- Are varying standards and long sale cycles scaring investors away from a sector with a strong upside?

Electrical grids will need at least $14trn investment by 2050

With varying degrees globally, electrical grids are under increasing stress. Renewables, which are non-synchronous power sources, are causing low stability on the grids. Furthermore, increasing electrifications of adjacent sectors e.g., transportation (EVs), heating (heat pumps) is decreasing the overall visibility of the grid system (as more decentralized generations and consumptions will occur). This leads to a heightened frequency of system risks such as power outages resulting from imbalances between electricity generation and consumption. Moreover, more decentralized energy system means that power quality would become hard to manage and grid congestion would occur more frequently, resulting in e.g., curtailment of renewable energy.

These issues faced by grid operators will become more prominent in the future with increasing distributed energy resources such as 8,500 GWp of PV capacity and 6,000 GWp of onshore and offshore wind capacity that will be installed, and 700 million electric vehicles on the road globally by 2050. With these rapid developments expected in the energy system, meeting grid stability requirements (e.g., frequency level) becomes more challenging putting increasing pressure on grid operators to take prompt measures to prevent potential grid system failures.

Significant investments are required to transform the current grid infrastructure for our changing energy system. Globally, about $300b was invested in electrical grids in 2021, with at least $14trn needed cumulatively by 2050.

“For start-ups to achieve successful financing or for investors to make successful investment, it is crucial to understand the overall market dynamics, trends, as well as investors’ general concerns and appetites.”

Grid operators adopting smart grid technologies at an accelerated pace

Depending on the applicable voltage levels of grids that they are operating, grid operators have different pain points and strategies to solve them:

Transmission operators (TSOs): TSOs are responsible for the high-voltage transmission system and one of their primary tasks is maintaining the grid’s frequency at a stable level. With increasing non-synchronous generation (i.e., renewables), TSOs are primarily focused on the grid impact of the related loss of inertia, i.e., how fast grid frequency changes with varying demand and supply. Stabilization of inertia level is achieved via curtailment of renewable energy, dispatching conventional power plants as well as by using balancing services – all leading to increasing costs.

Distribution operators (DSOs): DSOs, on the other hand, are responsible for mid- and low-voltage grids. Their main concern is voltage stability. Thus, with more renewables deployed, DSOs focus on the loss of system strength, i.e., how fast grid voltage changes alongside changes in demand and supply. To ensure a level of system strength complying with operation regulations, DSOs have traditionally invested into infrastructure, e.g., replacement of power lines and increased short circuit protection.

As our energy system is changing rapidly, grid operators can no longer solely rely on traditional measures i.e., grid reinforcement, which are costly and take too long to implement. Thus, they are increasingly turning to investments in smart grid solutions along with grid reinforcement, which enables digitalization of grids via monitoring and analyzing key parameters such as inertia, voltage change, power quality and control them to stabilize the system. Various hardware and software smart grid packages allow more cost-effective, reliable, and secure operations of grids.

The acceleration towards smart grid solutions has been displayed through recent efforts by various industry players and start-up funding activities.

The acceleration towards smart grid solutions has been displayed through recent efforts by various industry players and start-up funding activities. For example, Enel, operating over 2 billion km of grid lines globally, is accelerating its effort to digitalize its grids with their vision called Grid Futurability. $70bn investment is earmarked for improving power quality and the resilience of their grids between 2021-2030. Another example is Iberdrola, who launched the Global Smart Grids Innovation Hub in 2021, a global innovation and knowledge center aiming to be a world reference in smart grids. Iberdrola earmarked €75bn investment by 2030 for grid networks. Focusing on smart grid solutions is also clearly visible for electrical equipment manufacturers such as Siemens, Hitachi Energy, Eaton, Schneider Electric, and General Electric. Their offers span from various hardware equipment such as IoT sensors and smart meters to software solutions that can enhance and complement existing SCADA (supervisory control and data acquisition), enabling advanced monitoring and control of grids and ensuring security and stability of operations. To accelerate their product offering, these established players often look for partnership or investment opportunities from innovative start-up companies.

Also, an increasing number of innovative solution providers are entering the smart grid space. Zaphiro, a Swiss-based real-time grid monitoring and control solution provider received €3m of Series A funding from a consortium with Excellis as the lead, together with ABB Technology Ventures, and Club Delgi Investitori as followers. Another example is SparkMeter, a US-based grid management software provider who received $10m from a consortium of Accurant International as the lead, together with Breakthrough Energy Ventures and Clean Energy Ventures. In 2021, Reactive Technologies, a UK-based inertia and system strength measurement provider received $15m of Series C funding from a consortium led by BGF, Breakthrough Energy Ventures and Eaton, in which Apricum acted as the exclusive financial advisor to Reactive Technologies.

