Summary

- As corporate decarbonization targets become harder to meet, the rise of 24/7 carbon-free electricity (CFE) Power Purchase Agreements (PPAs) presents a much sought-after solution for companies seeking to further decarbonize their emissions

- 24/7 CFE PPAs with up to 87% hourly matching can already provide an interesting decarbonization business case for companies, with a cost of ~€50 per ton of CO2 avoided taking a simplified example for Germany

- Developing and operating 24/7 CFE PPAs requires innovative approaches, blending renewable energy sources with optimally sized energy storage and combining hedging, trading and new capabilities such as hourly matching certification

- As they require more sophistication than standard PPAs, early movers in this space can gain a lasting competitive edge

A record year for PPAs and the rise of 24/7 carbon-free solutions

The European power market is undergoing an unprecedented transformation. Driven by record-breaking growth in renewables, the PPA market has been thriving, especially for multi-technology PPAs, with corporate and industrial offtakers signing deals at an all-time high. As decarbonization efforts intensify, PPA buyers seek firmer alternatives, and a new frontier has emerged: 24/7 carbon-free electricity PPAs (24/7 CFE PPAs).

These agreements go beyond traditional renewable PPAs and aim to maximize the amount of carbon-free electricity that is delivered on an hourly basis to the customer, also called the CFE hourly matching rate. Two main pathways are used by PPA sellers to procure/develop 24/7 CFE PPAs: 1) Source renewable electricity guarantees of origin that match the hourly energy consumption profile of the customer (marketplace type of business) or, 2) A dedicated energy project with renewable energy sources and an energy storage system. While the former has great market potential with many startups recently launched, the focus of this article will be on the latter where renewable energy developers and IPPs have a larger role to play.

In the past weeks and months, a flurry of 24/7 projects have been announced across the world, focused on markets with high availability of low-cost renewables such as Chile, India and Saudi Arabia. Notably, Masdar and EWEC launched the world’s largest 24/7 solar PV and battery project, featuring 5.2 GW solar and a 19 GWh BESS to be located in Abu Dhabi and to deliver 1GW of local baseload power.

While achieving 24/7 carbon-free electricity may seem like a long-term ambition for 2050 or beyond, especially on a system level, on a project level, recent research has shown that already more than 90% of CFE hourly matching rates can be achieved with a combined wind, solar PV and lithium-ion battery project in Europe. In this article, we will explore whether such projects can be competitive from the perspective of corporates seeking to decarbonize and will provide an outlook for IPPs and project developers to stay ahead in this emerging space.

Understanding 24/7 CFE PPAs

At the heart of 24/7 CFE PPAs lies the concept of hourly matching, which calculates the amount of CFE supplied to the customer every hour of the year. Achieving a high hourly matching rate requires careful dimensioning of the project and operational capabilities to balance in real-time the supply coming from the wind, solar PV and energy storage to the customer’s demand profile. Demand-side flexibility can also play a role in further increasing the hourly matching rate.

Depending on the size of the energy storage system, not all hours of the year will fully match the customer’s demand, so that some amount of grid electricity will be needed. This is what a recent Eurelectric[1] study assessed. Different case studies of onshore wind, solar PV and energy storage set-ups were developed for hourly matching assessment against a 10 MW baseload demand profile, excluding grid constraints. In their German and Finish case studies, an optimized portfolio of only wind and solar could already achieve 67% and 75% hourly matching respectively. Then, with a 4-hour battery and a 1:1 capacity ratio to renewable assets, an 88% and 90% hourly matching could be achieved respectively for Germany and Finland. These conclusions already indicate that long-duration electricity storage (LDES), biomass or CCUS technologies will be required to achieve a 100% CFE hourly matching rate at a project level.

[1] Eurelectric is the federation of the European electricity industry, representing more than 3,500 European utilities active in power generation, distribution and supply.

