Energy storage technologies are a key element for some of the most comprehensive and impactful industrial transformations of our modern society, such as mobile communication and e-mobility. The power sector has further potential to integrate storage capacity and transform its current structure; yet, demand is still limited and a plethora of technologies and business models is competing for customers. Further cost reductions are essential to fully realize the transformational potential of storage to the power sector.

We examine fundamental drivers and applications for energy storage technologies in the power sector and outlines how storage companies can create a competitive advantage by consequent execution of a comprehensive growth strategy.

Major current industrial transformations are driven by energy storage technologies

Electricity is the most versatile form of energy we know; its availability forms the backbone of our culture and lifestyle. The volatile nature of electric power however requires a constant balancing of supply and demand. Consequently, the overwhelming share of electricity today is delivered via extensive power grids. Energy storage technologies can decouple generation and consumption of electricity and allow for consumption without access to the grid.

Continuous progress in the field has driven major transformation processes in key industries that shape our daily lives, such as:

- Communication: From landline phones to mobile electronics. Laptops, tablets and mobile phones have changed the way we communicate and organize ourselves, and battery storage technology is a key enabler for increasingly complex and powerful mobile devices. Today, lithium ion batteries are widely accepted as the most competitive technology for mobile applications and are produced at massive scale.

- Mobility: From fossil-fueled combustion engines to electric vehicles. Electronic vehicles are gradually gaining ground in private and public transportation, reflecting society’s commitment to a less CO2-intensive economy. The shift from liquid fuels and combustion engines to e-powered cars constitutes a disruptive change to the energy and automotive sector and beyond. More cost-effective storage technology with high power and energy density and a wide range of operating conditions is the key to stronger market penetration of e-vehicles; until now, lithium-ion technology is the favored technology, while fuel cell power blocks are a less utilized option.

- Grid-level power: From dispatchable fossil-fueled to intermittent renewable power. The future agenda of many countries includes a higher share of renewable power in their generation mix to meet CO2 reduction targets, increase energy independence or make domestic fossil fuel available for export. But due to the intermittent character of renewable power sources such as wind and solar, the higher share of volatile power generation will require energy storage capacity to ensure vital grid stability and help to balance supply and demand. A transformation of our power generation landscape thus will also depend on the availability of storage technology with commensurate cost.

- Consumer-level power: From utility procurement to self-generation. The rapidly falling prices of solar systems have made it more cost-effective to self-produce energy from solar than to buy from the local utility in many regions where price includes transmission and full distribution charges, taxes, etc. Consequently, solar system owners have a strong incentive to maximize their share of self-consumed energy. Inexpensive storage solutions complementing distributed PV generation systems can amplify the self-consumption share and substantially increase the attractiveness of an investment in private small-scale solar installations.

Transformation in the communication sector has by and large been accomplished with a single dominant storage technology (Li-ion). In the e-mobility sector, much progress has been made in recent years. Following a number of product introductions by the likes of Tesla, Chevrolet and Nissan, the focus is now on further cost reduction, e.g., through the establishment of large-scale dedicated battery production facilities as announced by Tesla this year. Most manufacturers have placed their bet on lithium-ion technology.

