Brazil has made international headlines on political and economic issues lately, most of which did not paint a rosy picture of the country’s current situation. Nonetheless, development of the solar sector is on a promising path, with the successful execution of several large-scale PV auctions and increasing interest from industry players to set up a local value chain. The much touted small-scale distributed generation (DG) PV segment, however, is still struggling to meet growth expectations. Brazil has recently introduced new legislative measures to stimulate the DG segment, yet will these provide the remedy the market needs? This article explains the structural reasons for the slower than expected market development and examines the effectiveness of the government’s newly introduced legislation to stimulate demand for solar DG systems.

Falling short of expectations

Much promise has long been attributed to the small-scale DG PV sector. Since the introduction of a net-metering scheme in 2012, policy makers and stakeholders from the PV sector have been emphasizing its huge potential. Indeed, as we outlined in a previous newsletter article from August 25, 2014, many preconditions for the healthy development of a self-sustaining residential and commercial PV segment under a net-metering scheme can be found in Brazil, and the market is undoubtedly attractive in terms of size.

Demand for distributed solar systems, however, has fallen short of expectations until now. Recent figures put the total installed capacity registered for net-metering at 27.15 MW from a total of ~2,500[1] PV systems. As a comparison, the Federal Government in Brazil is planning 1,593 GWh[2] of electricity from small-scale DG by 2024, equivalent to ~1 GW of installed PV power.

So why has DG failed so far to live up to its promised potential?

Interest rates render investment in solar unattractive

As investments are driven chiefly by expected financial returns, the conclusion is simple that DG solar investments in Brazil are not economically attractive – mainly due to the high interest rates investors need to pay for a loan to finance such systems. In our article from August 2014, we outlined that an annual debt interest rate of ~12% on a long-term loan would be required to attract investment in solar systems from a meaningful share of private and commercial customers. Brazil’s Central Bank, however, recorded annual interest rates averaging 35.7% for private and 19.5% for commercial borrowers in 2015. If directed (subsidized) lending is excluded from this view, these rates climb to 59% and 28% respectively. In fact, the likelihood is high that investors will not find a lender for a loan with a 15 or 20 year tenure at all.

Solar systems are not per se a high risk asset class (indeed, rather the contrary), and best practices for evaluation and disbursement of debt have become mainstream in many countries over the past years. So why are interest rates in Brazil so prohibitively high and loans so difficult to access?

Typically, high interest rates are driven by a high default rate, a perception of high macroeconomic and political risks and high inflation. Arguably, Brazil cannot match the leading global economies in any of these indicators. But neither is its performance sufficiently bad to fully explain the magnitude of interest rates.

