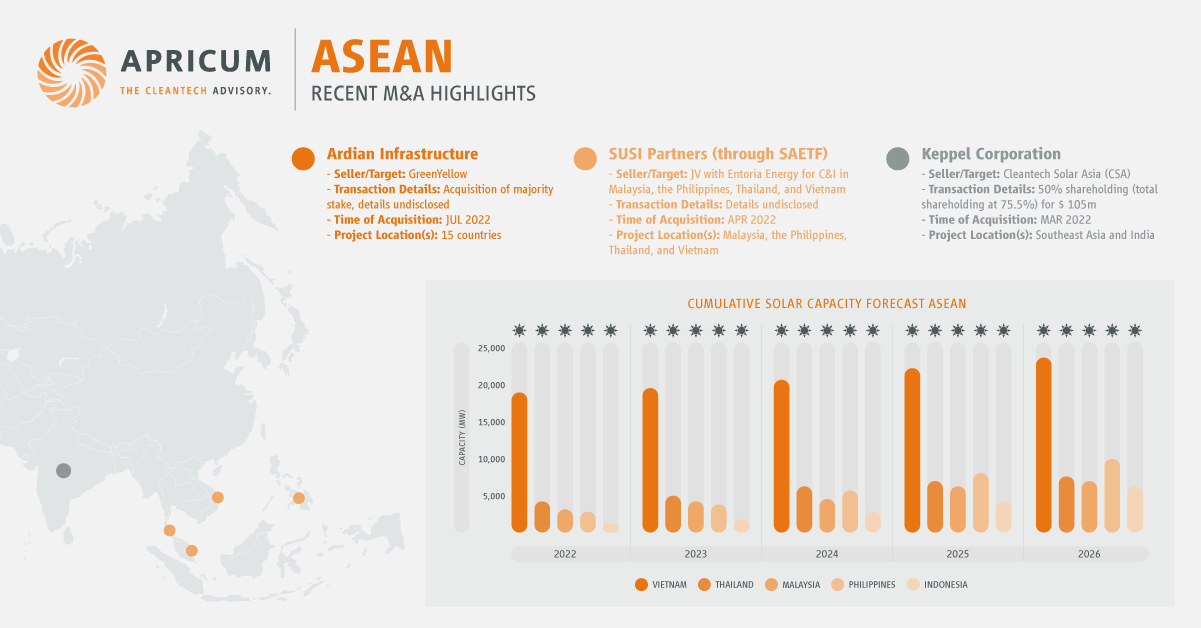

What are the latest trends in the ASEAN scene? The Association of Southeast Asian Nations (ASEAN) is a dynamic market for solar power as well as for renewable energy mergers and acquisitions. Here Apricum Senior Advisor Moritz Sticher provides an update to his 2021 article, Solar Power in ASEAN: A snapshot and outlook of the solar power markets and growing M&A scene, for 2022 and beyond. The article provides deep insight into the Vietnamese, Thai, Malaysian, Filipino, and Indonesian markets, drawing from Moritz’s many years of experience as an entrepreneur and a solar power and renewable energy expert in the ASEAN region.

