Introduction

Capital markets for the upstream battery value chain have faced significant challenges as delays and cancellations of major projects have left investors without returns and increased skepticism towards new projects and startups. The burden of proof to attract funding is growing as investors gain deeper knowledge of the value chain and its key success factors.

As capital market momentum builds, we are sharing our perspective to help direct capital toward the right targets and highlight some technology trends, which deserve attention now.

Key success factors for upstream battery projects in Europe

While battery investments are often judged on the innovation and performance improvement of the technology and processes used, projects often fail for reasons outside of these factors. A technology or process that promises moderate but not ground-breaking improvement, or even just competitive performance, can be safer and more successful if it has:

Offtake

Binding offtake in the form of take or pay contracts is the most important success factor, ensuring the startup will be able to generate revenue once production is up and running. While being able to fulfil these contracts is still dependent on successful scale-up, without them startups are gambling on customer demand for their products and being able to secure offtake in line with their production timeline.

Scalability

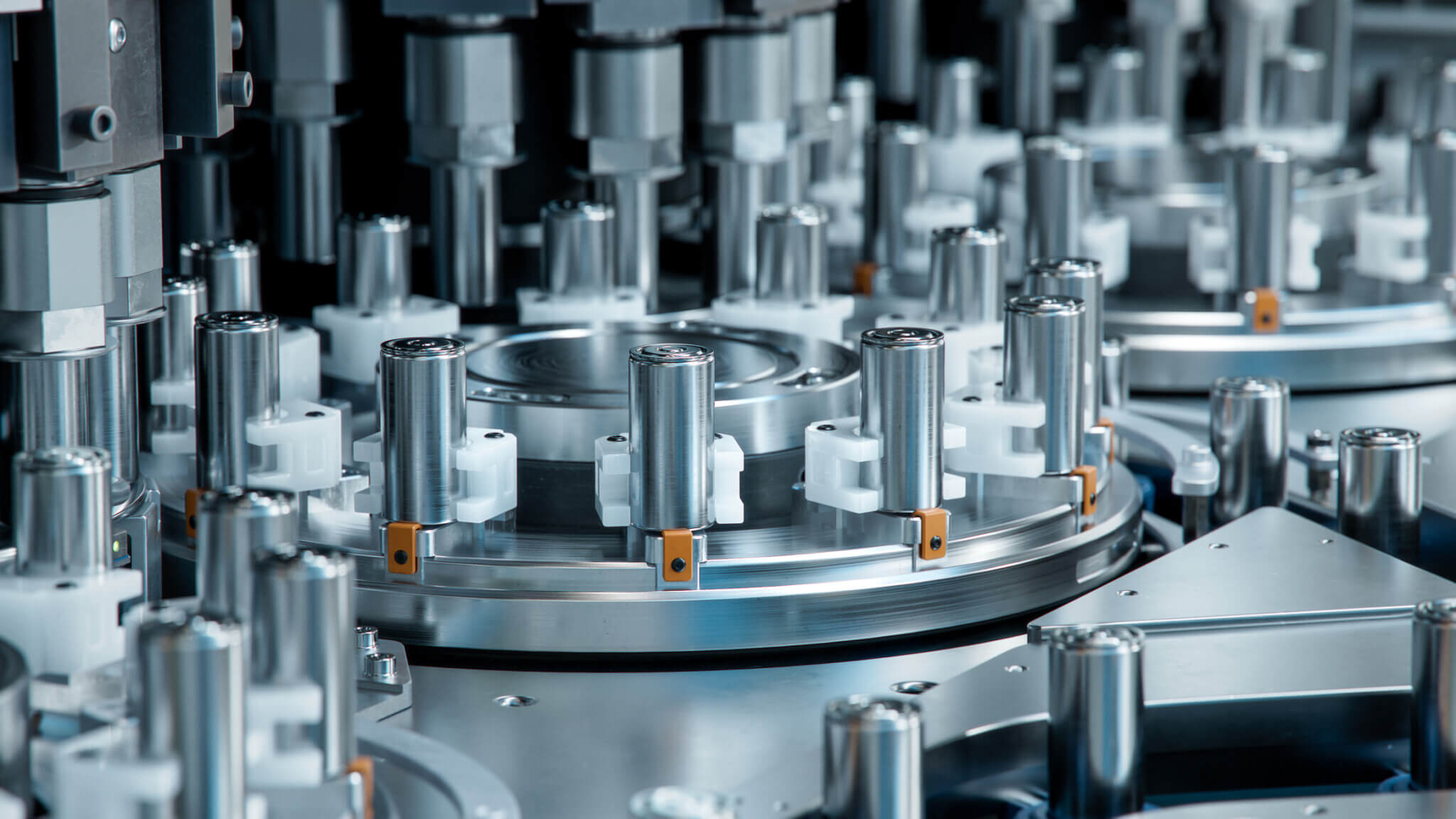

While some products like battery cells have mature production processes that do not pose a challenge to scalability (although execution can still be a challenge), others require new process flows or even new equipment. Any startup with a new process flow or equipment must ensure its scalability, otherwise costs will never become competitive enough for widespread adoption.

Supply chain

New products often require new materials and components or materials and components with limited availability, especially outside of China. Startups must balance their need to reduce costs with diversified supply chains, especially sourced from suppliers outside of China, in order to provide the supply chain security and cost competitiveness demanded by customers.

Industry trends, what’s coming next and where to invest

LFP is here to stay

It’s a familiar refrain, but still relevant: LFP is here to stay and will mostly remain in control of Chinese cell manufacturers, especially with the rapid growth of utility-scale BESS deployment and relative decline in EV sales growth. Players who have primarily focused on nickel-based cathode chemistries are now taking multiple approaches to competing in the low- and mid-cost battery market: adopting LFP, working to develop LMFP or lower-cost nickel-based chemistries such as LNMO or a combination of the two.

Solid-state is getting closer to reality

