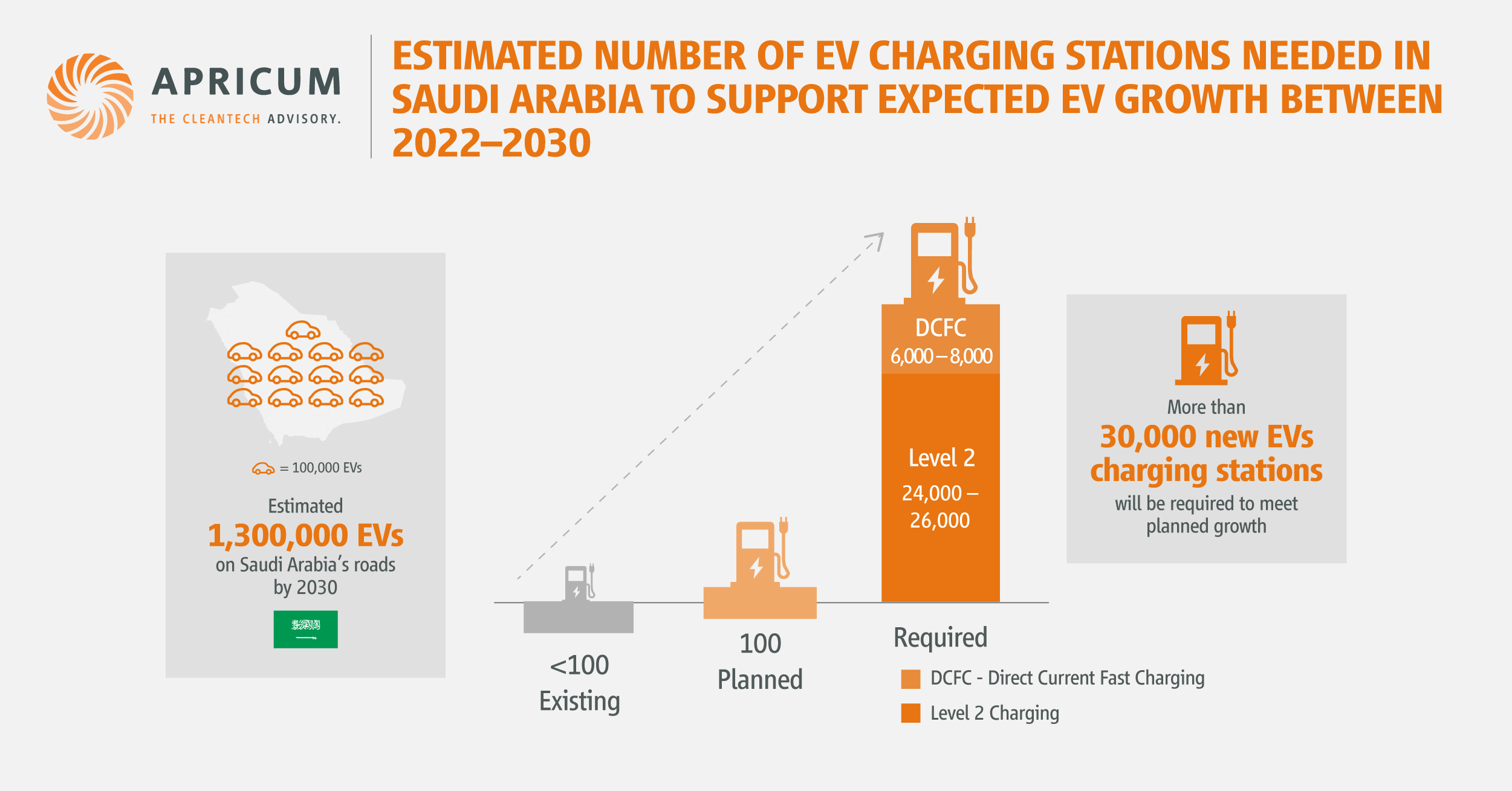

An increasing number of electric cars requires an increasing number of opportunities to refuel. It’s no surprise that IEA expects 54 million charging stations globally by 2025. Depending on the available power capacities of the local grid, the additional power demand can cause expensive and time-consuming infrastructure upgrades, or at least high operational costs due to demand charges [2] billed to the charge point operator (CPO).