Source: Apricum PV market forecast Q1/2022 center case

Solar Market Profile: Vietnam

Solar Power Policies & Targets Updates

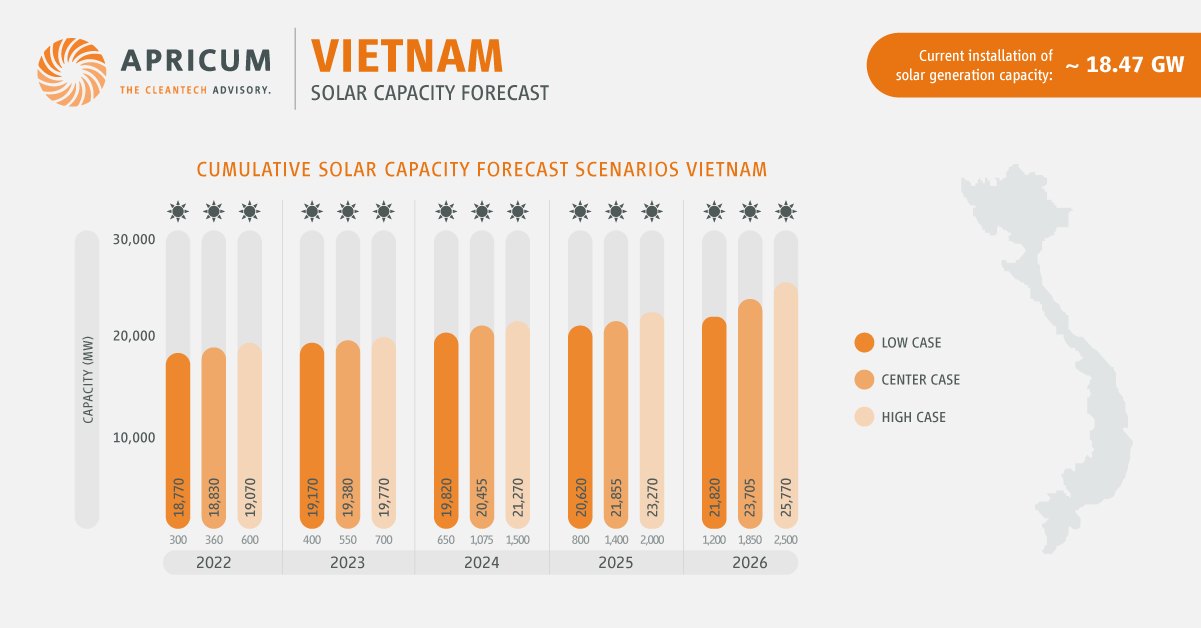

The National Power Development Plan VIII (PDP 8) for the period of 2021–2030 with a vision to 2045, is still awaiting approval by the Prime Minister, with solar targets being reduced compared to previous drafts. The draft foresees RE generation capacity increasing to 146 GW by 2030 and 352 GW by 2045. Solar targets up to 2045 in the current draft are reduced to 13.6 GW of utility-scale and 3.4 GW of rooftop solar. Currently, around 18.47 GW of solar generation capacity has been installed.

Solar Programs and Market Updates

- Direct PPA (DPPA) program: In January 2022, further changes were introduced e.g., on the tariff structure EVN/PC at the retail price level (instead of the VWEM spot market price plus DPPA charges as proposed under the previous draft MOIT circular), timing for pilot program 2022-24 and official program commencing 2025, and in May 2022 a draft was published for public comments. Specific criteria for selection of developers/GENCOs and private consumers to be announced by Vietnam’s Ministry of Industry and Trade (MOIT).

- Transitional solar (and wind) project mechanism: On June 13, 2022, the MOIT issued a draft circular on an electricity tariff building mechanism for transitional solar and wind projects (applicable to invested projects that did not match commercial operation dates’ (COD) deadline to catch FIT) under the principle that the cost of equity does not exceed 12% based on verified CAPEX and OPEX. The draft circular also laid out a method and formula for the calculation of electricity tariffs and a 5-step application process under which the project owner submits to Vietnam Electricity (EVN), EVN to the Electricity Regulatory Authority of Vietnam (ERAV), and ERAV to MOIT, with ERAV also publishing the approved tariff on its website.

- Commercial & industrial (C&I): In the C&I segment, more and more players are entering the market and developing locally. This process is supported by the expected lack of further RTS FIT phases, having the advantage of not relying on government-announced programs. Most of the region’s specialized solar C&I players have already commenced operations and multiple local players have emerged and established their market position. The progress of the C&I segment has been, and remains, impacted by the increased material prices and delays resulting from the pandemic.

Cumulative solar capacity forecast scenarios: Vietnam

Source: Apricum PV market forecast Q1/2022

Solar M&A Highlights

Vietnam’s M&A scene remains rather slow with the remaining utility-scale projectswithout PPA being hindered in progress by the pending DPPA program and regulation on transitional solar (and wind) projects. Ongoing curtailment, to be resolved only after expansion of Vietnam’s transmission line networks, presents another challenge that extends to the operational projects affected. Hence, the market is expected to heat up once these mechanisms come into force and developers look for sources of project funding or re-financing.

