What are the latest trends in the ASEAN solar energy scene? The Association of Southeast Asian Nations (ASEAN) is a dynamic market for solar power as well as for renewable energy mergers and acquisitions. Here Apricum Senior Advisor Moritz Sticher provides another update to his popular 2021 article, Solar Power in ASEAN: A snapshot and outlook of the solar power markets and growing M&A scene, for 2023 and beyond. The article provides deep insight into the Vietnamese, Thai, Malaysian, Filipino, and Indonesian markets, drawing from Moritz’s long of experience as an entrepreneur and a solar power and renewable energy expert in the ASEAN region.

ASEAN OVERVIEW

Solar Market Profile: Vietnam

Solar Policy & Market Summary

While the new PDP 8 lays out more ambitious long-term goals for RE, including solar energy, the implementation remains rather slow and bumpy, with the DPPA program regulations still pending, transitional solar (and wind) projects receiving tariffs making project profitability challenging, and further negatively perceived adjustments of the PPA template. While the bidding law has been updated, concrete prospects for utility-scale solar remain somewhat vague, also due to the ongoing required national grid updates. The C&I market continues to be one of the steadier growing segments in the solar energy market.

Solar Power Policies & Targets Updates

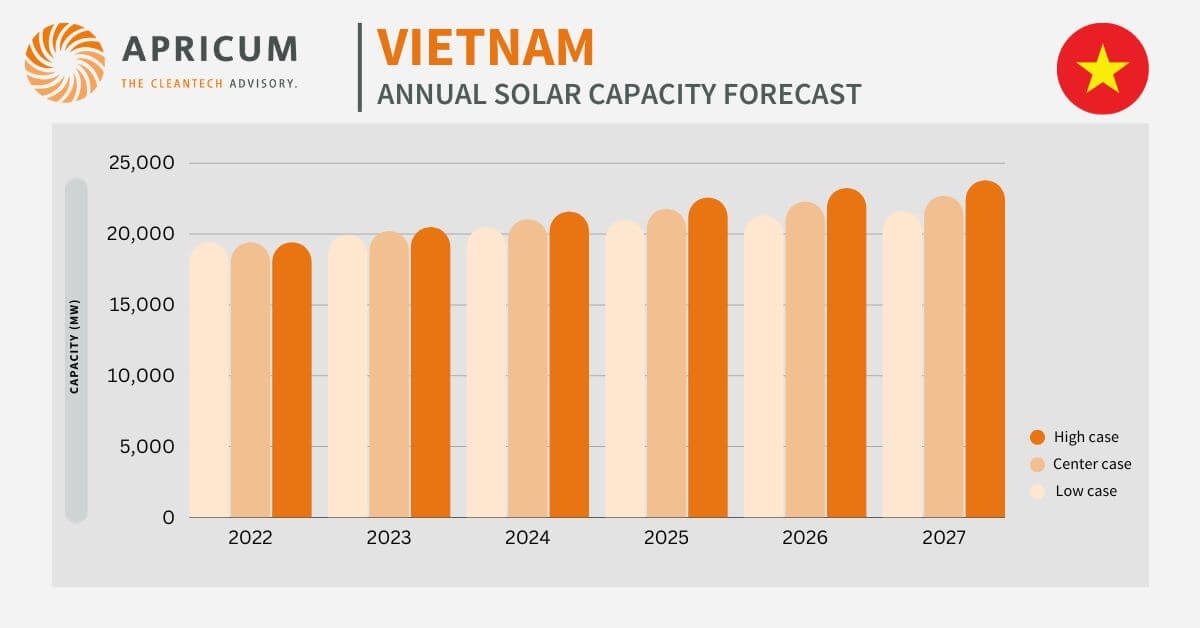

On May 15, 2023, the Prime Minister of Vietnam finally approved the National Power Development Plan VIII (PDP 8) for the period of 2021–2030, with a vision to 2050. Solar capacity targets until 2030 account to a total 12.836 GW and until 2050 to 189.294 GW. All RE targets are subject to funding provision under the Just Energy Transition Partnership (JETP) agreement with the International Partners Group (IPG) entered on December 14, 2022 The PDP 8 further includes a 50% target by 2030 for rooftop solar self-consumption for residential and office buildings. By the end of 2022, around 19.38 GW of solar generation capacity has been installed.

