In the first of a two-part series on opportunities in battery energy storage in Europe, Apricum Partner Florian Mayr discusses the key drivers, challenges and outlook for today’s main use cases in Germany – residential storage and the primary control reserve market.

Europe is one of the key regions for energy storage alongside the USA, Japan, Korea, China and Australia. There are already more than 250 MW installed, with almost 390 MW more in the pipeline. However, Europe is not just one homogenous market for energy storage, but several, each with different, country-specific drivers and challenges that determine the individual opportunities for energy storage.

There are six markets with significant energy storage activities worth highlighting: Germany, the UK, Italy, France, the Netherlands and recently Sweden. In comparison, the latter three are certainly less dynamic. If you exclude the French overseas departments like La Réunion in the Indian Ocean, most projects that have been realized are demonstrators and pilots by national utility EDF or major distribution system operators (DSOs), and these were already completed some years ago and did not trigger a significant push for storage.

In the Netherlands, the major chunk of the 14 MW installed comes from the 10 MW energy storage system built by AES for the European TSO Tennet for the purpose of primary control reserve. On the horizon, only one single major storage system, a 4 MW project by The Mobility House for the Amsterdam stadium, has been announced.

Sweden just announced a program to incentivize the deployment of residential energy storage for increasing PV self-consumption and improving grid stability. Via the subsidy scheme, a very significant share of up to 60% of system costs can be covered. But up until now, energy storage deployments have been extremely limited.

This two-part series therefore examines energy storage activities in Germany, the UK and Italy, as each of these markets has significant energy storage capacities installed and also a large pipeline in place.

The Two Main Use Cases in Germany: Residential and PCR

There are two main use cases for energy storage in Germany, which make up the vast majority of all installations: residential storage and the primary control reserve market.

Main Use Case #1: Residential Storage

Germany is one of the key markets for residential storage with about 300 MWh installed today. The residential segment also represents one of the key markets for energy storage in Germany right now. Let’s take a look at what is driving this opportunity.

Germany has a feed-in tariff (FiT) in place to incentivize homeowners to install rooftop PV by basically guaranteeing a fixed amount of money per kWh fed into the grid for a period of 20 years. In the first 13 years after the FiT introduction in 1999, FiTs were at very generous levels and drove a boom in rooftop PV, with some 4 GW currently installed. With the falling costs of PV, however, the government has steadily decreased the FiTs for new installations each year. Feeding into the grid has therefore become less attractive and the self-consumption of self-generated energy is becoming more appealing.

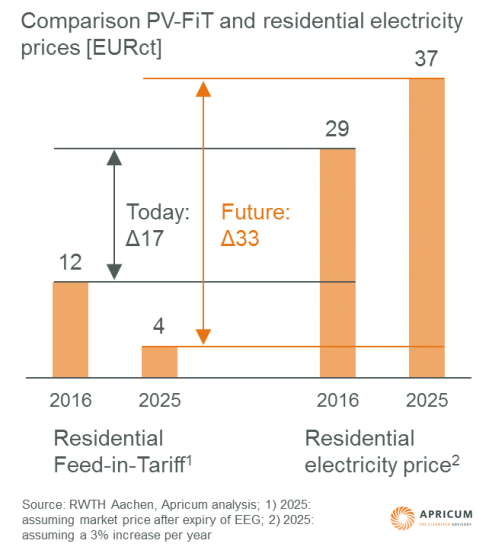

Given that the generation profile typically does not match the demand profile, energy storage is required to effectively self-consume what is generated by your rooftop PV. The lower the FiT and the higher the price for electricity from the grid, the more economically viable energy storage becomes, as illustrated below in Figure 1.

Figure 1: Residential storage for PV self-consumption in Germany

Currently, the FiT is 12 EUR-cents per kWh while the price for residential electricity stands at 29 EUR-cents. In simple terms, if you decide to self-consume one kWh generated on your rooftop, you are saving the 29 EUR-cents you would have had to pay for buying the kWh from the utility. In turn, you would miss out on the FiT of 12 EUR-cents for feeding the self-generated kWh into the grid, resulting in a net-saving of 17 EUR-cents. Net savings give a good indication of the maximum that energy storage costs (excluding costs of charging) could reach to enable self-consumption in an economically viable way.

As the gap between the FiT and the electricity price widens and energy storage costs sink, PV self-consumption combined with residential storage is becoming more and more attractive.