Recent solar M&A activities: Vietnam

Solar Market Profile: Thailand

Solar Power Policies & Targets Updates

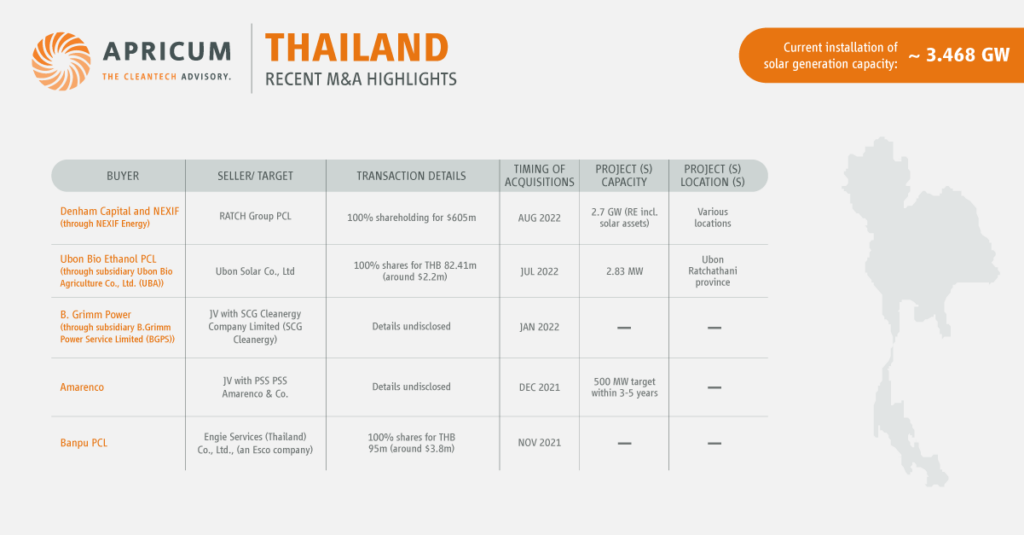

In the first draft revision of the 2018–2037 Power Development Plan (PDP), Thailand currently foresees a reduced target of 8,740 MW of solar power generation capacity until 2037 and an unchanged target of 2,725 MW for floating solar farms at nine dams operated by the Electricity Generating Authority of Thailand (EGAT). Currently, around 3.468 GW of solar generation capacity has been installed.

Solar Programs and Market Updates

- Utility-scale Solar PV and BES program (in draft): In June 2022, Thailand’s Energy Regulatory Commission (ERC) published a draft RE purchasing regulation including approved tariffs for public hearing ,published in the Royal Gazette in September 2022, which includes utility-scale solar PV and solar PV + BESS, besides wind and biogas as generation sources. The draft program foresees a 25-year non-firm FIT of 2.1679 THB/kWh (around $0.077/kWh) for solar PV and a 25-year partially-firm FIT of 2.8331 THB/kWh (around $0.060/kWh) for solar PV + BESS. As in past programs, regional adders of 0.5 THB/kWh (around $0.014 /kWh) are applied for Yala, Pattani, Narathiwat provinces and 4 districts in Songkhla province. For solar + BESS from 09:00 a.m. to 04:00 pm., the PPA is firm, from 06:00 a.m. to 09:00 a.m. non-firm and from 06:00 p.m. to 06:00 a.m. 60% of contracted capacity must be provided on standby. The quota included in the ERC draft foresees for solar PV the following annual quotas until 2030:

| SCOD | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Total |

| Solar PV [MW] | 100 | 100 | 100 | 100 | 200 | 200 | 200 | 1,000 |

| Solar PV + BESS [MW] | 190 | 290 | 258 | 440 | 490 | 310 | 390 | 2,368 |

Like past programs, SPV registered capital and bond requirements (bid, development, and guarantee bond) must be complied with at application and throughout the process. Applications will be pre-screened according to application completeness criteria including readiness of land, technology, funding, and project planning. Highest scoring applications will then be allocated to reach target annual capacities. Solar PV and solar PV + BESS rank third and fourth in terms of merit order for feeder after biogas and wind. The program is expected in Q4/2022 and given the number of uncompleted projects developed under past programs, new developments, PEA’s attractive PPA, and the number of market participants, it is likely to be heavily oversubscribed. Since the applicants must be majority Thai-owned, registered capital has to be fully paid in, and the timeline for project award is very tight, the regulation seem to favor large Thai players with such qualifying corporate setup and developed projects readily available.

