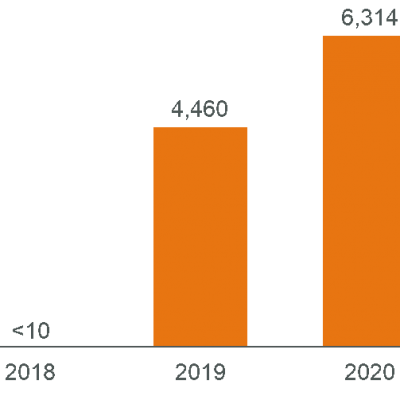

Vietnam’s solar star is clearly on the rise. In 2016, the long awaited announcement of the first solar feed-in tariff (FiT) policy for solar project development (also further referred to as FiT phase 1) in Vietnam triggered a solar success story, unique in the ASEAN region, resulting in an unprecedented increase in solar capacity. With less than 10 MW of operational solar power capacity in June 2018, capacity jumped quickly to 4,460 MW in July 2019 and then to more than 6,314 MW by September 2020, and with many hundreds of MW of solar projects still under construction or development – Vietnam has effectively overtaken Thailand as the largest solar market in Southeast Asia.

Figure 1: Total operational solar capacity in Vietnam, 2018–2020 [MW]

Which factors contributed towards such a rapid development of solar power, which policies and regulations enabled and catalyzed this progress, which barriers and hurdles exist in the development process, and what is the outlook for solar in Vietnam? In this article, we will answer these questions and more.

Besides the described significant addition to the operational solar assets, the number of both green- and brownfield acquisitions so far has been rather modest within the ASEAN region (mostly in Thailand) for several reasons that will be discussed further, with local IPPs or diversified conglomerates taking the lead. Especially Thai conglomerates are currently eyeing the market for available projects with multiple acquisitions under negotiation with some having signed MoUs already.

By the end of 2020 – potentially later in case a commercial operation date (COD) extension is granted to solar projects under construction due to the heavy impact of Covid-19 and severe natural disasters (including flooding, mudslides, and typhoons that battered central Vietnam in October 2020) – a further 2,988.9 MW of ground-mounted solar projects that were granted solar FiT phase 2 tariffs could potentially reach COD.

Many of these solar projects have been developed for sale and will become available for acquisition once successfully reaching COD. From the FiT phase 1, additional ground-mounted projects are up for acquisition as well as rooftop solar projects that have been developed under both FiT phases. This expected market supply of operational solar power plant assets plus the number of ongoing M&A transactions not yet finalized (as well as other factors to be discussed) is likely to create more traction in the so far slow solar M&A scene of Vietnam, driven by a rather oversupplied capital market looking for renewable energy assets.

Vietnam’s growing power demand and power development planning

Vietnam, with its vastly growing economy, forecasted to grow at 6.5% to 7.5% annually from now until 2030 that will require forecasted power demand growth of 10% annually, has traditionally relied heavily on fossil fuels, especially on coal power, which has increased to a staggering 35% of the generation mix currently.

Vietnam’s National Power Development Plan VII for the 2011– 2020 period with a vision to 2030 released in 2011 includes a target to increase renewable energy-generated electricity from 3.5% of the total electricity production to 4.5% in 2020 and 6.0% in 2030. A new National Power Development Plan VIII for the 2021–2030 period with a view to 2045 has been drafted and is awaiting approval by the beginning of 2021 and presents a shift towards renewable energy (RE) expansion. By 2030, Vietnam’s power demand is expected to increase by 80 GW where power generation from coal, gas and liquefied natural gas (LNG) are expected to increase by over 30 GW, while onshore and offshore wind and solar power are expected to grow by 50 GW. Over the next decade, around 14 GW of solar generation capacity is expected to be gradually added under competitive selection processes as advised by the World Bank.

Vietnam’s natural fit for solar power

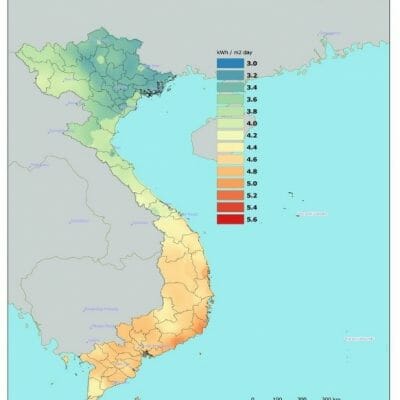

Figure 2: Solar Radiation Map of Vietnam Source: MOIT

Besides its forecasted growth in electricity demand, Vietnam exhibits high irradiation levels with an average global horizontal irradiation (GHI) of 4–5 kWh/m2/day (equaling 1,460–1,825 kWh/m2/year) mostly in the southern central area and even partial northern regions and peak irradiation levels of up to 5.5 kWh/m2/day on average in some southern regions (equaling 2,008 kWh/m2/year) making the country well suited to solar power.

