- The USA’s Inflation Reduction Act of 2022 is not an eat-all-you-can feast for developers

- U.S. development faces many of the same challenges as Europe

- However nimble solutions exist to some of these hurdles

In this article we look beyond the headlines of the USA’s Inflation Reduction Act (IRA) and at some of its pitfalls and direct opportunities for PV developers in the U.S. market. Apricum is best known in Europe and the Middle East, but the USA represented 25% of group revenues last year. Our PV development clients eyeing the USA should be mindful of the complexity in capturing these IRA-led opportunities. U.S. PV development is not an all-you-can-eat feast; familiar challenges mean only a few strategies are likely to yield immediate results when trying to capitalize on these opportunities.

The IRA has tilted the renewables industries on their axis. Many clients now debate the merits of U.S. expansion: 10 years of policy certainty, with higher asset values, ends the inefficient policy lapse/extension cycle to allow developers, investors and other stakeholders in the U.S. renewables market to make longer term plans.

However, as in Europe, supply chain constraints, long interconnection queues, and rising interest rates all create challenges in building successful projects and add to uncertainty. Capturing the opportunities will require greater strategic insight than in other booming markets.

US PV development is not an all-you-can-eat feast

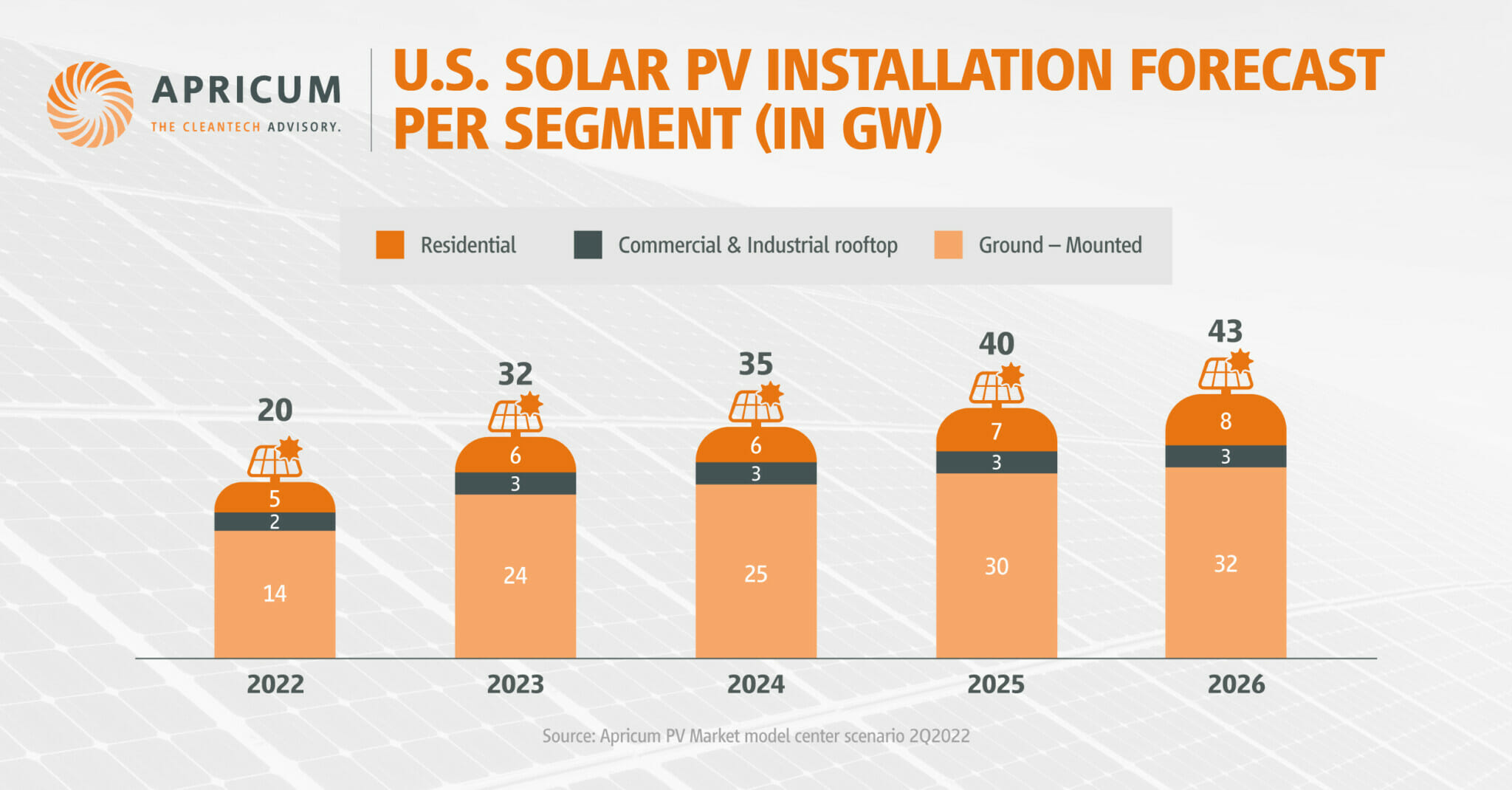

U.S. solar PV installation forecast per segment. Source: Apricum PV market model center scenario 2Q2022