Solid-state batteries are garnering more interest, with players such as BYD, Gotion and Samsung SDI planning mass production in the next couple of years. But the samples that are currently on the market haven’t reached the energy density necessary to make them attractive for widespread use (publicly available spec sheets show energy density around that of high-quality LFP) and costs will be high while the supply chain and production processes are expanded and improved.

Localization might be ready for slow take-off

After a big wave of disappointments, Europe’s domestic battery value chain may be starting a slow but steady path of growth. With Morrow’s first GWh of production capacity and PowerCo’s Salzgitter gigafactory expected to come online in 2025, Europe may have the foundations needed to build out the rest of the upstream battery value chain, including CAM manufacturing and lithium processing. While there’s still plenty of overcapacity in upstream battery announcements, a domestic cell manufacturing base would provide offtake certainty for at least some announced upstream projects to be built.

Anodes

Graphite anode production is still dominated by China, with only a few select projects looking to start facilities in Europe and the U.S. Silicon-carbon anodes, on the other hand, are still being developed heavily by European startups, promising increased energy density at the cell level and fast-charging capabilities. While not applicable to budget EVs, sufficient demand for high-performance EVs will still create enough demand to make silicon-carbon anodes viable if they can be scaled.

Asian investment in Europe

While Western players have struggled, upstream battery companies in Asia, especially China, have seen rapid growth, leading to overcapacities. Many Asian players now see Europe as a more stable market with healthier margins despite higher electricity and labor costs, which has led to increased investment in European plants, especially in Central and Eastern Europe. Asian investment in Europe brings additional opportunities for partnerships, tech transfer and a new way for the European battery value chain to grow.

Supporting investment and growth in the battery materials sector

Apricum supports clients across the upstream battery value chain with services in strategy and transaction advisory, and technical due diligence. We have acted as commercial due diligence advisor in many of the largest upstream battery capital raises in this decade, such as Group14’s Series D, Our Next Energy’s Series B, and Skeleton Technologies’ E1 capital raises.

With over 17 years of experience and 400+ projects in 30+ countries, our team combines strategic insight, financial expertise, and deep technical know-how. From market screening to M&A and capital raising, we help companies succeed in the battery materials space.

To explore how we can support your growth, please contact Apricum Partner Florian Haacke.

This article was written by Dr. Benjamin Silcox, former Apricum project manager.