The easiest way to mitigate the grid impact of EV charging is to apply lower power and reduce simultaneousness. Provided that there is a sufficiently long period of time available, AC power charging at only 3.6 or 11 kW can be applied and measures such as V1G (see part one featured in the last edition of Apricum’s newsletter) can help to distribute the load more evenly, preventing the grid from reaching its limits. Charging overnight at home to prepare for the daily commute to work clearly falls into this category – a popular way of refueling, preferred, e.g., by 65% of German EV owners, according to a recent study by the German Association of Energy and Water Industries (BDEW).

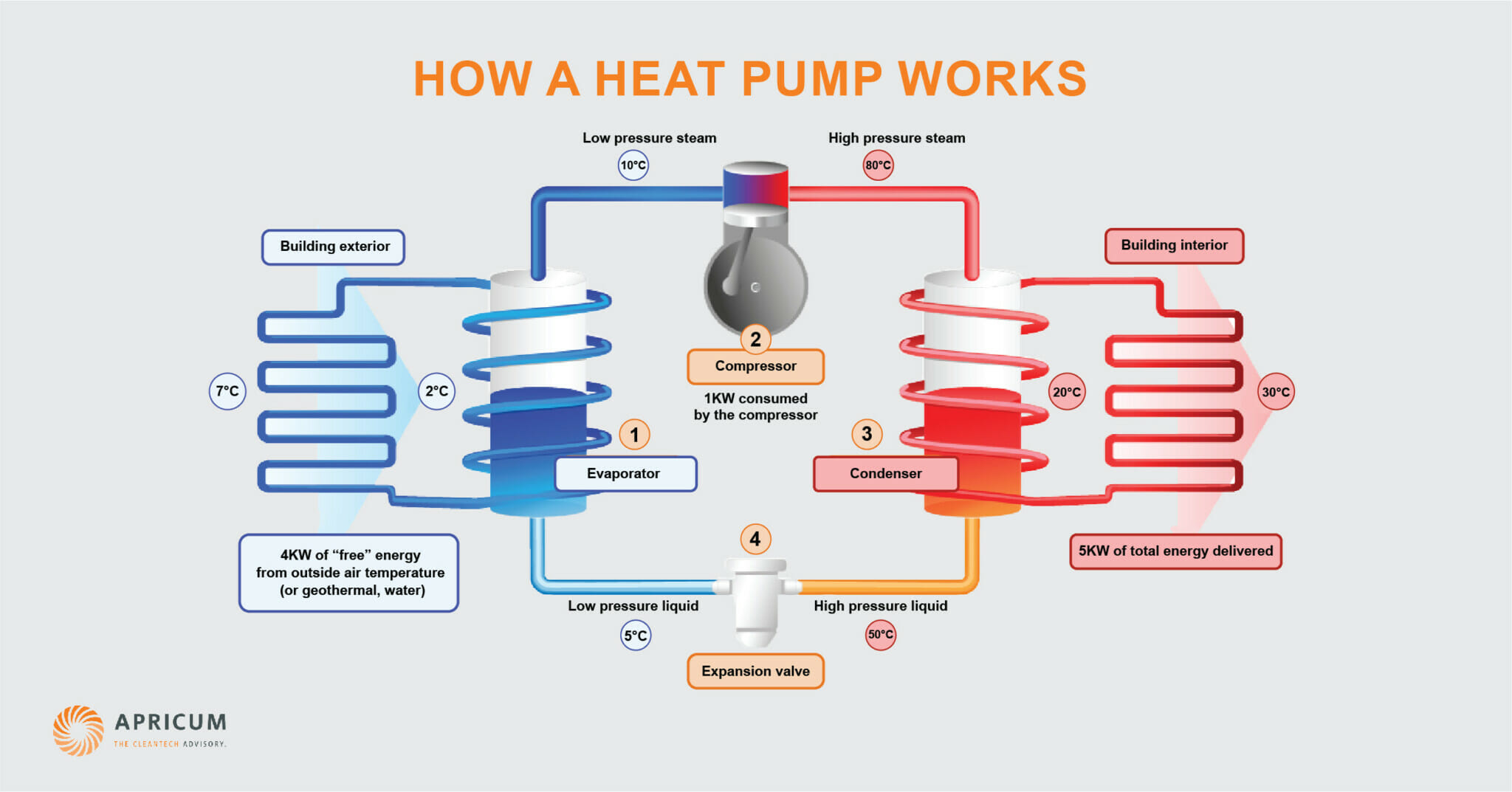

In other situations, charging has to be quick and instantaneous, for example, during long-distance traveling. Along highways, DC fast-chargers with up to 350 kW are deployed and used in parallel, causing significant demand peaks. As time is a constraint, flexibility has to be provided differently: Adding a battery to the charging station can help to “buffer” the power required from the grid, thus avoiding peaks and related grid constraints or costly charges – a common stationary energy storage use case called “demand shaping”.