- Interconnection queues drive project timelines in the USA and are the leading cause of project failure in most markets. These processes and issues are very different across the myriad vertically-integrated utilities and Regional Transmission Organizations and Independent System Operators (RTO’s/ISO’s) that lay across the USA. in patchwork fashion. Some ingenious and nimble strategies can be deployed by astute developers to circumvent the resulting project delays that otherwise occur from sticking with the standard utility-scale development template. Picking sub-markets and selective strategies are critical to success. For instance, projects connecting at distribution voltage (below 69kV) can go through local interconnection processes more quickly because they are subject to state-level rather than Federal regulation. In markets such as Virginia, PPA’s can be secured with both corporate buyers or large utilities like Dominion, allowing developers to complete the ISO processes in PJM at a later date to provide additional offtake options.

- Certain IRA financial incentives subject projects to stringent local content requirements. In order to qualify for an additional 10% tax credit, local content must constitute 40% of the project if starting construction before 2025, rising by 5% p.a., to 55% for projects starting construction in 2028. Companies eyeing tax incentives can face bureaucratic hurdles, without in-house/external expertise that understands these supply chain implications.

- IRA simplifies tax credit transferability between taxpayers, reducing the need for complex partnership flip structures and five-year hold periods. Projects can be designed for RTB or COD sale in a more straightforward manner.

While the IRA has national application, this does not diminish the need for local market sensitivity. Some stackable IRA incentives will also only apply to local communities (eg +10% for low Income or fossil-reliant communities). But the largest impact is from local energy market design and policies. Below we review the top four below with a developers’ eye.

The majority of the Texas population is served by ERCO.

ERCOT – Texas: The majority of the Texas population is served by ERCOT, an independent grid insulated from the rest of the US. Within ERCOT, not subject to Federal regulation, developers generally have more flexibility in deploying infrastructure. ERCOT has a geographically zonal market structure, presenting very different opportunities for projects. Historically dominated by wind, in recent years solar and battery storage have grown rapidly in ERCOT. Unique characteristics such as a lack of capacity market, a highly open and competitive energy market, and the ability to build private-use networks, mean projects in ERCOT have unique requirements. For instance, many projects are financed using hedges instead of a PPA or a PPA only for a portion of the total capacity, running the additional capacity as merchant power to capture spot market pricing that can be as high as $5,000/MWh during periods of high demand.

PJM is the largest ISO in the USA.

PJM: The largest ISO in the USA, roughly a triangle shape spanning between NYC, Washington DC, and Chicago. Most large projects in PJM were given 2 year delays in mid 2022 while a new interconnection process was implemented. This pushed almost half of projects in development out to the 2025/2026 timeframe. The result is an opportunity for patient capital, such as new market entrants from Europe, to cheaply acquire partially-developed projects whose domestic appeal has diminished with the later connection dates. Additional opportunities exist for projects connecting at the distribution level with utilities in specific state markets. PJM projects in particular benefit from sourcing short-term PPA’s with local utilities prior to broader PJM market access.

The California Independent System Operator (ISO) maintains reliability on one of the world’s largest and most modern power grids.

CAISO – California: Historically one of the largest and most active markets for solar in the world, recent years have seen extraordinary growth of renewable projects paired with storage. The rise of Community Choice Aggregators [CCAs] is challenging the status of the big 3 regulated utilities [PGE/SCE/SDGE] and creating opportunities for new contracts/customers. This is not as easy a market as new entrants assume. Challenges around credit and structuring exist with CCAs, and it’s never easy to surmount permitting obstacles for new projects of any type anywhere in California.

Like California and Texas, New York has a single-state ISO

New York ISO – New York State: Like California and Texas, New York has its own (i.e., single-state) ISO, making project development somewhat more straightforward. Like California, New York has strong renewables and energy storage ambitions in pursuit of aggressive decarbonization targets. Unlike California (and Texas), opportunities for the biggest PV developers are limited: insolation quality is mediocre, and there are few sizable parcels of land suitable for large-scale PV deployment. However, community and behind-the-meter PV markets are fairly robust, spurred by leading-edge distributed energy resources (DER) pricing policies. Moreover, given New York’s plans to add 9GW of offshore wind by 2035, as well as significant intrastate transmission bottlenecks constraining the ability to serve New York City, the need and value associated with energy storage assets is profound.

Apricum can help globalizing developers and IPPs by supporting detailed analysis of markets, projects and pipelines for customers interested in capturing the unlocked growth potential following passage of the IRA bill. If you would like to discuss these opportunities for your business, please reach out to Jesse Atkinson, Richard Stuebi or your usual Apricum contact.