Electricity production and consumption are disparate in the country – while northern Vietnam has a power oversupply, the southern part is consuming more than it currently produces. This regional power demand disparity conveniently correlates with the solar irradiation potential of the country allowing for lowest levelized costs of electricity (LCOE) from solar power plants in the southern regions where the power is mostly needed.

While land resources are somewhat limited and solar power in some regions competes with land used for agriculture, the rise of floating solar with abundant water surfaces available, plus the still mostly untapped solar rooftop potential offer suitable future applications of solar power in Vietnam.

Solar policies and regulations enabling the solar success story and industry outlook

The following policies and regulations – closely coordinated between the Ministry of Industry and Trade (MOIT) as the market supervisor and national electric utility Vietnam Electricity (EVN) – are expected to drive further growth in the solar industry in Vietnam.

Feed-in tariff programs

- FiT Phase 1: After Vietnam had been drafting a potential support mechanism for years, finally an initial program with 850 MW overall capacity was announced in 2016, with a rather generous feed-in tariff over 20 years of 2,086 VND/kWh (equivalent to 0.0935 USD/kWh) and subject to annual adjustments of fluctuations in the VND/USD exchange rate. The program allowed for on-grid, rooftop, insular, off-grid and net-metering models and was heavily oversubscribed with around 4,460 MW being commissioned by 31.06.2019, which constituted the end of phase 1 of the FiT program. An exemption for Ninh Thuan Province was granted, allowing projects to still obtain the FiT phase 1 tariff that can reach COD by 31.12.2021, accounting for 30 solar power projects with a total capacity of 1,932.92 MW included in the master plans.

- FiT Phase 2: After many developers’ and investors’ painful wait, in April 2020, phase 2 of the FiT program as an extension of the FiT phase 1 (also further referred to as FiT phase 2), came into effect, with a tariff over 20 years of 1,758 VND/kWh (equivalent to 0.0769 US cents/kWh) for floating solar and 1,620 VND/kWh (equivalent to 0.0709 USD/kWh) for ground-mounted solar projects and subject to annual adjustments of fluctuations in the VND/USD exchange rate. Criteria for eligibility included grid-connected solar power plants, reaching COD between 01.07.2019 to 31.12.2020 and investment policy decisions issued by the authorized agencies before 23.11.2019). A report from February 2020 from the MOIT estimated a total of 36 solar farms with a total accumulated capacity of around 2,988.9 MW that could be eligible for the FiT phase 2. The extension for Ninh Thuan Province was not challenged in this decision. The rooftop tariff was fixed at 1,943 VND/kWh (equivalent to 0.0838 USD/kWh) for eligible rooftop solar systems that achieve a COD and have its meter readings confirmed between 01.07.2019 and 31.12.2020, connect to voltage levels <35kV, have a capacity of <1 MW, and sell at least a part of their generation to EVN.

Transition to competitive selection processes:

- Announcement of a pilot auction scheme for floating solar: In February 2020, a pilot auction scheme for floating solar on hydropower plant dams of around 400 MW in two phases for 2020 was announced. The first EPC auction is anticipated to be held over 50–100 MW and a second EPC procurement round over 300 MW are planned for 2021. Both projects will be located at hydro facilities belonging to the Da Mi Hydropower Joint Stock Co, a division of EVN.

- Announcement of a pilot synthetic DPPA scheme: Another announcement in February 2020 included a pilot synthetic DPPA scheme of 400–1,000 MW for 2020 (eligibility for registered projects >30 MW in areas with no grid congestion and developers with proven technical and financial capabilities) with certain registered private sector buyers.

- Eligibility of projects in competitive selection processes: Ground-mounted and floating solar projects in the master plan that are not eligible in the FiT phase 2 remain eligible to bid for the to-be-announced auctions post the pilot auction scheme, and to participate in the pilot synthetic DPPA scheme or later envisioned synthetic DPPA or on-site “behind-the-meter”/ “sleeved” DPPA models, or sell to the wholesale market (Vietnam Wholesale Electricity Market or VWEM).