Already, an estimated 50,000 storage systems have been sold to German home owners. However, it is important to understand that this demand is not purely return driven.

Based on Apricum’s methodology to calculate the “true” costs of energy storage, which includes all cost influencers such as upfront costs, charging costs and usable energy over the lifetime, installing rooftop PV plus residential storage is often not feasible yet without subsidies, as the costs for storing a kWh simply exceed the savings from self-generated PV power (reflected in charging costs) compared to the electricity price from the grid.

So why are there so many systems installed?

First of all, a PV system combined with energy storage can still offer a lower average energy procurement cost than pure grid supply over a year, as not every self-generated kWh needs to be stored – although in this case the PV system is “subsidizing” the storage unit.

Hence, if the reason for increased self-consumption is rather based on non-financial rationales, such as the aim to be more independent from the utilities, a distinct ecological consciousness or also technical curiosity, then residential storage is a viable solution to achieve this objective.

Also, economics can be improved by the German incentive scheme for solar plus storage that basically provides a low interest loan from the German state bank KfW along with a cash grant of up to 22% of the system costs. The scheme was introduced a few years ago and was extended earlier this year to the end of 2018. Due to high demand, the 2016 share of the program’s budget was already fully allocated by the beginning of October, and new applications are now only possible from January 2017 onwards.

It is worth noting however, that a significant portion of the home owners who installed PV plus storage did not apply for the incentive schemes. One reason for this is the eligibility requirements for the incentives. For example, you are not allowed to feed-in more than 50% of the installed PV power into the grid and that applies to the lifetime of the PV system. Your storage system might not last as long as the PV system, so this might be seen as a significant disadvantage.

In the future, an increasing opportunity to combine revenue streams will improve economic viability. Examples include the aggregation of various residential storage units to offer ancillary services or innovative business models such as P2P platforms, which allow the direct sharing of stored, self-generated electricity between home owners.

In summary, the extended incentive scheme and the continued demand from early adopters will prolong the momentum for residential storage in the short-term. In the mid-term, improving economics will make new installations of PV with residential storage economically viable, mainly driven by falling costs of the storage unit. Interestingly, with the first PV systems running out of FiT support in 2019, storage will start to become extremely compelling also for owners of existing roof-top PV, opening up a massive market peaking towards the 2030s.

Main Use Case #2: Primary Control Reserve Market

The second big use case in Germany is serving the primary control reserve (PCR) market and this is already economically viable. The PCR market is the first line of defense in the German grid, being activated automatically in case of changes in the grid frequency of more than 0.01 Hz. The capacity required for that is auctioned jointly for Germany, Switzerland, the Netherlands, Austria and Belgium. For Germany alone, it totals 583 MW as of November 2016. Storage companies can generate revenue by winning a weekly auction and receiving a capacity remuneration for their services. In order to participate, 1 MW of power is required that can deliver full capacity for 30 minutes in both directions and can be fully activated within 30 seconds. Energy storage is now an accepted technology for providing PCR and prequalification is not a big issue anymore.

The PCR market, however, is affected by a high and ever increasing degree of competition.

First of all, an activation time of 30 seconds means energy storage has to compete against all the established incumbents like gas peakers. There is no remuneration for fast response in Germany at the moment as there is in the USA, for example as offered by regional transmission organization PJM based on FERC order 755.

In addition, the number of new entrants with new storage capacities continues to rise, for example, German utility Steag alone announced 90 MW of additional energy storage capacities in 2015, of which the first 15 MW system was already completed in summer 2016. Furthermore, aggregated distributed energy storage will increasingly play a role in PCR as mentioned in the previous case.

All of these factors impact a market with limited growth potential as the effect of increasing intermittent renewable generation on the demand for balancing services seems to be largely offset by opposing trends, such as consolidated balancing markets and better production forecasts.