A closer look at LDES technologies

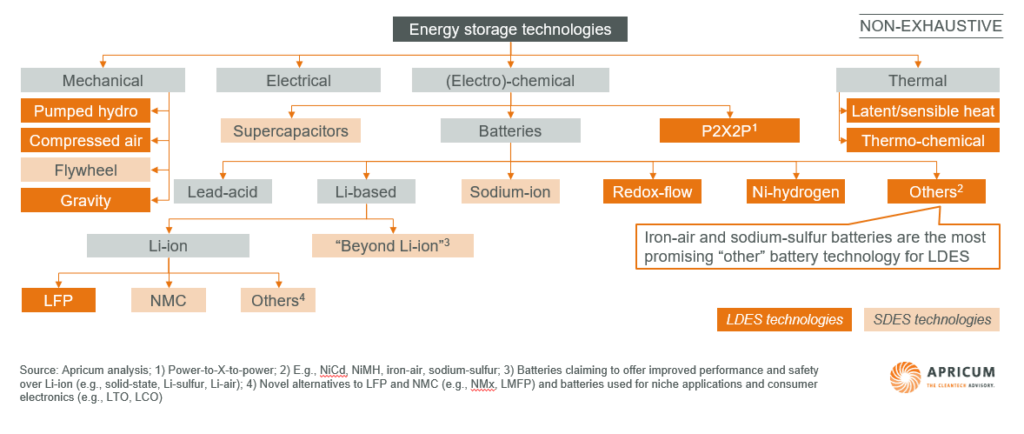

LDES technologies are rapidly evolving, offering a range of possibilities to reach higher levels of CFE hourly matching rates. Options include for instance compressed air (CAES), pumped hydro, P2X2P (hydrogen electrification) and redox flow batteries.

Figure 1: Overview of energy storage technologies

Not all LDES technologies are however suited equally for 24/7 CFE PPAs, and each faces unique challenges. For hydrogen-based solutions (P2X2P), the primary hurdle lies in securing a reliable supply of low-cost hydrogen, e.g., from imports. The bankability of CAES depends on finding sites that offer optimal conditions for grid connection and geological storage, while CCUS requires extensive governmental support to develop the required infrastructure. Overall, as the current regulatory and market frameworks stand, long-duration energy storage technologies often lack the bankability and cost competitiveness to be deployed on a wider scale. Until regulation evolves, LFP batteries are expected to play a bridge role in kicking off the 24/7 CFE PPA market thanks to their more appealing economics and bankability, which we will assess next.

The Short-Term Case for 24/7 CFE PPAs

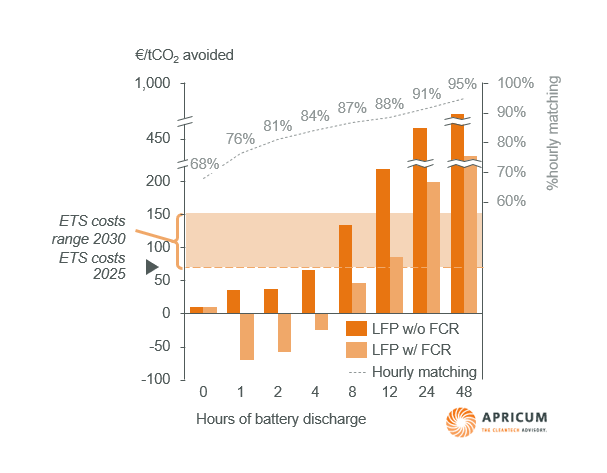

To further explore the economics behind 24/7 CFE PPAs, Apricum assessed a simplified case study of a combined onshore wind, solar PV and LFP battery system in Germany using today’s energy storage technology costs, for a baseload customer demand profile. With the renewable assets being dimensioned to meet 100% of the overall yearly customer electricity requirements, the goal of the exercise was to estimate the cost per ton of CO2 avoided from the grid by varying the storage size. This metric is typically the one used by corporations to assess their cheapest path to decarbonization even if, as with the rest of the PPA market, corporations are not required to pay CO2 taxes or EU ETS[2] certificates for their scope 2 emissions. In addition, complementary revenues from FCR ancillary services are also included, which is the ancillary service that would affect the hourly matching requirements the least while being stacked. A more detailed list of the assumptions is provided at the bottom of this article.

[2] Emissions Trading System from the European Union

The model output, shown in the graph below, first highlights that customers can already expect a CFE hourly matching rate of ~68% without any energy storage, meaning ~68% of their power consumption is at all times carbon free. Next, the model highlighted that using today’s EU ETS price (in the 65-75 €/tCO2 range), an ~87% hourly matching rate can be achieved economically for a corporation with an 8-hour battery, while for 2030, a 12-hour battery only marginally increases the achievable economic CFE hourly matching rate by ~1%. The results also highlight that provision of ancillary services via FCR is essential to the economics of the project.

Figure 2: Additional costs per emissions avoided from the German grid in €/tCO2 and CFE hourly matching rate

When assessing the final investment decision on a 24/7 CFE PPA project, Apricum would also recommend including more complex-to-model benefits of batteries as they would further improve the project business case, such as aFRR ancillary services, hedging and arbitrage opportunities with day-ahead and intraday markets, while including a limit on battery daily cycles (to be noted that in our simple case study, the average cycling of the battery is below 1 cycle per day, well below typical warranty limits).