- Publication of the draft for the future competitive selection process: In September 2020, the MOIT published the draft proposal presented to the Prime Minister together with the draft decision from the Prime Minister on the pilot program for the competitive selection of solar power projects.

- Eligible projects must be in the relevant master plans, not be eligible for FiT phase 1 or FiT phase 2 and reach COD before 01.07.2021. A pilot phase from November 2020 until May 2021 (to be adjusted) is foreseen and key criteria for the selection is anticipated to be the lowest price per kWh with the FiT phase 2 tariff as the ceiling. Other proposed legal restrictions for the pilot program include the maximum program capacity to be 60% of all projects participating in the program, the maximum capacity for project(s) of one investor to be 20% of selected projects, a restriction on project transfer before COD, and a 5% tariff reduction penalty per quarter of delay in COD post 30.06.2022.

Due to the impact of Covid-19 and the severe natural catastrophes plus the still significant issue with countrywide curtailment, for now the focus of Vietnam seems to be on grid enhancements and renewable energy integration, potentially further postponing competitive selection processes. These competitive selection processes will likely rely on tender mechanisms for the next few years before solar can be developed on a merchant basis, as Vietnam remains committed to liberalizing its power sector and reaching its renewable targets while avoiding an increase in power costs.

Solar markets outside of government policies

Due to the relatively high electricity tariffs compared to potential solar LCOEs, there is substantial interest from commercial and industrial (C&I) as well as residential consumers in lowering their electricity bills. Private PPAs for C&I consumers, operational lease or other similar business models are starting to gain traction in the market and similar growth in this market segment as in Thailand, which shows a very active C&I segment, can be expected. The varying irradiation levels in the country compared to Thailand will make projects in areas with lower irradiation slightly to significantly more economically challenging, and will therefore lead to increased traction of solar power mostly in the south of Vietnam, where most of Vietnam’s industry also happens to be located.

Key solar projects in Vietnam

The following key solar projects have gained international recognition for their large capacity.

Table 1: Key solar projects in Vietnam

| Project | Developer/Investor (Country) | COD | Installed Capacity | Province |

| Loc Ninh Solar Power Plants (4 single projects) | Super Energy (Thailand) | Target before 31.12.2020 | 750 MW | Binh Phoc |

| Dau Tieng Solar Power Complex (3 single projects) | JV between Xuan Cau Group (Vietnam) and B. Grimm (Thailand) | June 2019 for 2 projects, 1 project target 2021–2025 | 650 MW | Tay Ninh |

| Trung Nam Thuan Nam Solar Plant | Trung Nam Group (Vietnam) | October 2020 | 450 MW | Ninh Thuan |

| BIM/AC Renewables Solar Farm (3 single projects) | AC Energy (Philippines) and BIM Group (Vietnam) | May 2019 | 330 W | Ninh Thuan |

| Hong Phong Solar Power Plant (2 single projects) | Vietnam Trading Engineering Construction (Vietnam) | June 2019 | 325 MW | Binh Thuan |

| Hoa Hoi Solar Power Plant | JV between B. Grimm (Thailand) and Truong Thanh Vietnam Group (Vietnam) | June 2019 | 275 MW | Phu Yen |

| CMX Renewable Energy Vietnam | JV between Sunseap (Singapore), InfraCo Asia (Singapore) and CMX Renewable Energy Canada (Canada) | June 2019 | 168 MW | Ninh Thuan |

The solar development process in Vietnam and its barriers and hurdles

The development process for ground-mounted utility-scale solar projects (fortunately, rooftop solar has rather simple and much easier procedures to pass) in Vietnam is laborious, time-consuming, expensive and still largely difficult to navigate for foreign developers without entering a strategic partnership, in whatever form, with a local Vietnamese counterpart.

