The PV industry has bounced back from a tough few years of drastic consolidation driven by overcapacity and savage price competition. The PV market is now global and diversified, and is experiencing strong and consistent growth resulting in companies across the PV value chain becoming profitable again. Consequently, promising investment opportunities exist for those who can read the industry trends and identify companies with an innovative concept, differentiated product or simply better cost structure.

The global PV market has experienced a double-digit growth rate in the last 12 months, and is set to continue this strong pace well into the future. This positive outlook for the PV industry provides the basis for profitable returns and is mainly due to three key factors.

Firstly, with the rapid decline in costs, PV has largely become independent of subsidies and is simply a competitive source of power generation today; the cost of PV is expected to decline further in future, making solar competitive with almost every other source of power generation.

Secondly, the diversification of PV demand means that the global PV market is no longer dependent on just a few markets.

Thirdly, manufacturing companies in the PV industry are returning to profitability thanks to the improved supply and demand situation.

1. PV power is competitive without subsidies

PV-generated power is already economical in many markets today due to the significant reduction in PV costs that we have witnessed in the last few years. Among different power-generation technologies, PV technology has witnessed the steepest learning curve. PV prices are expected to decline continuously with further technological improvement, thereby strengthening PV’s competitive advantage in the coming years.

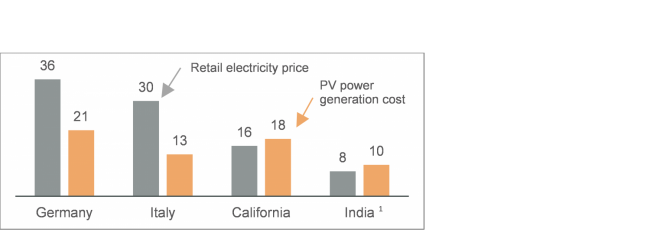

PV-generated power is already competitive at a residential and commercial level in several markets around the globe. In some markets with high power prices for end consumers (e.g., Germany, Italy, Hawaii, Brazil), PV can generate power at a substantially lower cost than electricity prices.

Residential electricity prices vs. residential PV power-generating cost2 in 2014 [USD cent/kWh]

Source: Apricum market model; 1) electricity prices for a typical household in Delhi; 2) LCOE/cost of power calculated for a typical region in the country at 6% discount rate, system prices differ for different countries

In the utility-scale segment, PV power is already competitive with oil-based power generation (e.g., fuel oil, diesel), which costs >20 USD cent/kWh at unsubsidized market prices. The generation cost of PV power will be competitive with other conventional power sources in many regions by 2020 as PV power generation costs decline to 5–10 USD cent/kWh. In recent times, the subsidies required for solar power have decreased significantly and are expected to fully fade out during the next few years.

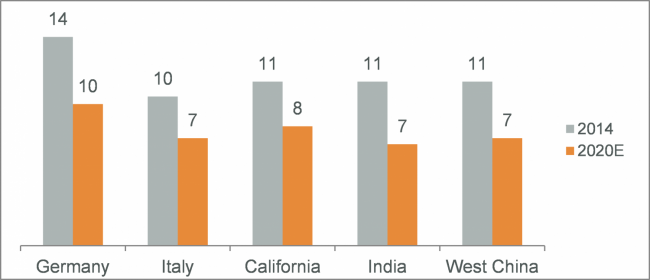

Expected utility-scale PV power-generating cost 2014 vs. 2020 [USD cent/kWh]

