Substations are the joints of the energy system, connecting the limbs of the transmission and distribution grids. While they often receive little attention and are viewed as an eyesore or bottleneck, Apricum believes they may be of growing appeal.

As demand for electricity increases due to population growth and the decarbonization of our energy systems, we need more substations and more investment. This article explores the significance of substations, their economic value, and the challenges and opportunities that exist for infrastructure funds to invest and for energy generators to release capital.

Understanding Substations: The Connective Joints of the Grid

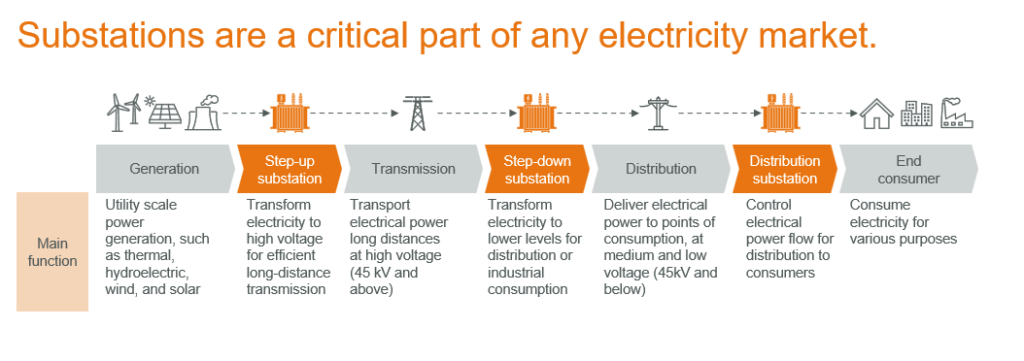

Substations are integral nodes in the electricity grid, facilitating the transfer of electricity from power plants to consumers. They step up voltage for efficient long-distance transmission and step it down for safe distribution to homes and businesses. They are, in every sense, classic core infrastructure.

The importance of substations is highlighted by their sheer scale and value. The UK power grid consists of well over 150,000 substations, including 680 transmission-scale substations or approximately one for every 100,000 residents.

Substations are not just critical infrastructure; they are also substantial economic assets. Based on publicly available development cost data, transmission-scale substations alone are worth more than £12.2 billion in the UK. Substations and their connecting transmission lines generate revenue through “use of service” fees. These fees, regulated to prevent competitive pricing, are charged to both energy producers and consumers. For instance, in the UK, total Transmission Network Use of Service (TNUoS) fees amounted to £4.4 billion in 2023 (UK Electricity System Operator, 2023).

Substation infrastructure must grow as electrification ramps up. According to Rystad Energy, over £14 billion is expected to be invested in 120 substation projects connecting offshore wind across Europe by 2030. This investment has policy tailwinds, as the EU targets at least 15% electricity interconnection between member states by 2030, to enhance resilience and price convergence across the region.

As a result, we believe this infrastructure class could become of increasing interest to investors.

Key players in the United Kingdom

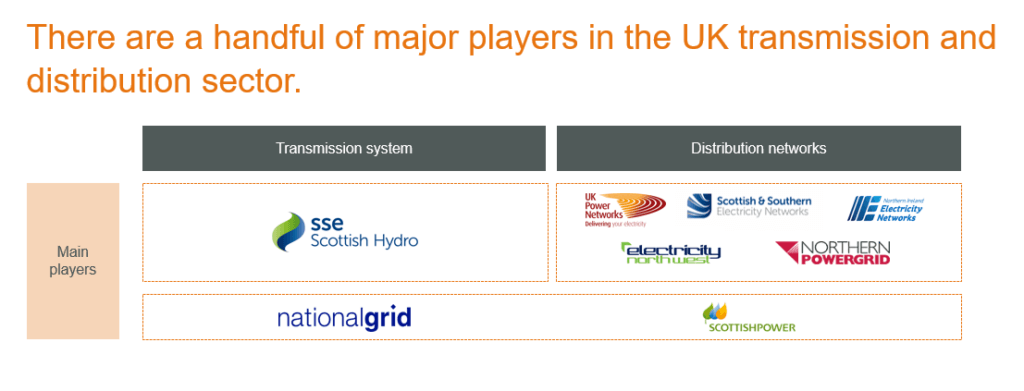

The landscape of substation ownership and operation is dominated by major utilities and system operators (TSOs). In the UK, the primary players include National Grid, SSE and ScottishPower, with National Grid managing system operations. The UK’s distribution network is divided into 14 regions, managed by seven companies, known as Distribution Network Operators (DNOs) with Independent Distribution Network Operators (IDNOs) also competing in the market.