About Apricum’s Energy Storage practiceEnergy storage is one of Apricum’s key areas of expertise – we have covered it since the dawn of the sector. Since the creation of the practice in 2014, we have covered 60+ projects on battery storage across 15+ countries over 4 continents, covering both strategy consulting and transaction advisory. Our team combines more than 60 years of experience in energy storage, and we are recognized as thought leaders on the topic, highlighted by our active presence in conferences and journals, such as ees Europe, PV magazine and Energy Storage News. LDES has also been a topic covered by Apricum for many years, both on the thought leadership side, with publications in selected press, as well as on the project side. Key reference projects include due diligence on LDES companies, a capital raise support for an LDES company and storage cost model developments for a wind/solar project developer/EPC player. Our state-of-the-art set of industry knowledge, proprietary models of economic key metrics and our network of LDES players have provided valuable insights to our clients enabling a competitive edge in their respective fields. |

Key considerations and strategies for PPA operators/IPPs

As 24/7 CFE PPAs provide a firmer electricity supply to corporates while enabling them to further decarbonize cost effectively, interest from the market is expected to progressively pick up in the short to medium term. PPA operators/IPPs with the most experience with the operation of BESS assets are set to offer the most competitive 24/7 CFE PPAs on the market, as hedging/risk modelling and short-term trading experience play an important role in developing compelling economics to customers.

Additionally, new capabilities relating to hourly matching certification will be required for PPA operators, as customers require more transparency in their carbon accounting. 24/7 CFE PPAs thus require a higher level of sophistication than standard PPAs, forcing market participants to strategically plan ahead to capture a long-lasting competitive edge.

How we can help you

Navigating the complexities of 24/7 CFE PPAs requires deep expertise in renewables, energy storage technologies and market dynamics with a particular focus on BESS expertise in the short-term. As a trusted advisor and energy storage expert to leading IPPs and project developers, we can help you succeed in this high-growth market with the following support:

- Strategic technology positioning: We evaluate the most suitable energy storage technologies for your projects or your company, considering e.g., technology maturity and market conditions. Our wide network in the BESS and LDES space enables our customers to get access to insights otherwise not publicly available

- Levelized Cost of Energy (LCOE) modelling: Thanks to our proprietary energy storage models, our experts provide detailed cost modeling to quantify the levelized cost of energy for combined wind, solar and energy storage projects

- Partner and supply chain selection: With our extensive network, we connect you with the right partners, whether for technology, financing, or operations

- Strategy implementation and team upskilling: We work closely with your team to enhance capabilities, refine operational strategies, develop new business models and position your offerings for competitive advantage

Conclusion

The shift toward 24/7 CFE PPAs marks a pivotal moment for the energy sector. Developers and IPPs who proactively position themselves in this market will gain a competitive edge, due to the high level of sophistication required with 24/7 CFE PPAs. Corporates seeking the next frontier of decarbonization efforts can do so economically tomorrow.

Contact us today

Ready to position your business at the forefront of the 24/7 CFE PPA revolution? Let’s collaborate to unlock your potential and build a competitive, future-ready strategy. Reach out to Managing Partner Nikolai Dobrott to discuss how we can support your journey.

Sources

24/7 CFE Hedging Analysis, Report for Eurelectric by Pexapark, November 2023

24/7 Clean Power, A Climate Technology White Paper, BloomberNEF, June 2022

Apricum energy storage transaction database

Apricum Levelized Cost of Storage (LCOS) model

Key assumptions

The 50-50 wind onshore and solar PV utility scale asset is dimensioned to cover 100% of the customer’s energy needs over the year, i.e., if the customer consumes 100 GWh over the year, the renewable assets are dimensioned to produce 100 GWh over the year but their profile will not always match the customer profile. No grid constraints are assumed. A standard baseload retail contract is taken as reference for cost comparison with the 24/7 CFE PPA using 2027 German futures plus a retailer margin. When the battery is empty and the renewable production does not match the customer requirements, additional electricity from wholesale markets is procured and included in the costs to match 100% of the customer requirements on an hourly basis. No economic optimization of the battery utilization is modelled for simplicity: when there is excess electricity, it charges, when there is a gap, it discharges by required capacity to match the customer baseload. The bid FCR capacity for each 4h window is the maximum available battery capacity over the 4h window that does not affect customer/charging hourly profile, assuming sufficient forecasting quality for the wind and PV generation profile 24h in advance. The LFP batteries are assumed to have a maximum discharge duration of 8h per system (i.e., a 16h discharge is 2x 8h batteries). The BESS capacity is dimensioned optimally to its maximum foreseen capacity over the year (per unit of the renewable assets), here at 65% of the RES capacity. FCR revenues are assumed at €55k/MW/yr on average over the lifetime of the asset (i.e., 20 years) – in 2024, 2h batteries could expect a revenue of €145.6k/MW/yr for FCR only (source Suena, Battery income in Germany 2024), however this is expected to decrease over the next decades.

[1] Emissions Trading System from the European Union

This article was written by former staff members, Henri Bittel, Dr. Benjamin Silcox, and Florian Mayr.