2. Diversification of global PV demand

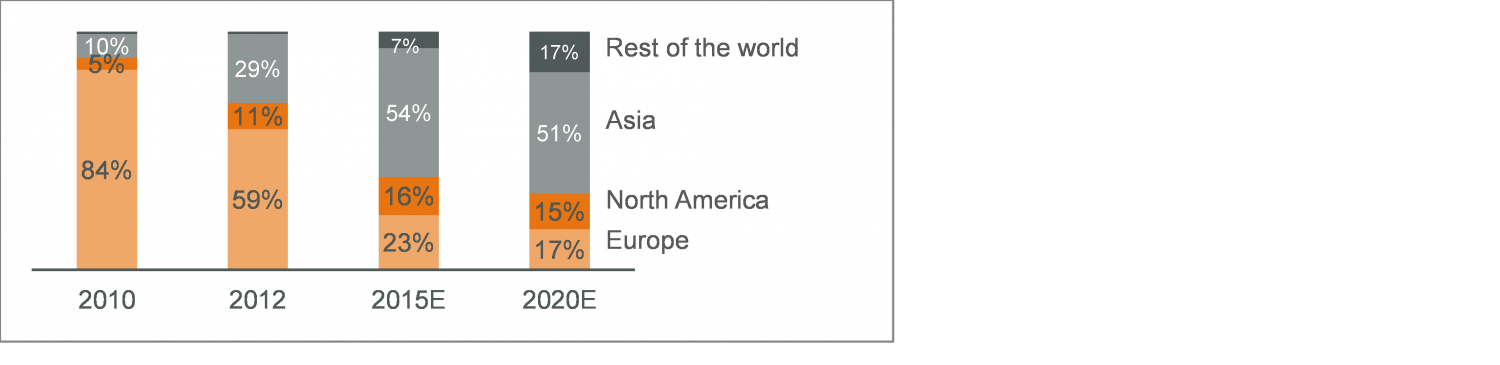

Global PV demand is now more regionally diversified than ever before. European countries, the PV leaders for the last 10 years, have been toppled and replaced by countries such as China, USA and Japan. With market diversification, the global market is much less affected by demand shocks arising from policy changes in single markets.

Global distribution of PV demand across continents

Due to PV’s increased competitiveness, new markets of global significance have emerged. In 2010, five markets in the world represented 80% of global PV market volume. Next year, we expect to see 14 markets instead making up the same 80% of global PV market volume – an increase of almost threefold.

There are now at least eight markets with annual installations of >1 GW each, and at least 20 markets with annual installations of >100 MW each.

Besides China, USA and Japan, emerging economies in the MENA region and Central / South America are gaining a larger global market share and will drive significant global PV growth in the future.

3. Profits are returning to the PV industry

Thanks to rising capacity utilization and stabilizing prices along the value chain, PV manufacturing companies are beginning to be profitable again. Looking just at the crystalline silicon (c-Si) value chain over the last few years, large capacity expansions caused a steep decline in utilization in 2012 for wafer, cell, polysilicon and module production. This resulted in a sharp price decline but helped to increase demand, which therefore increased capacity utilization the following year in 2013.

With limited capacity expansion plans, the PV industry is expected to reach full utilization levels in 2014–2015. In addition, PV component prices have been stable since 2013 after 2012’s significant price drop. With further technological improvements, PV production costs will continue to decline in line with this learning curve and will result in lower prices in the long term.

PV’s positive outlook spurs investment activity

Although several investors lost significant amounts of money backing PV companies in the past, investors have started to reconsider this industry. In recent months, we’ve seen carefully selected investments with solar companies all along the value chain. While there has been a recent investor focus on downstream companies with innovative concepts (e.g., several residential PV-leasing companies in the USA), selected upstream companies with differentiated products have also managed to attract investor interest (e.g., Silevo bought by SolarCity in 2014). Large publicly-listed companies have also raised money in public markets recently.

In a highly commoditized industry like PV, companies with innovative concepts, differentiated products or simply better cost structures are likely to provide sustainable returns to investors. These types of companies can be found along the entire value chain, but especially in downstream (e.g., Sungevity raised over USD 50M in venture capital funding for its customized home solar systems). Innovation is a driving force in the PV industry, and there are many companies with innovative technologies who are still seeking capital in order to realize further growth. Against a backdrop of improving industry dynamics and a rapidly-growing end market, companies with unique and sustainable value propositions will undoubtedly make attractive investments.

Selecting investment trends is key

While there are many promising investment opportunities along the PV value chain from materials to installation, they need to be carefully selected. For example, the trend of local production in emerging solar markets to increase market presence presents several opportunities, such as acquiring a struggling module manufacturer or forming a joint venture for new manufacturing facilities to serve the local market. Understanding market trends and the path of future technology will be crucial for investors to ensure the safety of their capital while earning adequate returns on it.

For questions or comments, please contact Nikolai Dobrott, managing partner: dobrott@apricum-group.com