Privately held offshore substations are the most accessible

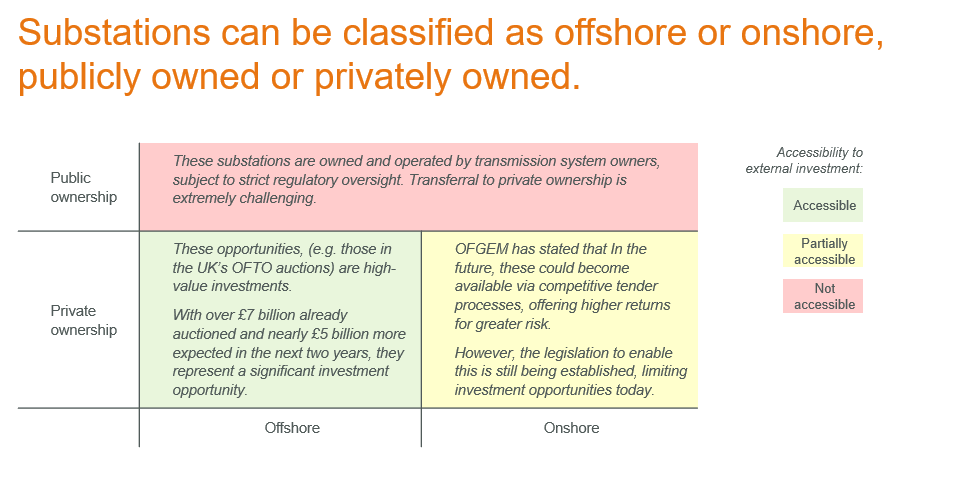

Substations in the United Kingdom can be classified as offshore or onshore, and utility owned (by the big 3 transmission owners) as opposed to privately owned (such as operated by a licensed standalone transmission operator):

As seen above, offshore substations, typically connected to offshore wind plants, are currently the main accessible UK investment opportunities for third-party capital such as infrastructure funds.

The rise of the OFTO

OFTOs (Offshore Transmission Operators) were established via the United Kingdom’s Energy Act 2004 and the first license was awarded to Transmission Capital Partners in March 2011. There are currently eight OFTOs across the United Kingdom, spanning some 27 wind farms. These eight OFTOs –Transmission Capital Partners, Blue Transmission, Equitix Group, Balfour Beatty, West of Duddon Sands Transmission Plc, Diamond Transmission Partners, International Public Partnerships Limited and ETEPCO – have successfully won the right to hold transmission licenses.

Director Matteo Quatraro at London-based Gravis Capital believes the number of OFTOs across the UK will only increase with time, given the UK’s ambitious target of reaching 50GW of offshore wind capacity by 2030. “With 10 billion pounds worth of assets being tendered over the next three years, the existing OFTOs will not be able to manage the entirety of these new assets in addition to their existing portfolios, so newcomers are needed in the sector”, says Quatraro.

Challenges and opportunities abound

Investing in substations is not a straightforward exercise. Barriers to entry for an infrastructure fund take many forms, including:

- Regulatory, including land permitting and resource consent. Environmental regulation is also increasing over time

- Financial, due to the high associated CAPEX and the inherent risks that come with entering a new asset class such as substations

- Technical, due to the complexity associated with connecting to the grid and conducting a due diligence on a new asset

- Operational – with revenue streams contractually correlated with uptime and reliability metrics, transmission system owners and operators must maintain high competence in the operation and maintenance of facilities

- Social license to operate, with few considering substations to be aesthetically pleasing and “NIMBYism” leading to possible opposition from neighbouring communities. For example, in May 2024 North East Lincolnshire Council opposed a planned 87-mile-long high voltage electricity line between Grimsby West and Walpole

However, despite these challenges, the growing presence of Offshore Transmission Owners (OFTOs) presents an opportunity for infrastructure funds. There are signs that the UK’s new Labour government will expedite the transferral of substations from developers to OFTOs. Gravis Capital Associate Director Benjamin Rider says, “Labour in the election campaign suggested a desire to ‘Rewire Britain’ and build the clean energy electricity grid the country needs. This is crucial as it will allow new clean energy projects to be connected and unlock substantial private investment in the sector. However, it remains to be seen how this action will be delivered and what the role of Great British Energy might be in achieving this goal.”

Infrastructure funds looking to own substation infrastructure should consider leveraging energy infrastructure expertise and strategic partnerships to help enter what is a new and complex investment environment.

Beyond the Sea

The current opportunity lies principally in UK offshore-connected substations, but this may change over time. First, other European countries may also adjust regulation to accelerate offshore wind deployment. WindEurope CEO Giles Dickson believes that “The political support for the growth of offshore wind is extremely strong. Not just in the North Sea, but also in the Baltic, Atlantic, Mediterranean, Black and even the Caspian Sea.” Second, a growing number of European BESS asset owners, with a higher cost of capital than renewable generators, may seize the opportunity to:

- Release capital from their portfolios by selling down connections, and/or

- Book a profit on substations sales to lower cost capital.

For onshore wind asset owners in Europe, there may also be an opportunity to release capital without reducing generation exposure.

In conclusion

Substations are pivotal to the electrification of any energy system. With substantial economic value and growing investment opportunities in the UK, they may become an attractive infrastructure asset class for investors. Paying close attention to any changes in regulation across continental Europe might allow infrastructure funds to be at the forefront of offshore substation ownership and operation, much like early movers in the UK. However, pioneers of this new asset class seeking to navigate a complex regulatory and operational landscape will require strategic foresight and significant energy expertise.

If you would like to discuss opportunities for infrastructure funds to invest in substations or for IPPs to release capital, do not hesitate to reach out to Apricum Managing Partner Nikolai Dobrott.

This article was written by former staff member Ben Fulton with support from Kyle Barth, Gabija Navickaite, Dario Castaneda and Charles Lesser.