- Powering of farmland: In April 2022, the Ministry of Agriculture and Cooperative of Thailand announced intentions to install solar power panels on at least one million farms throughout the country to help lower farmer’s electricity bills by up to 30% for the next 25+ years to come. The project will be financed via a non-fungible token (NTF) named “Solar Panels NFT for Thai Farmers” to trade with international investors active in the region.

- Rapid shutdown requirement for rooftop solar (RTS): In June 2022, PEA circulated a letter regarding the new Engineering Institute of Thailand (EIT) RTS standard on the use of rapid shutdown as a part of DC connection of RTS systems. For the time being, the standard will not be enforced by PEA (only the grid compliance for the AC connection is of course still to be complied with). Whether a rapid shutdown device is required, depends in practice in large parts on corporate and insurance policies. ERC or the Department of Alternative Energy and Development (DEDE) have yet to position themselves in this matter. As the rapid shutdown would be required to be installed on a module level, such regulatory change would mean around 7% EPC cost increase for RTS systems affected.

- Commercial & industrial (C&I): The Thai C&I market has become a highly competitive buyer’s market with a larger number of established players and still new players entering the market. The pandemic has led to a slowdown and developers struggling with rising project costs and delays in supply chain and project execution.

Cumulative solar capacity forecast scenarios: Thailand

Source: Apricum PV market forecast Q1/2022

The new utility-scale program draft, once in effect, will likely trigger a new wave of deals for greenfield projects, participating in the upcoming program. In C&I the deal flow should remain on a constant low level due to the ongoing high competition in this market segment and once slowly commencing market consolidation picks up, it should grow.

Recent solar M&A activities: Thailand

Solar Market Profile: Malaysia

Solar Power Policies and Targets Updates

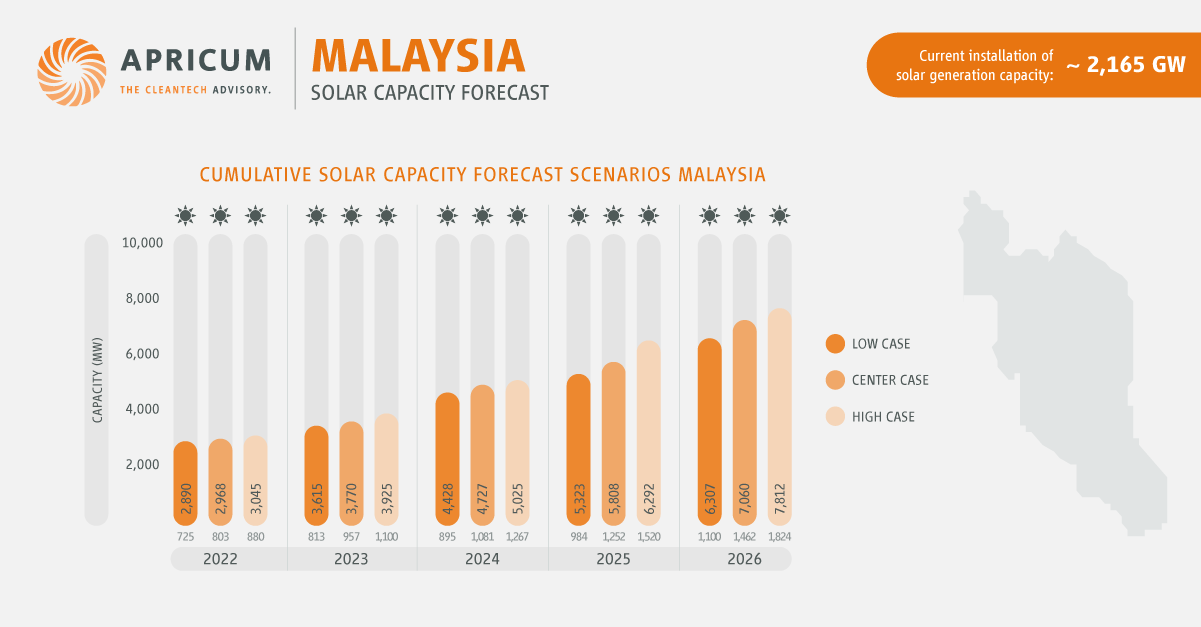

In 2021, Jawatankuasa Perancangan dan Pelaksanaan Pembekalan Elektrik dan Tarif (JPPPET) set a target to increase the RE target to 31%, equaling 8.53 GW total RE generation capacity by 2025 (with 26% in the peninsula) and to 40%, equaling 10.94 GW total RE generation capacity, by 2035 (with 32% in the peninsula). Hence, additional 1,098 MW of solar is planned to be added from 2021-2025 and 2,414 MW from 2026-2035. Currently, around 2,165 MW of solar generation capacity has been installed.