Solar Programs and Market Updates

- Direct PPA (DPPA) program: The new PDP 8 emphasizes the need for regulations for the pending DPPA program. In August 2023, the Ministry of Industry and Trade (MOIT) submitted a report to the Prime Minister with two options for the DPPA program, the first option without going through Vietnam Electricity’s (EVN) grid. In this case, which the ministry recommended for implementation, the sales of electricity would be conducted via privately invested transmission lines, hence mitigating capacity, voltage level, and electricity use restrictions. Appliable tariff would be the electricity retail prices for large users regulated under Decision No. 1062, dated May 4, 2023, with an average price at 1,920.37 VND/kWh (around 0.081 USD/kWh). The second option would be going through EVN’s grid, requiring a minimum capacity of 10 MW, and selling at voltage levels > 22 kV. The tariff for the second option would be governed by the Prime Minister’s Decision No 24/2017 about the average electricity retail prices and Decision No 28/2014 about the electricity price bracket until the Law on Price would come into effect, which would base tariff on production costs plus service fee.

- Transitional solar (and wind) project mechanism: On October 3, 2022 the MOIT issued Circular 15/2022/TT-BCT describing the method for formulating tariff ranges for transitional solar (and wind) power plants. On January 19 2023, the MOIT issued Circular No. 01/2023/TT-BCT which annulled certain provisions regarding the implementation and development of solar (and wind) projects, including annulment of FIT references, USD indexation, 20-year PPA tenure, and rooftop solar capacity limits. On January 7, 2023, the MOIT issued Decision No. 21/QD-BCT setting ceiling prices (EVN to negotiate tariffs per project) tariff for transitional solar (and wind) power plants, with ground-mounted solar at 1,184.9 VND/kWh (around 0.049 USD/kWh) and floating solar at 1,508.27 VND/kWh (around 0.063 USD/kWh). On the 24/25th of May 2023 the MOIT issued documents to EVN regarding the urgency to negotiate temporary tariffs for operational projects and submit to MOIT for approval and issue PPAs for projects with MOIT-approved tariffs. Meanwhile most affected projects have entered PPAs with temporary tariffs equal to 50% of celling price under Decision No 21/QD-BCT with EVN.

- Updated bidding law: On July 23, 2023 a new bidding law was passed by the National Assembly, coming into effect on January 1, 2024, which also is applicable to power generation and transmission projects. The new bidding law clarifies when bidding for investor selection is applicable and adds five new inclusions – a new approach to the scope of application of international bidding, new criteria to assess bids and select winning investors, new detailed regulations on the list of key provisions of project contracts, new requirements regarding contract performance security, and new conditions for project transfers.

- Commercial & industrial (C&I): The C&I segment shows steady growth and given the prioritization of rooftop solar in Vietnam’s PDP 8, is expected to be a major market segment with a broad mix of international and local players developing projects.

Solar M&A Highlights

Vietnam’s M&A scene is remaining on a lower level due to a lack of new utility-scale programs and the DPPA pilot program regulations still not being released, for which many players are seeking to acquire projects under development to participate with. Ongoing curtailment still presents a significant challenge and, in many cases, leads to abandoning of attempted acquisitions. The fewer unaffected projects up for acquisition in many cases have high asking prices complicating such attempts further.

Solar Market Profile: Thailand

Solar Policy & Market Summary

With the last RE utility-scale auction program being released on rather short notice, regulatory hurdles for foreign players and hence winning bids favoring Thai conglomerates, international interest in further auction rounds may likely be rather reserved. The steady but highly competitive C&I segment remains the less government-controlled playfield, for local and international players alike. It remains to be seen whether the announced PDP update will change the picture but given the now finalized new government, major changes in RE ambitions and business environment seem unlikely.

Solar Power Policies & Targets Updates

A new PDP for the period of 2023–2037 is in draft and is aiming to increase the share of renewable in the energy mix further up to 50% by 2036, as well as potentially adding nuclear energy. By the end of 2022, around 4.67 GW of solar generation capacity has been installed.