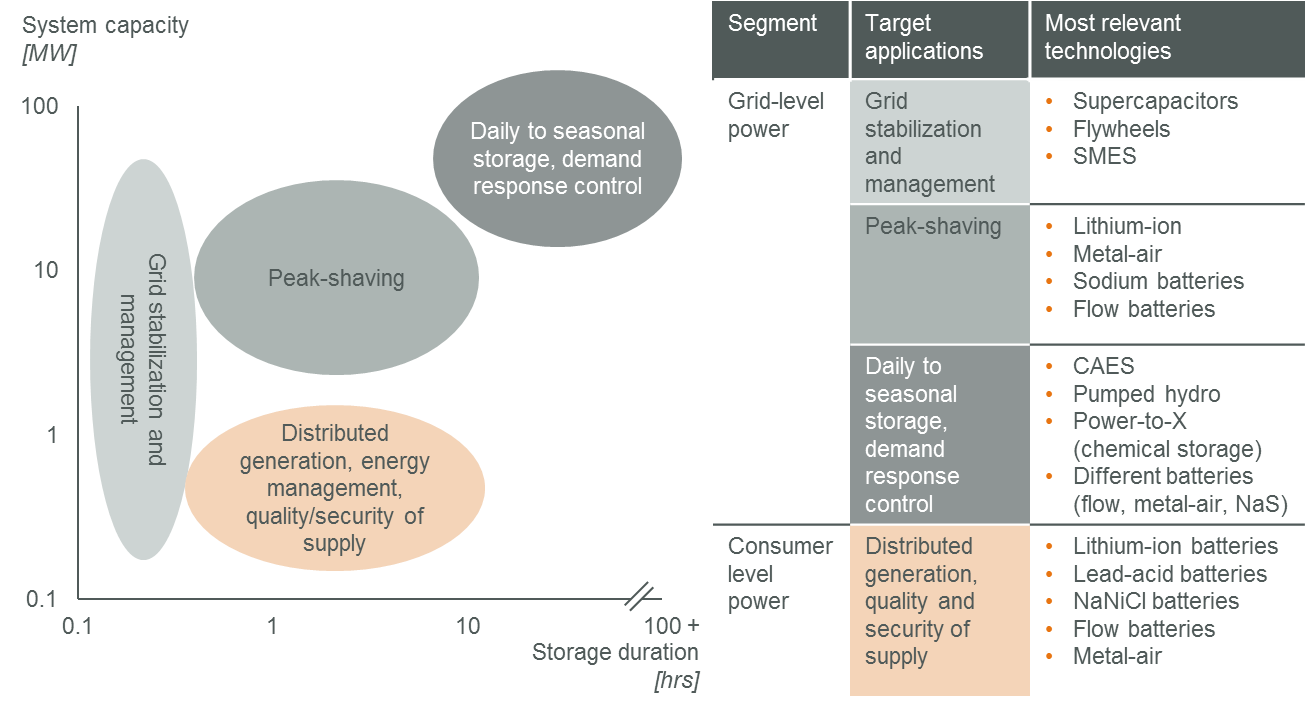

In contrast, the power sector is still in quite an early stage of transformation. A large number of promising technologies compete for deployment across different applications with individual technological requirements. Equipment with high power and short term storage capacity is required to manage loads in transmission and distribution grids, while in separated micro-grids like on islands long term storage ability is most important to allow shifting renewable daytime generation to evening and night hours. Commercial viability at this stage is still limited to discrete applications that enjoy public subsidies.

Figure 1: Overview of the most relevant energy storage applications and different technologies (non-exhaustive)

A key difference with the communications and mobility sectors is the range of storage technologies that are still in the race to service the growing demand; flow battery technology alone comprises at least five different technological options customers can choose from. The power sector storage industry is now at the critical stage of technology selection; emerging dominant concepts will enable companies to leverage economies of scale and realize the needed cost reductions to become attractive for mainstream deployment.

Positive outlook for storage solutions due to strong fundamental drivers

Overall, there are strong fundamental drivers for the growing demand of storage solutions in the power sector. At grid-level, the main drivers are the need for stabilization of aged or strained grid infrastructure (e.g., USA), the continuously increasing share of volatile renewable power in the generation mix (e.g., Germany) and a trend towards time-of-day and power demand pricing. At the consumer level, storage demand will be primarily driven by high retail electricity prices and their growing gap to continuously reduced feed-in-tariffs.

Based on these fundamental drivers that follow solid financial rationale, there is broad consensus that power sector storage demand will grow at a fast pace over the next few years. Market outlook is especially positive in the USA, where an aged and constrained grid infrastructure needs upgrade with e.g., storage and where very expensive peak load prices can be avoided with the deployment of suitable storage devices. Europe, China and Japan are attractive midterm markets where the rapidly increasing share of renewable generation and high power prices for end customers are creating demand for energy storage on both the grid and the consumer level.

