Market entry opportunities still available in booming market

With its recent renewal of the feed-in tariff (FIT) for solar installations, the Japanese market poised to be among the top solar markets worldwide throughout the coming years. With a mere ten percent decrease of the very attractive FIT rate as of April 1, 2013, the new Japanese government has demonstrated its continued commitment to solar energy.

| FIT rate from April 1, 2013 | 37.8 JPY/kWh (0.29 EUR/kWh; before 42 JPY/kWh) |

| FIT period | 20 years for installations > 10 kW 10 years for installations < 10 kW |

| Valid for | Grid-fed electricity from solar installations |

| Governmental body in charge | Ministry of Economy, Trade and Industry |

Table 1: Key features of the renewed Japanese FIT for solar installations

Apricum expects 5-7 GW of new PV capacity to be installed by year end 2013, thereby making the country the second-largest PV market globally after China. This strong market development is mainly a consequence of the very attractive ROIs for investors in utility-scale solar projects (>10% project ROI achievable), who benefit from high and reliable FIT rates, coupled with continuously decreasing PV system costs.

Managers at solar companies that have not yet entered the Japanese market now raise an obvious question: it is still advisable to enter the market? Two key aspects are often considered:

1. Is the market sustainable? Will heavy market entry investments pay off?

2. Can we succeed in the market, i.e., gain market share and be profitable?

In the following both aspects shall be briefly discussed.

1. Is the Japanese solar market sustainable?

To assess the sustainability of the Japanese solar market, a close look at the country’s energy balance and the development of electricity prices is advisable.

With natural gas, coal and oil accounting for two thirds of electricity produced, Japan keeps striving to reduce the strong dependence on imported energy feedstock, which is a heavy burden for the country’s foreign trade balance. Despite plans of the new government under Prime Minister Abe to stick with nuclear energy, which contributed ~30% to the power mix before the Fukushima disaster, renewable energy sources have been identified as a viable alternative to fossil fuels. Among renewable energy sources, solar energy is particularly attractive as irradiation is high across the country (1,200-1,600 kWh/m²/a). At least on the solar energy file, the new administration maintained the political direction of the previous government, which introduced the generous FIT for solar. As a sustained support of the domestic PV industry certainly is in the interest of the Abe government, a significant revision of the current FIT policy is unlikely short-term.

After a long period of stability, electricity prices have recently soared and this trend is expected to persist. A private household in the Tokyo area has to pay ~26 JPY/kWh (0.20 EUR/kWh) today, coming from 23 JPY/kWh in 2011. Given an already high and still rising power price and continuously falling PV system prices, it becomes clear that consumer grid-parity is in reach in Japan. Consequently, as the economics for PV self-consumption become increasingly viable, the level of the FIT will become less relevant in a few years. Companies with an attractive value proposition to address power consumers with PV self-consumption solutions are therefore particularly well-positioned to achieve sustainable growth. Requested solutions encompass high-efficiency PV modules, flexible and building-integrated PV (BIPV) modules and integrated energy systems that enable residential and commercial power consumers to cut energy costs.

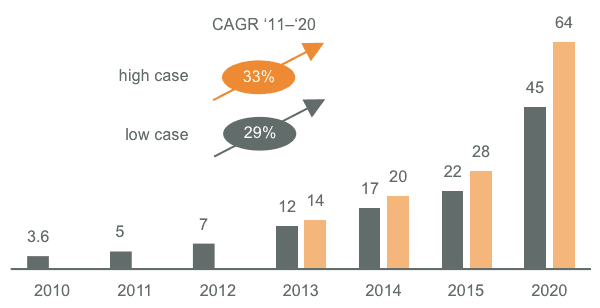

Until 2015, Apricum forecasts up to 20 GW of installed solar capacity in Japan, which could reach even more than 50 GW by 2020.

Fig. 1: Cumulative PV capacity in Japan [gigawatts]. Source: Apricum market model Q1/2013

Summing up, the Japanese solar market is characterized by political commitment and increasingly viable economics and therefore is expected to be a sustainable market with strong mid- to long-term growth prospects.

2. Can we succeed in the market?

Yes, you can – if you do it right. The following three points should be taken into consideration for a successful market entry:

1. Adapt your business model.

As an example, Japanese clients highly value quality and an all-encompassing service. To be successful, your product and service portfolio must reflect that outlook. Moreover, the solar downstream sector is very fragmented with an abundance of players and potential sales channels, stretching from do-it-yourself stores to full-service “housing makers”. It is imperative to choose the right target clients and respective sales channels that guarantee solid turnover, coupled with a healthy margin.

2. Be patient.

Patience is a distinctive character of Japanese people. You are expected to demonstrate the same to succeed in the market. Building client relationships requires a substantial amount of time in the Japanese market and additionally, certification of solar products with the responsible body, JET, typically is a lengthy process for foreign companies.

3. Be perceived as Japanese.

Japanese customers place extremely high value on Japanese products. Try to reflect this by adding a Japanese flavor to your offerings. This can be done with the product itself, e.g., by using Japanese branding or bundling your product with Japanese products to offer a “Japanese system”. Further, employing Japanese sales staff or partnering with a Japanese company that takes care of sales activities is advisable.

Interview with Masataka Asano, Apricum Country Representative Japan

Are we seeing a one-time boom in the Japanese market that will be over soon?

Masataka Asano: The current development is exciting to see, indeed. I expect that the Japanese government will continue promoting solar as a future energy source.

There is a gold rush regarding utility-scale “Mega Solar” projects. Would you agree that this is the most attractive market segment?

As you know, land for “Mega Solar” projects is limited in Japan. Therefore, in the long-term, the major market segment will be roof-top installations. Another challenge for utility-scale projects is insufficient transmission lines, which need to be upgraded at high cost. The Japanese PV market will certainly grow, but one needs to be careful targeting the right market segment and choosing the right business model.

You mentioned the BIPV segment. Why do you think this market segment will be attractive?

For BIPV installations, light-weight modules are required, but the appropriate products are currently not available at competitive prices. Module manufactures at the moment are supplying low-cost modules to “Mega Solar” projects, but in the long run high-end products that address the needs of roof-owners will survive in the Japanese market.

What are the key success factors for companies entering the Japanese PV market?

It is largely a matter of acceptance in the market. Therefore, a Japanese appearance, which can be brought by a Japanese partner company, is critical.

If you want to discuss opportunities for your company in the Japanese solar market, please get in touch with Matthias Kittler

Matthias Kittler

Principal

kittler@apricum-group.com

Telephone + 49 30 30 877 62-16

Apricum – The Cleantech Advisory

www.apricum-group.com