Solar Programs and Market Updates

- Utility-scale Solar PV and BESS auction: The first annual bidding round has concluded with Thai conglomerates being awarded the vast majority of all auctioned RE projects of the totally awarded2 GW (a total of 175 RE projects was awarded), including utility-scale solar (129 projects over 2,368 MW) and solar plus BESS (24 projects over 994.06 MW). The second annual bidding round is expected likely towards the end of 2023.

- Floating solar by the Electricity Generating Authority of Thailand (EGAT): Subject to approval of the revised PDP 2023–2037 and inclusion of such target, EGAT aims to increase its power generation capacity from floating solar at nine hydropower dams to 10 GW by 2037 and plans to invest around THB 300 billion.

- Commercial & industrial (C&I): The Thai C&I sector remains steady with many local and international players competing heavily for PPAs, resulting in a buyers’ market with low tariffs (average around 40% discounts on prevailing utility tariffs) and returns. Currently, the new world largest solar rooftop plant with 22 MW is being constructed by KEPCO under a PPA with Sumitomo Rubber Industries.

Solar M&A Highlights The M&A scene has been rather quiet and remains mainly driven by transactions in the C&I space or longer operational utility-scale projects, given the lack of newly completed utility-scale, which mostly also remain on the developers’ balance sheet for some years, given the meanwhile higher hurdles of participation in solar utility-scale auctions. Further, asking prices for such assets are typically high and being influenced by local stock market dynamics.

Solar Market Profile: Malaysia

Solar Policy & Market Summary

Malaysia’s government seems to finally mean business and just recently in July laid out rather ambitious RE targets and transitions levers to achieve such. As some hurdles for international players such as 51% Malaysian shareholding remain in place, it remains to be seen whether these RE targets will be achievable. The addition of virtual PPAs for corporate clients in December last year may help to unlock the slow C&I segment further.

Solar Power Policies and Targets Updates

On July 27, 2023, the Malaysian government launched Phase 1 of the National Energy Transition Roadmap (NETR) to accelerate Malaysia’s energy transition applying six transition levers, namely renewable energy, hydrogen, bioenergy, green mobility, energy efficiency, and carbon capture, utilization, and storage (CCUS). The RE target has been increased to 70% by 2050, a substantial increase from the previous target of 40% by 2035 and with the majority to be generated from solar power. NETR policies also include the concept of a self-contained system of “willing buyer, willing seller”, the increase of solar on government buildings and allowing for RE cross-border trading via a central electricity exchange system. By the end of 2022, around 1.94 GW of solar generation capacity has been installed.

Solar Programs and Market Updatesa

(a) NETR flagship projects: Under the NETR, Malaysia’s government also announced 10 flagship projects in the areas of the NETR transition levers, with the following projects including solar energy:

- Development of five 100 MW utility-scale solar plants by Tenaga Nasional Berhad (TMB) in several states in cooperation with SMEs, cooperatives, and state economic development corporations.

- Development of five up to 2.5 GW of floating solar hybrid plants by TMB at TMB’s hydro reservoirs to serve as energy storage.

- Leasing of residential rooftops: Residential building owners can lease their rooftops to earn income instead of having to invest into a rooftop solar power plant. As a pilot project, Sime Darby Property committed to install 4.5 MW of < 10 kWp rooftop solar plants at 450 homes in Elmira and Bandar Bukit Raja, Selangor (source of funding remains vague).

- Establishment of a large-scale, integrated sustainable development zone or RE Zone, including industrial park, zero-carbon city, residential development, and data center.

- Increase in development of utility-scale solar (and small hydropower) plants in Sabah.