- Permitting & licensing process: The development process is governed by plenty of administrative procedures and related legal documentation in many different fields such as investment and enterprise, national and provincial planning, electrical connection, land, environment, just to name a few. Local legal support is mostly required to navigate the time-consuming permitting and licensing process that can easily take 1–2 years to reach a ready-to-build (RTB) status. Major milestones, that in many cases require the involvement of local technical consultants to prepare in the correct format and liaise and lobby with relevant authorities, in this process include:

- Investment research request and approval by relevant provincial authorities

- Site detail gathering and site commitment acceptance by relevant provincial authorities

- Pre-feasibility study (Pre-FS) preparation and approval by relevant national and provincial authorities

- Inclusion in national and provincial power development plans (>50 MW approval by the Prime Minister required, >30 MW approval by MOIT on national level required, <30 MW approval by DOIT on a provincial level is sufficient)

- Investment decision including issuance of Investment Registration Certificate (IRC) by relevant provincial authorities

- Establishment of local special purpose vehicle (SPV) and issuance of Enterprise Registration Certificate (ERC) by relevant provincial authorities

- Land acquisition, compensation, clearance and issuance of land use rights certificate and land lease agreement appraisal by relevant provincial authorities

- Feasibility Study (FS) and Basic Design (BD), appraisal by independent third party and appraisal by relevant national and provincial authorities

- Power Purchase Agreement (PPA) negotiation and signing by relevant EVN branch

- Environmental Impact Assessment (EIA) and approval by relevant national and provincial authorities

- Preparation of detailed technical design, appraisal, and approval by relevant national and provincial authorities

- Application for electricity generation license and approval by relevant national authorities (post COD)

- Many additional different technical reports, agreements, and approvals of grid connection point, grid impact, and transmission line corridor, tariff metering system, SCADA and telecommunication system, relays and automation, electricity supply, fire prevention and firefighting, clearing explosives, entrance route, water supply etc. in different phases of the development process

- Land identification, availability, and costs: Solar power still requires plenty of land – with current state-of-the art systems in Vietnam typically larger than 8,000 m2/MW of installed capacity. For a developer it can be hard to find suitable land plots in proximity to potential grid connection points that are feasible from a planning, technical and economic point of view. The cost of land can be high in Vietnam and often land use rights are split between many single owners making the whole process, including public hearings, cumbersome and risky.

- Curtailment caused by underdeveloped transmission line system: EVN operates the power distribution system which requires urgent expansion and countrywide interconnection to improve the country’s power supply-demand balance. Such new transmission lines would also help to bring power from LNG from the central and southern regions to the northern region, currently still heavily dependent on coal and hydropower. The situation has led to the significant curtailment of affected solar power plants, especially in the southern region and their RE centers in Ninh Thuan and Binh Thuan provinces, as well as the central region. Due to the long timeline (typically >5 years for transmission line system enhancement) and EVN lacking required investment, a pilot project allowing a private company to build a substation and transmission line was approved in March 2020 – to replicate this model, major changes in Vietnam’s current Public Private Partnership (PPP) law would be required.

- Regulatory uncertainty: Due to the speed of solar market development in Vietnam and its varying policy drafts, turnarounds on draft decisions, and delayed announcements, it poses a significant risk for developers and investors to deploy resources. Examples include a) many changing drafts of the FiT phase 2 but only finalization in April 2020, leaving developers and investors in the dark for 10 months and b) the initial announcement of the introduction of competitive selection processes, then announcing a turnaround and continuation of FiT models, and finally reversing the decision again in favor of the competitive selection processes.

- Model PPA and bankability: The revised mandatory model PPA, effective from August 2020 onwards, still does not address many commercial and legal issues, giving investors and lenders cause for concern, some major points include:

- Offtake and curtailment: No take-or-pay clause is included, and conditions are not specified under which EVN is permitted to curtail the generation such as installation, repair, replacement of equipment, grid breakdown and grid recovery.

- Compensation for default and PPA termination: Default of EVN leading to PPA termination results in a termination payment for damages incurred until “end of contractual term” while it remains unclear if that means the termination date or the end of the 20-year PPA.

- Force majeure and commissioning: Improved force majeure clauses for damages incurred but does not address termination due to prolonged force majeure events.

- Inflation and exchange risk: No indexation of the solar FiT tariff to the Consumer Price Index (CPI) is incorporated. An annual exchange rate compensation mechanism according to VND/USD central exchange rate published by the State Bank of Vietnam of the last working day of the previous year is included.

- Dispute resolution: Local rather than international dispute resolution unless both parties agree on another dispute resolution body taking up the case, which would be subject to the (rather unlikely) approval of EVN.