Solar Programs and Market Updates

- LSS utility-scale solar tender: The project execution of the LSS utility-scale solar tenders (LSS4 was the last which bidding had completed and project execution commenced) has been slowed down by rising material prices and fears of rising interest rates. Of the 2,457.27 MW of awarded capacity, in Q2/2022 only 47% (equaling 1,160.42 MW) are operational. The Energy Commission (EC) commenced the first projects to extend the PPA tenure from 21 to 25 years to account for these financial difficulties. The next round, LSS5, is expected in 2023 with the government currently studying the inclusion of virtual PPAs.

- Commercial & industrial (C&I): The already sluggish C&I segment remains slow being additionally impacted by rising material prices and delays in supply chain and project execution related to the impacts of the pandemic.

Cumulative solar capacity forecast scenarios: Malaysia

Source: Apricum PV market forecast Q1/2022

Solar M&A Highlights

The solar M&A scene remains slow with the following noteworthy transactions.

Recent solar M&A activities: Malaysia

Solar Market Profile: the Philippines

Solar Power Policies & Targets Updates

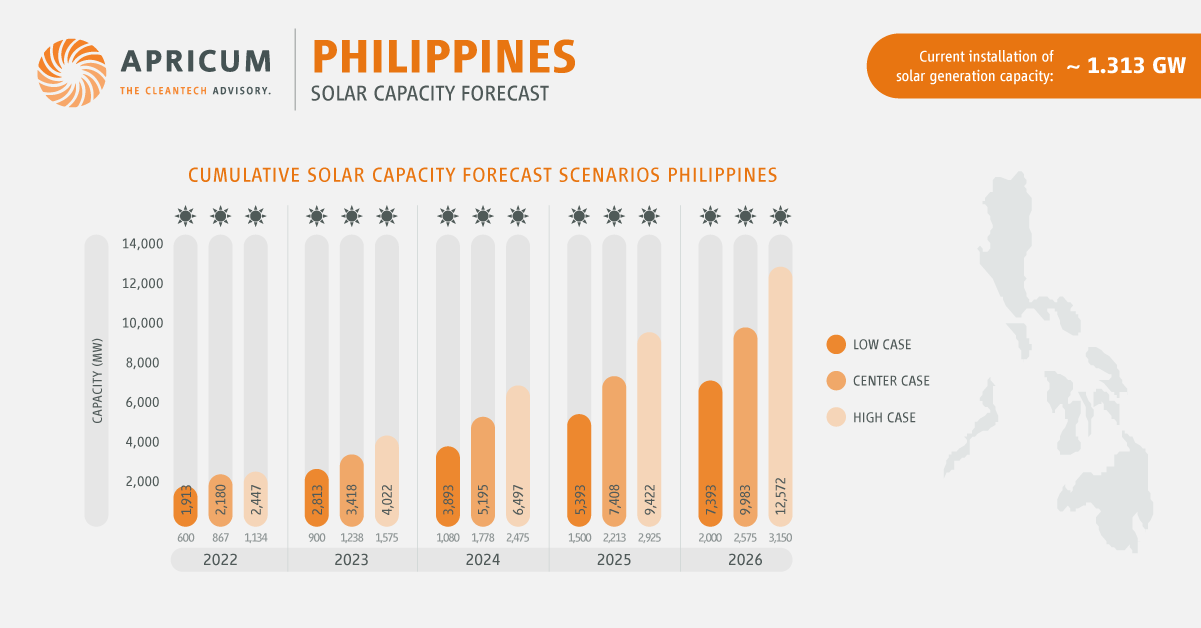

The Philippine Energy Plan (PEP) 2020-2040 envisions an increased solar target of 32.59 GW (equaling 34.07% of total generation capacity) by 2040. Capacity additions for the years 2021-2030 are 18.64 GW (equaling 65.16% of total added generation capacity) and 12.93 GW (equaling 31.69% of total added generation capacity) for the years 2031-2040. Currently, around 1.313 GW of solar generation capacity has been installed.