(b) Corporate Green Power Program (CGPP): On November 7, 2022, the Energy Commission of Malaysia launched the CGPP to allow eligible corporate consumers to enter a virtual PPA (VPPA) / Corporate Green Power Agreement (CGPA) with solar power producers for the virtual delivery of RE. The solar power producer would export electricity to the grid of TMB under the New Enhanced Dispatch Arrangement (NEDA) framework at the System Marginal Price (SMP) while the corporate consumer would purchase electricity at the applicable tariff from the local grid. The CGPA represents a contract for difference under which the parties agree on a settlement price mechanism for supplied and consumed energy. Eligible corporate consumers include manufacturing and service companies in Peninsular Malaysia with a credible three-year financial record (for new consumers a proven annual revenue of > RMB 10 million) which must remain TMB consumers. Solar power producers require 51% Malaysian shareholding, > 3 years of experience in development, financing, and execution of solar projects, operate a solar power plant with > 1 MW capacity, own assets > RMB 10M, have registered capital > RMB 1M, demonstrate the ability to finance the project, have the respective land use rights, and have entered into agreements with the corporate consumer. Changes in shareholding and shareholding structure are prohibited for five years. A total of 800 MW was offered for bidding in May 2023, with each project being a 5-30 MW greenfield solar power project and having to reach COD within 2025.

(c) Commercial & industrial (C&I): The C&I segment is slowly growing but remains on a rather low level.

Solar M&A Highlights

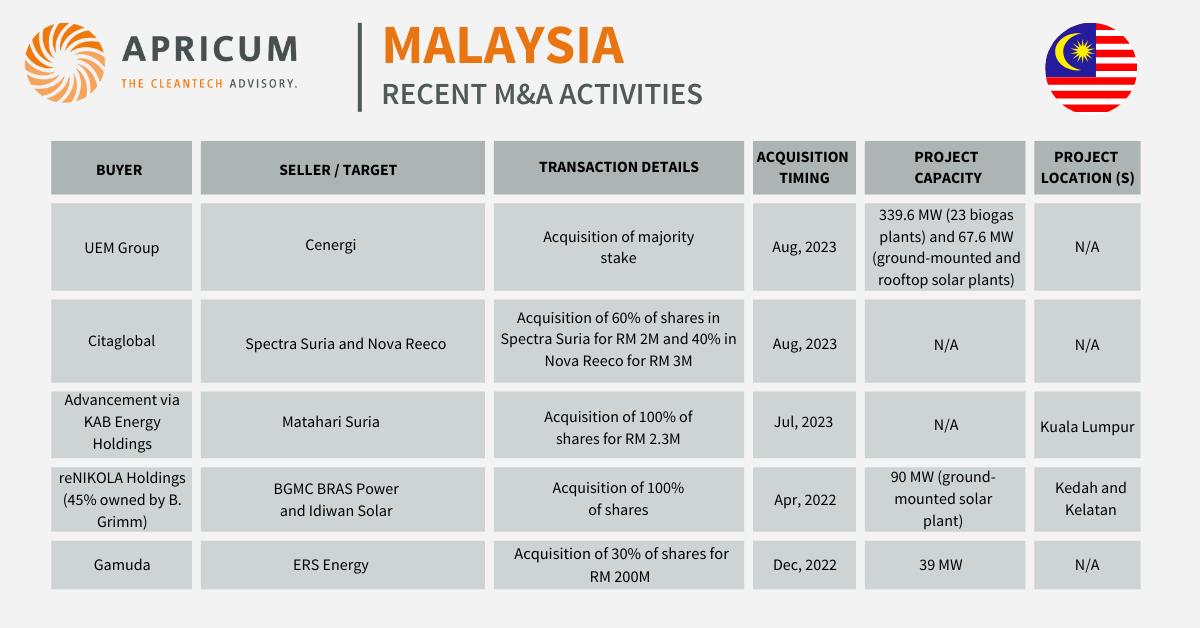

The solar M&A scene remains slow with the following noteworthy transactions mostly constituting a domestic consolidation of players or assets.

Solar Market Profile: the Philippines

Solar Policy & Market Summary

Under the new government, the Philippines have seen a surge in RE ambitions, also fueled by the lifting of the past foreign ownership restriction in December last year. As visible from the last green energy auction, transmission grid capacity remains a major hurdle to implementation of the desired RE targets. The C&I market, allowing for high returns due to the high electricity tariffs, especially areas outside of Manila that Meralco does not serve, continues to grow, and attract more players to enter the market, or to increase their local activities.