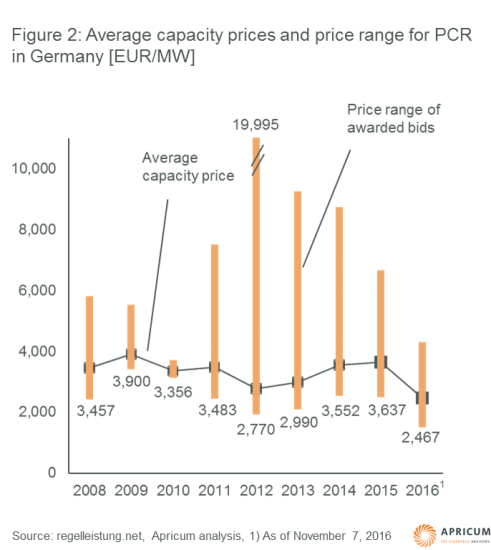

Hence, it is little wonder that compared to 2015, average prices in 2016 so far for one week of PCR have already dropped by 30% resulting in a current value of about [1]EUR 2,500 per MW. Presently, Germany’s total PCR market volume is worth around EUR 75M.

Also important to mention is the current difficulty in planning ahead, with auctions only covering a period of one week. It’s hard to say what prices can be realized with storage investments in the future, making financing difficult.

Another challenge is created by uncertainty in regulatory rules. Minimum provision duration capability used to be 15 minutes in Germany, until a working paper from the EU indicated that a rise to 30 minutes would soon become the rule for member states. Although a working paper is not binding, Germany prematurely adopted the rule, only to have the EU change its plans back to 15 minutes shortly after. The German 30 minute regulation is currently still valid and it remains unclear whether and when Germany will switch back to 15 minutes. Market players right now are therefore struggling less with the higher capacity requirements, and more with the uncertainty in current regulations.

To summarize, in the very short-term, the PCR can still offer a good opportunity to establish a strong position in the German market and earn money with it. Soon, the saturation of the market will likely cause prices to fall further and will significantly reduce the economic attractiveness.

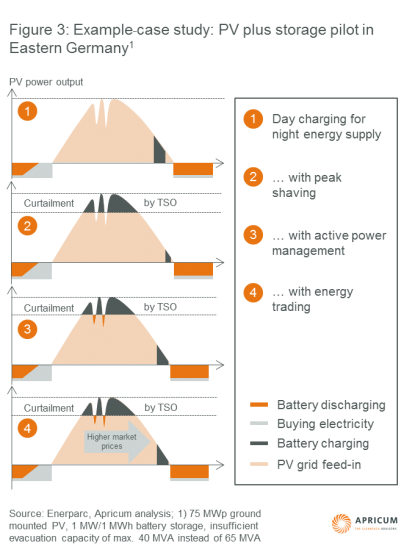

What about co-locating storage with large-scale renewables? To answer this question, consider the following case study, in which a PV asset owner tested the viability of adding energy storage to his PV plant (as illustrated below in Figure 3). The setup was a 75 MWp installation of ground-mounted PV with a 1 MW/1 MWh storage system. The main reason for the battery was a substation bottleneck causing a maximum yield reduction of 20%, so storage was added to avoid curtailment by peak shaving and active management. In addition, stored energy was also used to provide night time supply of the park’s facilities and for realizing arbitrage in the wholesale market. In this case, however, the expected benefits did not materialize. In addition, the complex technical setup was perceived as challenging to the plant owner. In general, if additional revenue streams such as providing ancillary services can be added, economic viability could probably be reached.

Beyond these mainstream use cases, various other individual opportunities exist. One very interesting example is demand charge reduction, which is becoming increasingly attractive for the commercial and industrial segment in Germany, as peak shaving can save up to 80% of grid charges in some circumstances. The economic potential strongly depends on the individual load profiles and often needs to be combined with other use cases, such as back-up and self-consumption. If rumors regarding planned regulatory changes materialize, this could further increase attractiveness here.

As we have seen, to successfully pursue a business use case for energy storage in Germany, a thorough understanding of the challenges and drivers at a regional and even industry level is essential. So too is a keen understanding of the developments in the regulatory frameworks that can create but also destroy business cases for energy storage.

In part two of this article to be published next month, we will examine the development of the energy storage markets in the UK and Italy and discuss the use cases with the most potential.

Apricum offers a range of services to accelerate entry into the European storage market. We offer support with raising funds from strategic and financial investors to finance expansion, conducting in-depth target market, use case viability and business potential analyses, and deriving the most suitable business development and partner company strategies.

For questions or comments, please contact Apricum Partner Florian Mayr.

—————————————————————————————————-

[1] Prices for PCR typically peak around Christmas in December, but the historical impact on the annual average is very limited and therefore no extrapolation was performed for the 2016 value.