- Limited access to project financing: The project financing scene in Vietnam to date has seen a high involvement of local Vietnamese banks, some of which have received concessional loans from multi- and bilateral organizations for direct lending (interests 7–9%, tenures 10–15 years), while international banks, due to concerns of the risk allocation in the PPA, have played a smaller role and typically operate in cooperation with a local Vietnamese bank providing country- and offtaker risk cover. Vietnamese banks (e.g. Vietinbank, Agribank, Techcombank, Vietcombank, BIDV, SHB, Military Bank, SCB, Maritime Bank, VP Bank, Eximbank, and Sacombank) traditionally lend to state-owned or well-established business. Interest rates typically exceed 10% and most cases are rather corporate financing than non-recourse project financing in which securities, other than the project itself, are pledged. The Asian Development Bank (ADB) and other international banks have provided several loans to large projects recently, such as:

- USD 186M to B.Grimm’s 275 MW solar project in Phu Yen Province: USD 27.9M by ADB, USD 148.8M by Bangkok Bank, Kasikornbank, Kiatnakin Bank, Industrial and Commercial Bank of China (ICBC) and Standard Chartered Bank, USD 9.3M by Leading Asia’s Private Infrastructure Fund (LEAP).

- USD 37M to Da Mi Hydropower’s 47.5 MW floating solar in Binh Thuan Province: USD 17.6M by ADB, USD 15M by Canadian Climate Fund and an additional USD 4.4M extended from Leading Asia’s Private Infrastructure Fund (LEAP)

- USD 37.8M to Gulf Solar Power’s 50 W solar project in Tay Ninh Province: USD 11.3M by ADB, USD 7.6M by LEAP, and USD 18.9M by Bangkok Bank PCL, Siam Commercial Bank PCL, and Standard Chartered Bank (Thai) PCL.

- Project bond issued by Hong Phong 1 Energy Joint Stock Company for its 195 MW solar project in Binh Thuan Province: VND 2.15T for 15 years and VND 400B for 5 years, guaranteed by the Credit Guarantee and Investment Facility (CGIF). ING Bank N.V. is acting as lead co-financier with USD 30M in loans.

- Costs of development and risk-return ratio: Due to the extensive permitting & licensing process, related documentation requirements, and the required involvement of local service providers, costs of the development process are high while chances of success vary widely according to the developer’s ability to lobby. Realistically achievable development premiums do not reflect well the underlying cost risks, effectively making the market for developers that do not aim for long-term ownership, unattractive.

- Natural disasters: Vietnam is prone to a variety of natural disasters including storms and typhoons (coastal regions are more at risk) from May to January, flooding mainly in the Mekong river delta area throughout the year, mudslides due to heavy rainfall especially in hilly areas, and rather rare earthquakes in the northwest.

- Culture and language: Vietnam’s distinct culture and language can quickly make business dealings for outsiders unfamiliar with this business environment extremely difficult and frustrating. Cross-cultural skills are essential, and a local setup is vital in proving commitment and establishing local networks.

Solar M&A activity and key solar power acquisitions in Vietnam

The reasons for the low numbers of solar (and other RE) M&A transactions to date are rooted in multiple areas, some of which have already been described above as barriers and hurdles to development, and similarly impact a project’s potential for acquisition:

- Covid-19: Many ongoing M&A transactions have stalled or have been cancelled because of the pandemic, forcing Vietnamese project owners to adjust their strategies.

- Fair development premiums and financial feasibility: Due to the described tedious, costly, and risky development process, developers require higher development premiums that most investors consider reasonable at the presented level of return and risk – a situation that also worsened through Covid-19 resulting in increased development period and costs for many developers. For projects that have been developed under the FiT phase 1 and could not reach COD by June 2019, the mismatch from the FiT phase 2 tariff or other prospective mechanisms is especially pronounced.

- Regulatory uncertainty: While regulatory uncertainties discussed above mostly impact developers, there is always a risk that governments apply retroactive changes to past programs when the costs are perceived as too high, as seen for example in Spain in 2015 with the introduction of a punitive solar tax or in Bulgaria in 2011, which introduced a sudden cut in tariff.

- Model PPA and bankability: As it is for developers, this risk is adversely affecting investment decisions due to unresolved bankability concerns.

- Limited access to non-recourse financing: As it is for developers, the financing landscape is still lacking large-scale involvement of the international project financing community, with some large projects, mostly in co-financing constructs with ADB, taking the lead.

- Environment and social (E&S) concerns: Some renewable energy projects (especially in hydropower) are lacking required documentation and due diligence on E&S aspects, which present red flags to institutional investors and lenders.

- Lack of standardized M&A processes: Clear and standardized M&A processes and related documentation e.g., teaser, investment memo, financial models, structured data room with English documents etc., are yet to be established in Vietnam as most sellers lack experience and gathering of information is arduous.