Solar Power Policies & Targets Updates

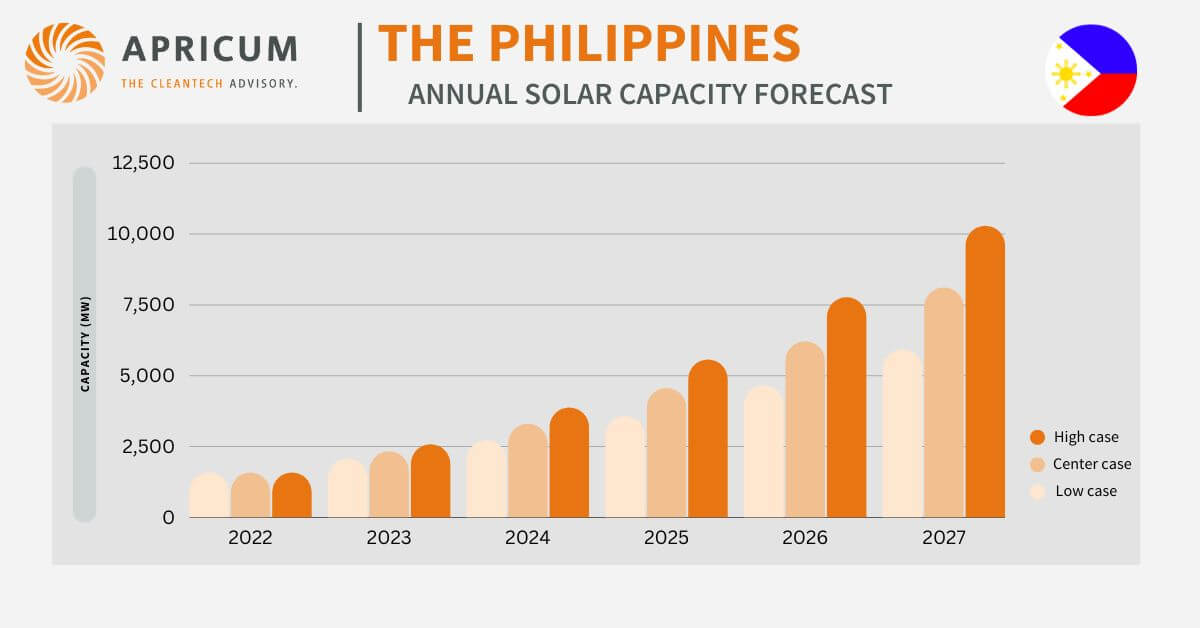

Currently, the Department of Energy (DOE) is seeking public consultation on the newly drafted Philippine Energy Plan (PEP) 2030–2050. The new PEP will include more ambitious RE targets and includes 2 scenarios – the reference scenario and the clean energy scenario. Under the referenced scenario, RE targets are 35% by 2030 and 50% by 2050 while under the clean energy scenario (which also includes nuclear energy), RE targets are 35% by 2030, 50% by 2040 and > 50% by 2050. By the end of 2022, around 1.56 GW of solar generation capacity has been installed.

Solar Programs and Market Updates

- Green energy auction: The second round of the green energy auction over a total of 11.6 GW in RE capacity was held by the Department of Energy (DOE) on 03.07.2023 for annual capacity targets to commence energy delivery 2024–2026 under a 20-year PPA. Ceiling prices for solar were set at 4.4043 PHP/kWh (around 0.077 USD/kWh) for ground-mounted, 4.8738 PHP/kWh (around 0.086 USD/kWh) for rooftop, and 5.3948 PHP/kWh (around 0.095 USD/kWh) for floating solar. The program was heavily undersubscribed with a total of 3,580.76 MW of RE capacity being awarded to 105 prior pre-qualified bidders, out of which solar included 3,580.76 MW ground-mounted (Luzon 1,657.9823 MW, 173 MW Visayas, and 48 MW Mindanao), 9.39 MW rooftop, and 90 MW floating solar (Luzon). The government blamed the low turnout on delays in crucial transmission projects under the National Grid Corp. of the Philippines (NGCP).