Solar Programs and Market Updates

- Green energy option program: In December 2021, the Independent Electricity Market Operator of the Philippines (IEMOP) launched the Green Energy Option Program (GEOP), providing consumers with peak electricity requirements equal to or greater than 100 kW have an option to source their electricity supply from RE sources of DoE-approved RE suppliers and not only from their local distribution utility.

- Green energy auction: In January 2022, the Department of Energy (DoE) announced a notice of auction with a solar utility-scale quota of 1.26 GW, with Luzon receiving 900 MW, the Visayas 260 MW, and Mindanao 100 MW shares. The reverse bidding taking place in June 2021 resulted in seven solar projects over a total of 1,490.30 MW of capacity being awarded.

- Commercial & industrial (C&I): The C&I segment has significantly increased speed with most of the big local corporations having own C&I segments or separate ventures and more regional players entering or eying the market. One recent factor causing a major upset for non-local investors being the Philippine Peso plummeting to record low and posing a significant threat to project profitability as off-take agreement typically are in local currency without coupling to USD or hedging applied. Further, the pandemic also has led to delays and cost increases which slowed down progress slightly, nevertheless the market is growing vastly.

Cumulative solar capacity forecast scenarios: Philippines

Source: Apricum PV market forecast Q1/2022

Solar M&A Highlights

The solar M&A scene has begun to increase in traction, fueled by the perspective for new utility-scale installations and the heating up of the C&I market.

Recent solar M&A activities: the Philippines

Solar Market Profile: Indonesia

Solar Power Policies & Targets Updates

In September 2021, Indonesia’s state electricity company, PLN released its Electricity Business Plan (RUPTL) 2021-2030, with an RE target of 23.0% (equaling 20,923 MW) under the optimum and 24.2% under the low-carbon scenario by 2030. RE projects will account for 51.6% of the 40,575 MW of projects to be developed and solar will account for 22.36% (equaling 4,680 MW) with an expected annual distribution as follows:

| SCOD | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | Total |

| Solar PV [MW] | 60 | 287 | 1,308 | 624 | 1,631 | 127 | 148 | 165 | 172 | 157 | 4,680 |

Currently, only around 190 MW of solar generation capacity has been installed.

Solar Programs and Market Updates

- Rooftop solar regulation MEMR: In August 2021, the Ministry of Energy and Mineral Resources (MEMR) passed new regulation MEMR 26/2021, replacing regulation MEMR 49/2018. Key changes include removing the 35% discount on net-metering, extension of unused credits from three to six months, improving speed of license issuance to five days post application, allowing for carbon trading for PV system owners, online licensing & reporting via MEMR system, IT application for digital-based RTS integrated with SCADA.

- Floating solar projects 110 MW: In May 2022, ACWA Power was announced preferred bidder to develop 110 MW of floating solar projects on water reservoirs in Indonesia (50MW Singkarak project in Sumatra and 60 MW Saguling project in Java).

- RE electricity export to Singapore: In Apr 2022, Singapore-based RE developer Quantum Power Asia Pte. With its German partner ib vogt, announced plans to invest $5b investment into a 3.5 GW solar power plant with 12 GWh battery BESS. The plant will be located on 4,000 ha of land in Indonesia’s Riau Islands and be connected via a 50 km undersea cable.

- Commercial & industrial (C&I): Due to the adjustment of the MEMR regulation, the market has started to pick up and more players have and are entering the market.

Cumulative solar capacity forecast scenarios: Indonesia

Source: Apricum PV market forecast Q4/2020

The solar M&A scene is slowly starting to pick up momentum with the following noteworthy transactions.

Recent solar M&A activities: Indonesia

Interested in acquiring or divesting of solar (or other RE) power assets / developers / IPPs / EPCs / manufacturers in ASEAN or interested in support how to enter and navigate these markets? Please contact Apricum Senior Advisor Moritz Sticher for further information on Apricum – The Cleantech Advisory’s transaction advisory services.