Storage solutions are currently too expensive for mainstream applications

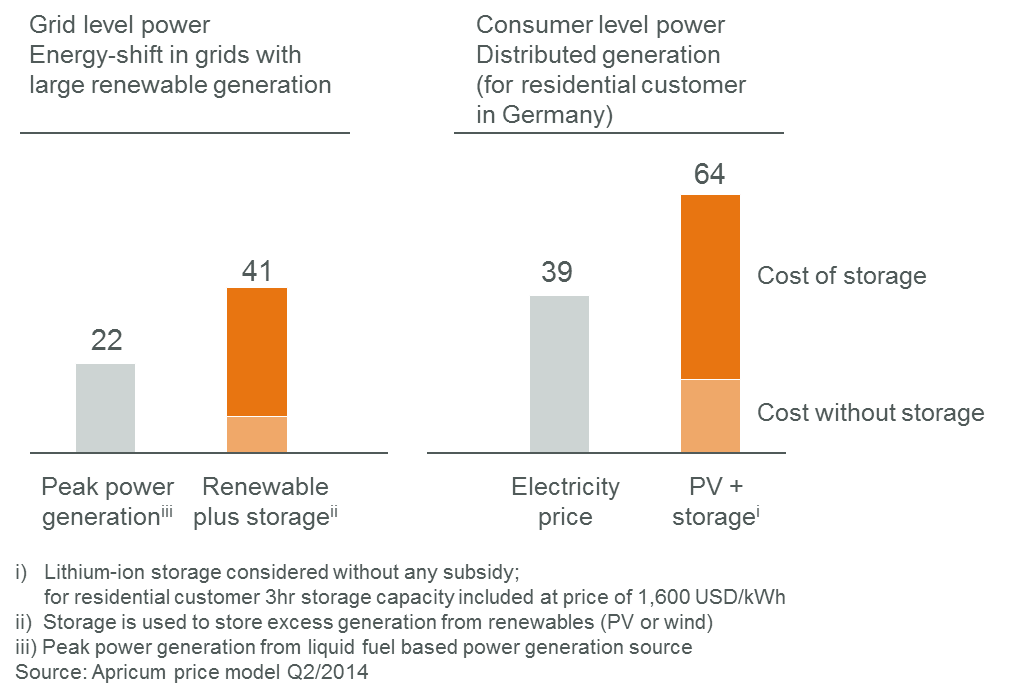

However, as other options also exist to improve flexibility of the power infrastructure (e.g., grid expansion or flexible operation of thermal plants), storage solutions will have to be economically competitive to be the preferred choice. This is why despite these positive fundamentals drivers, demand in the power sector for still costly storage capacity to date remains at low levels. The two examples below illustrate the need to further reduce the cost of storage to reach financial feasibility in mainstream applications and unlock full market potential:

Figure 2: LCOE analysis for two exemplary storage applications [¢ USD/kWh]

To book first revenues and build a track record for their technology, storage companies need to identify and address existing pockets of demand with unique cost-benefit profiles. These can be found for example in:

- Locations with high fuel prices (e.g., islands, remote locations). A good example is the 9 MW solar power plant on La Reunion island with 9 MWh Li-ion storage to shift PV electricity to evening hours, replacing costly fossil-fueled generation. The high cost of diesel-based power (>0.30 USD/kWh) renders PV plus storage a viable investment.

- Concession areas with high peak load pricing. In some regions, customers pay not only for energy, but also for peak power demand. Consumers with a pronounced and predictable demand peak can use short term storage to cap total power demand from the grid and reduce the power-related part of their electricity bill. Several companies like California start-up Stem have embraced this business model and target customers with high leverage of storage on their utility bill.

- Congested or remote grid infrastructures. Expanding grid infrastructure is very CAPEX-intensive. Upgrading grid capacity through selective integration of storage capacity can alleviate utilities from undertaking these costly expansions. In individual regional setups, storage companies already today have a convincing value proposition with their products – as demonstrated for example by the announcement of Texan state utility Oncor aiming at installing substantial storage capacity to support existing grid infrastructure.

- Subsidized markets and applications. Subsidy policies stimulate investment when standalone financials of a technology has not yet been reached – to trigger further improvements and cost reductions. Subsidy programs for energy storage have been introduced e.g., in Germany and in the USA, where the state of California recently mandated its utilities to invest in 1.5 GW of storage capacity by 2020.

A well-planned scaling strategy is the key to success

To emerge as a winner from the ongoing technology race, a well-designed and comprehensive growth strategy is required. A smart selection of initial target segments and quick realization of scale economies are important elements that will help storage companies to build competitive advantage and trigger self-reinforcing demand dynamics through e.g., track record and brand recognition.

The case of First Solar is a good analogy for a successful scaling strategy from the solar PV industry. First Solar outperformed its competitors in CdTe PV module production through rapid and determined capacity scaling at an early stage. By massively increasing its production capacity from around 700 to above 2,200 MW in period from 2008 to 2011, First Solar was able to realize a steep reduction of module cost from ~1.10 to ~0.75 USD/W. The resulting cost advantage helped the company to become the largest supplier of PV modules globally in 2011, build a significant track record, further improve on their product and production processes and accumulate cash that was used to make selective technology and project acquisitions to fortify their position in the market. At the same time, most other thin film and many silicon-based competitors incurred severe losses and many had to shut down operations.

Apricum recommends storage companies to develop a growth strategy

Storage companies in the growth phase need to carefully develop the right strategy in order to absorb initial demand, effectively realize economies of scale and capitalize on associated first mover advantages. To facilitate growth, the following levers are especially important:

- Smart selection of markets and applications: Storage companies have to balance capturing short term demand vs. focusing on optimizing their product to applications with highest technological fit. A smart selection of markets and applications to target should build on a well-designed product and marketing strategy that reflects both of these issues.

- Partnerships that enable fast growth: Building strategic partnerships in relevant near term markets is essential to access and service emerging demand. Ideal partners should contribute to swiftly reaching operational status, e.g., through customer access, distribution networks or manufacturing experience.

- Solid funding during growth phase: Moving from pilot to mass manufacturing is crucial to realize needed cost reductions. During this capital-intensive growth phase, solid and uninterrupted funding is a major leverage to execute a chosen strategy. Companies should therefore strive to establish timely access to both strategic and financial investors.

For questions or comments, please contact Florian Mayr, partner: mayr@apricum-group.com