- Curtailment: The significant curtailment of solar power plants, especially in the Southern and Central regions, partially curtailing some projects >50%, is an ongoing reason for concern. While the Vietnamese government has announced the expansion of the transmission line network as a priority, it remains a lengthy task to realize and – in combination with the model PPA and its bankability concerns – poses a significant financial risk to project investors and lenders.

Table 2: Examples of key M&A activities in the Vietnamese solar power landscape

| Buyer (Country) | Target Project | Transaction Details | Timing of Acquisition | Project(s) Capacity | Project Locations |

| Super Energy (Thailand) | Loc Ninh Solar Power Plants 1–4 | Acquisition of 70% of shares for USD 70M | March 2020 | 550 MW | Binh Phuoc |

| B. Grimm (Thailand) | Hoa Hoi Solar Power Plant | Acquisition of 80% of shares from Truong Thanh Viet Nam Group (TTVN) for USD 35.2M | August 2018 | 275 MW | Phu Yen |

| BC Container Glass (Thailand) | Xuan Tho 1&2 Solar Power Plants | Acquisition of 12.86% of shares for undisclosed amount | September 2020 | 99.2 MW | Phu Yen |

| Gulf Energy (Thailand) | TTCIZ-02 Solar Power Plant | Acquisition of additional 41% (increase to total 90%) for undisclosed amount | January 2019 | 50 MW | Tay Ninh |

| Begistics (Thailand) | GA Power Solar Park Cam Xuyen and GA Power Solar Park Huong Son | Acquisition of 40% of shares for undisclosed amount | July 2019 | 2 x 29 MW | Ha Tinh |

Why solar M&A in Vietnam is set to ramp up

Despite the slow development so far, there are many reasons to expect that Vietnam’s still rather dormant solar M&A landscape could start gathering steam in the coming months, with investors starting to assess risks from other perspectives rather than only focusing on the model PPA bankability concerns:

- Large supply of operational solar projects: 2,988.9 MW of ground-mounted solar projects will potentially reach COD by the end of 2020, further adding to existing operational solar assets out of which many will be up for acquisition. Unlike greenfield project acquisitions, for projects under development, which require consent of Vietnamese authorities and are difficult to execute, brownfield acquisitions of operational plants are far easier from a legal point of view and also reduce the risk of forecasting generation as real data already exists.

- EVN’s positive credit rating: In June 2018, Fitch assigned its first and positive credit rating of “BB” to EVN, which in April 2020 was confirmed with a stable outlook at the same level as the Vietnam sovereign rating. Therefore, besides the model PPA, there is a high likelihood of EVN honoring payments under the PPA.

- Vietnam’s reliance on foreign direct investment: Vietnam relies heavily on foreign direct investment (FDI) to grow its economy and is one of the most open economies in the world. Any negative headlines in the power sector would likely damage this reputation and be against Vietnam’s own strategic interests of further attracting FDI in the sector that urgently requires more foreign capital.

- Growing appetite by foreign lenders: As shown, the first large projects have received loans from international financing institutions – a trend likely to continue as there seems to be a growing appetite to finance such projects and lenders are starting to get familiar with assessing and mitigating underlying risks.

- Projected scarcity of electricity in Vietnam: Vietnam will face severe power shortages from 2021 onwards when electricity demand will outpace the construction of new generation capacity. Again, Vietnam can hardly afford to scare off foreign investors, who are much needed for investing in new generation capacity and expanding the still underdeveloped transmission line system.

- Attractive electricity tariffs: Compared to other solar projects in the regions and potential future tariffs in Vietnam under announced competitive selection processes, the tariffs awarded under both FiT phases are high, allowing for relatively high returns.

- Outlook of competitive selection process: The announced competitive selection process will likely make it more difficult for developers looking to sell projects post completion to participate in, leaving the market to large IPPs that would hold onto these assets for a long period of time and effectively reduce numbers of projects up for acquisition.

For these reasons, the M&A market for solar projects in Vietnam offers many opportunities but time is of the essence to secure the best projects now coming online.

Interested in acquiring operational solar (or other RE) power assets in Vietnam? Apricum has access to around 400 MW of ground-mounted and 30 MW of rooftop solar power plant assets in seven central and southern provinces under FiT that can be partially or fully acquired. Apricum stands ready to support you in entering or expanding your activities in Vietnam’s renewable energy sector. For further information, please contact Apricum Senior Advisor Moritz Sticher

Excerpts of this article were published by pv magazine here and here.