- RE obligation for government buildings: On July 7, 2023, the Inter-Agency Energy Efficiency and Conservation Committee (IAEECC) passed a resolution for all government buildings to cover at least 20% of their electricity consumption (based on highest monthly consumption) with solar or other RE energy within the next 3 years. Government buildings with an RE generator < 100 kW can become qualified end-users and sign net-metering agreements with distribution utilities.

- Foreign ownership: On 15.11.2022, the DOE issued Circular No. 2022-11-0034 amending 2008’s Renewable Energy Act to allow 100% foreign ownership in the exploration, development, and utilization of solar, wind, hydro, and ocean or tidal energy resources. The long-awaited policy came into effect on December 8, 2022 and finally fully opens the market for foreign investors.

- Commercial & industrial (C&I): The C&I segment continues to be vivid and growing, with more international players showing interest after the 100% foreign ownership limitations have been lifted.

Solar M&A Highlights

The solar M&A scene is slowly growing, fueled by the perspective for new utility-scale installations and the steady heating up of the C&I market.

Solar Market Profile: Indonesia

Solar Policy & Market Summary

Indonesia continues to disappoint in RE ambitions and implementation, with the country still bargaining on fossil fuel utilization and Perusahaan Listrik Negara’s (PLN) internal dynamics related to that complicating the matter. The dragging expansion of Indonesia’s transmission grid is making implementation of large utility-scale RE plants unfeasible and the timeline for such expansion under PLN’s lead remains vague. The C&I market, suffering from competition with subsidized electricity tariffs and lack of support from PLN, also remains on a low level, with little change at the horizon.

Solar Power Policies & Targets Updates

PLN is currently revising its Electricity Business Plan (RUPTL) 2021-2030, to allow for a higher RE target, in line with the JETP, entered with the IPG on November 15, 2022, under which Indonesia pledged a carbon-neutral energy sector by 2050 and increasing its RE generation share to 34% by 2030. PLN is planning transmission grid upgrades to allow for a higher share of around 28 GW of RE in the generation mix. By the end of 2022, only around 256 MW of solar generation capacity has been installed.

Solar Programs and Market Updates

- Adjustment in RE tariffs and streamlining of RE procurement process: On September 13, 2022, Presidential Regulation on the Acceleration of Renewable Energy Development for Electricity Generation was issued, altering RE tariffs from past being a percentage of the average local generation costs (generating BPP scheme) to annual ceiling prices, based on the type of energy sources and location. Further, the RE procurement process was altered to direct selection with time limit of 180 days for solar plants and based on government program quotas and the applicable ceiling tariff.

- RE energy export to Singapore: On September 8, 2023, Singapore’s Energy Market Authority (EMA) gave conditional approvals for energy import by 5 companies (Pacific Medco Solar, Adaro Solar International, EDP Renewables, Vanda RE and Keppel Energy) over a total of 2 GW from solar + BESS plants in Indonesia.

- Temporary local content requirement relaxation: As part of the JETP, Indonesia’s government is considering suspending the local content requirement, so far mandating solar projects to use 60% of domestically produced materials, until 2025, when Indonesia’s first solar panel factory is expected to start production.

- Commercial & industrial (C&I): The C&I segment remains slow due to both low electricity tariffs caused by fossil fuel subsidies and PLN’s lack of support in permitting, leading to major delays in many projects.

Solar M&A Highlights

The solar M&A scene remains stagnant due to the lack of new projects and significant installed solar (and RE) capacity.

HOW APRICUM CAN SUPPORT

As the energy transition accelerates, Apricum provides strategy and transaction advisory services along the entire solar PV value chain, leveraging a unique blend of expert strategy consulting, investment banking proficiency, and deep technology and market know-how. Our support helps drive the global renewable energy transition by answering the key strategic questions faced by both established market players and new entrants with market assessments, strategy and business model development and review, competitive screenings, fundraising, M&A (sell-side, buy-side), due diligence, and project finance. Interested in acquiring or divesting of solar (or other RE) power assets / developers / IPPs / EPCs / manufacturers in ASEAN or interested in support how to enter and navigate these markets? Please contact Apricum Managing Partner Nikolai Dobrott or Apricum Senior Advisor Moritz Sticher.