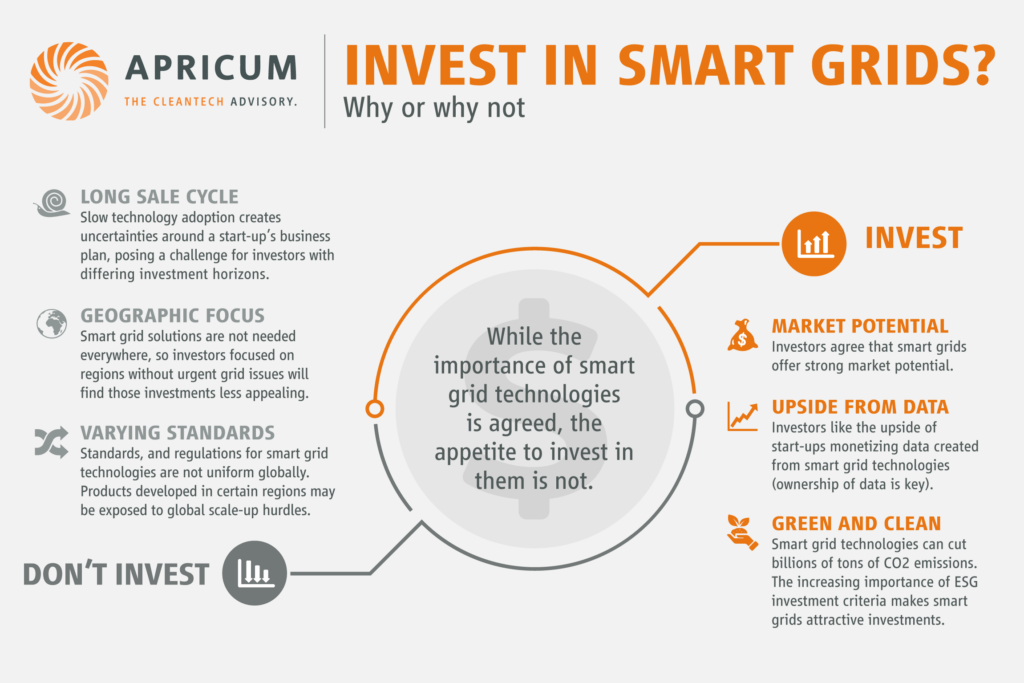

Why to invest, why not to invest

Apricum has facilitated numerous successful transactions within the smart grid space. Based on our experiences, below are some of the reasons we’ve observed from investors as why, or why not, to invest in smart grid solution providers.

Why to invest?

- Market potential: The urgency to digitalize grids is widely acknowledged by investors and the need for action by TSOs and DSOs are well understood. Therefore, investors agree on the global market potential for smart grids.

- Upside from data: Smart grid solutions enable significant amounts of data collection and the necessary analysis for TSOs and DSOs. This gathered data and insights (e.g., inertia level, power quality) can provide further benefits to other industry players and yield business opportunities for start-ups, such as selling data to energy traders who can utilize the data for their pricing forecast and preparing for bids. To access the upside, data ownership of smart grid offerings is an important topic for investors.

- Decarbonization impact: An increasing number of investors consider carbon emission reduction as an important criterion for assessing investment opportunity. Equipping transmission grids with smart grid solutions that provide visibility on inertia will reduce the necessity to invest and operate thermal power plants. Furthermore, having visibility on distribution grid assets’ system strength will reduce the curtailing of renewable energy. In addition to financial returns, investors see smart grid solutions as a way to enable an emission reduction of billions of tons of CO2.

Why not to invest?

- Long sale cycle: Due to regulatory barriers and the high investments needed, grid operators are cautious when it comes to adopting new technologies (although this sentiment is changing rapidly). Therefore, even if start-ups have proven and market-ready technology with apparent benefits, convincing grid operators to adopt a smart grid solution can take years. This creates uncertainties around realization and timeline of a start-up’s business plan, which poses a challenge to investors with varying investment horizons.

- Geographic focus: Although the importance of smart grid technologies is broadly agreed upon, the urgency to adopt them is different. The need for smart grids is more prominent for countries targeting e.g., high levels of renewable energy and EV deployment. The urgency further applies to countries like the UK where there is no interconnectivity between neighboring countries to help stabilize the grids when needed. We observed that for investors whose geographic focus countries have less urgent grid issues, smart grid investment opportunities tend to be less appealing.

- Varying standards: With rapid development of smart grid solutions and regional variation of adoption, standards and regulations, integration/communication with existing solutions and interoperability are not ensured globally. Thus, products developed in certain regions may be exposed to hurdles when it comes to global scale-up, which makes investors hesitant to invest.

Summary

Smart grids are essential to accelerating the energy transition and require significant investment in the coming decades. We see various companies emerging and offering highly innovative solutions. For start-ups to achieve successful financing or for investors to make successful investment, it is crucial to understand the overall market dynamics, trends, as well as investors’ general concerns and appetites. Apricum has extensive experience, knowledge, and a network in the smart grid space and has enabled numerous successful transactions. If you would like to learn more about how we can support transactions in the smart grid space, please contact Nikolai Dobrott.

This article was written by former Apricum Associate Solbin Kim.