Here, EVs are not a competitor to stationary storage, but an enabler for additional demand. But is it a sizeable market volume?

Demand is kicking in

The application of batteries to buffer charging stations has certainly started to gain traction around the world.

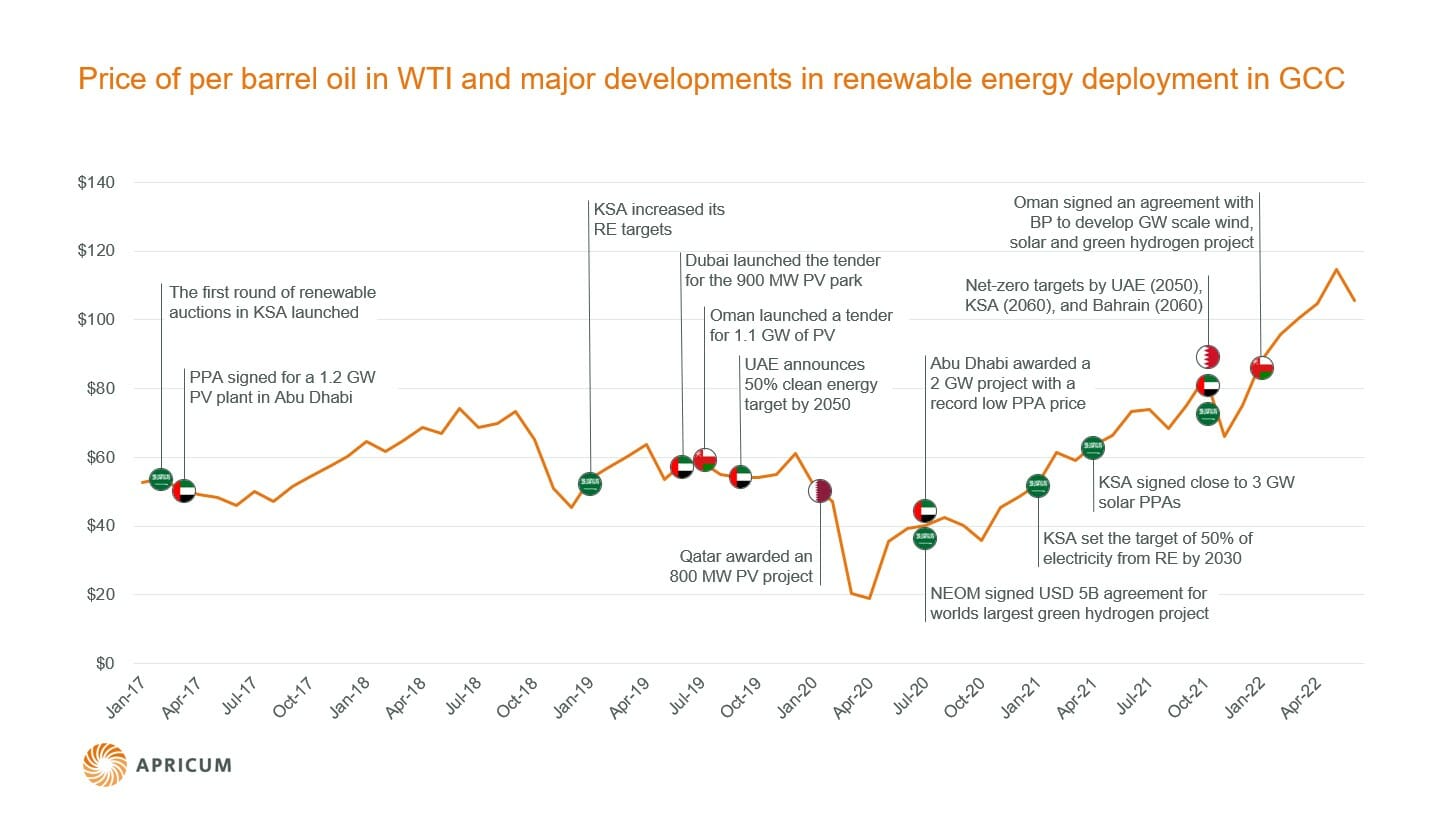

Early examples include California-based Chargepoint and Green Charge’s 2015 pilot project that set up energy storage in five EV chargers (including two DC fast chargers) – reportedly reducing demand charges by around USD 7,000 per year. Tesla has also installed its Powerpacks in some of its own Superchargers near London. Several big names in the automobile and energy storage industries have also announced battery buffered charging station plans, including Porsche’s mandating of its US dealers to install such stations in preparation for the launch of its first all-electric vehicle in 2020, Volkswagen’s deployment of fast-charging Tesla Powerpacks in over 100 EV charging stations in the USA, and Leclanché’s supply deals in Europe and North America – with the EV Network in the UK, Fastned in the Netherlands, Škoda Electric in the Czech Republic and eCAMION & SGEM in Canada. And in Germany, market players are already reporting the delivery of hundreds of battery buffered fast chargers to major CPOs.

As well as this, there are mobile charging solutions emerging to cover the local need for fast chargers for a limited amount of time, e.g., in the case of mass events such as concerts or soccer games. These solutions are not connected to the grid and fully rely on built-in batteries. An example is Volkswagen’s mobile 360 kWh charging stations, capable of charging 15 vehicles in only ~17 minutes per charge, which was piloted in the first half of 2019 and will be implemented widely in 2020. Another one is adstec’s PowerBooster, which is a compact and easily transportable EV fast charging station, and can be deployed quickly in limited-power distribution networks.

In order to broaden the application of battery buffered charging stations, however, there are two key prerequisites to be met.

1. Competitive pricing

Similar to other use cases, stationary energy storage must be competitive with the alternatives. Depending on the individual local situation, expanding grid infrastructure or simply accepting demand charges might be more favorable over deploying a battery. To improve competitiveness, the costs of adding energy storage have to come down. The rise of e-vehicles will help as economies of scale in battery production will lead to cheaper stationary storage hardware. Opportunity costs, for example, caused by bulky storage units blocking space that could be used for additional parking lots, can be avoided through clever, space-saving battery design and integration in the charger. On top of that, energy storage can add further value, thus enhancing its attractiveness: By charging the battery when grid prices are the lowest and discharging later (“demand shifting”), additional cost savings can be realized for the owner of the charging station to offset part of the upfront costs.

2. Optimal utilization levels

Achieving optimum utilization of the fast charging station is key. In theory, an increasing penetration of EVs requires more fast charging, which causes an increasing demand for (competitive) buffering batteries. However, this is only true up to a certain utilization of the fast charger: When more EVs are on the road and the charging stations are in constant use, it gets more difficult to recharge the stationary storage units frequently and flexibly enough to significantly save money as described above. The individual business cases for battery buffered charging have to reflect the evolving utilization through system sizing, flexible charging/discharging strategies and sophisticated system management software. But even if utilization reaches a level that does not allow for substantial buffering, the already installed batteries will not necessarily end up as stranded assets: Time-of-use optimization as well as grid services could still be provided and could generate considerable revenues until the end of the battery’s life, creating economically viable returns to make the case feasible.

A pocket of opportunity – but a sizeable one

As is the case for many energy storage use cases, demand shaping via buffered charging stations represents a true “pocket of opportunity”, i.e., a business opportunity depending on an individual, variable local setting.

A general roll-out of buffer storage is therefore not possible. Each situation has to be assessed individually, regarding, e.g., the competitiveness to locally available alternatives or the technical feasibility depending on the current and expected levels of utilization as described above. As competitiveness and utilization evolve over time, the pocket of opportunity can open – but also close – rapidly.

Due to the large number of variables, battery buffered charging stations offer a business opportunity that is hard to quantify. Nevertheless, it clearly has the potential to create a sizeable market volume: If only 10% of the over 14,000 fuel stations in Germany today were equipped with just one battery buffered fast charger, this would represent ~0.5 GWh [3] of additional battery demand – compared to ~1 GWh of stationary storage installed in Germany today.

To “gear up for power on wheels”, stationary storage players should make preparations now. To effectively seize the opportunities offered by battery buffered charging stations, they has to be assessed closely along the mentioned prerequisites and reflected accordingly in the individual business model. As a strategy advisor with exclusive focus on cleantech, Apricum is well positioned to offer support.

In part three of this article to be published next month, we will investigate the emergence of “second-life batteries” and the impact on stationary storage companies.

For questions or comments, contact Florian Mayr, partner and head of the energy storage and green mobility practices at Apricum – The Cleantech Advisory.

[1] BNEF

[2] Fee based on the highest power rate at which electricity is drawn in the monthly billing period, e.g., during any 15–30 minute interval

[3] Assuming each battery buffer is 350 kWh, in line with Tesla Powerpacks to be deployed in Volkswagen US charging stations