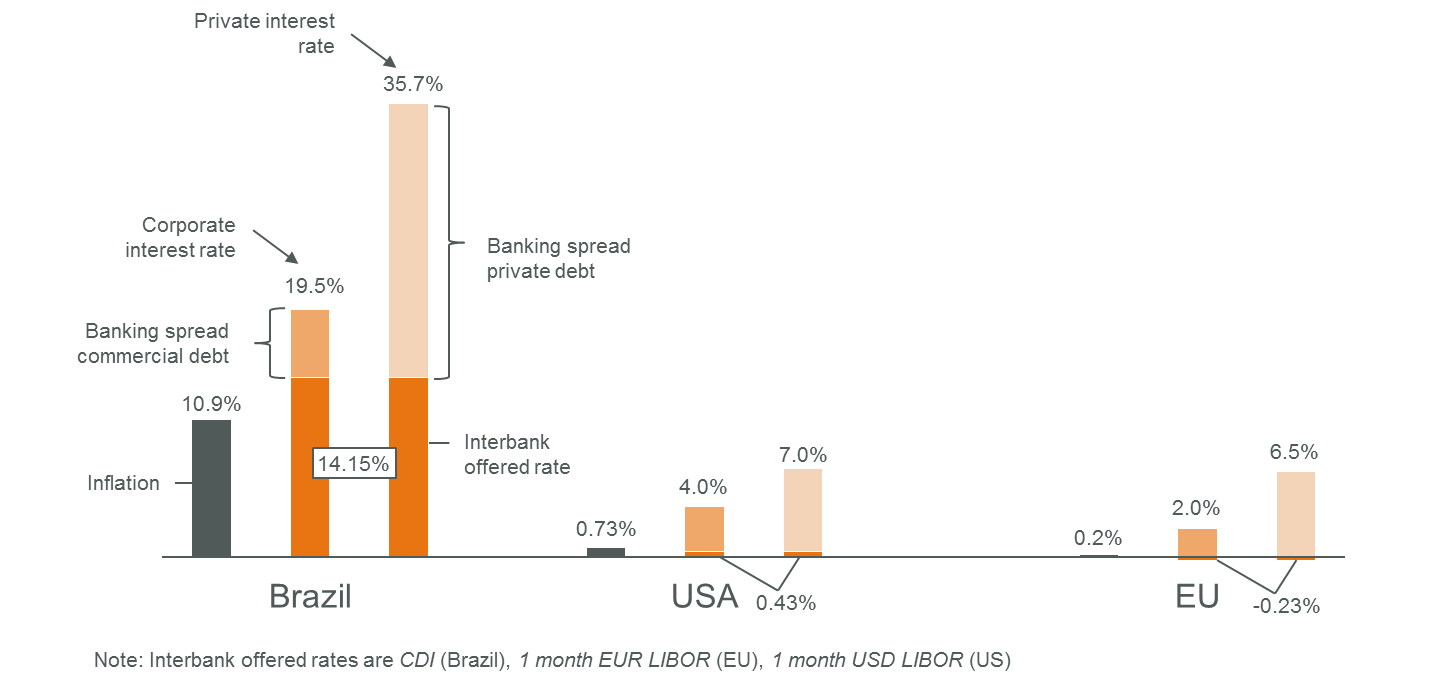

Figure 1: Comparison of interest rates in Brazil, the USA and the EU

Figure 1 shows an example comparison of interest rates for loans in the USA, the EU and Brazil. Apart from the much higher interbank offered rate (IR) at which banks access their funds, the figures show that the banking spread from the interbank rate to the final interest rate is dramatically higher in Brazil than in the USA or the EU. The World Bank found a number of reasons for this, e.g., the amplifying effect of a high central rate, but also an ineffective judicial framework for contract enforcement, high indirect taxation of the banking system, higher than average operational costs and the detrimental effect of high reserve requirements for banks.

All of these reasons are symptoms of a poorly developed and inefficient financial sector that will most likely not be solved in the short-term. The tight corset of Brazil’s banking sector policy and legislation increases short and mid-term interest rates; for commercial credits with duration longer than ten years, there is no liquid market at all.

Consequently, the country has resorted to funding required infrastructure, housing and similar long-term investment projects through directed lending at subsidized rates.

Directed lending for specific sectors or investments occurs mostly through BNDES or Caixa Economica and showed much lower annual interest rates of 9–10% in 2015. In fact, the high share of subsidized directed lending is another factor driving interest rates for non-directed loans. Nonetheless, this source of finance currently is the only means to render most long-term investment projects viable at all. Unfortunately, loans from BNDES are hardly accessible to small-scale solar customers since these (a) are restricted to companies, (b) have fairly high minimum lending amounts and (c) are subject to strict lending terms. Furthermore, a minimum of locally produced components is typically required such as the PV modules, which are currently not available at competitive prices in Brazil. Financing options from Caixa Economica, such as the ConstruCard, are more accessible, but interest rates are in the order of 15–20% p.a. and thus much less attractive.

Measures by the government are helpful, but do not solve the core problem

To encourage investment in DG solar, the government in recent months introduced a range of measures at the state and federal level. Tax exemptions are now a reality in many states for DG PV power; substantial adjustments to the original net-metering legislation came into effect on March 1, 2016. In November last year, the government also unveiled its “ProDG” incentive program for distributed generation that comprises several instruments to further stimulate demand.

The question is whether these changes will suffice to attract more investment from private and commercial customers. As outlined above, until now the lack of financial attractiveness has been the main reason for the sluggish adoption of DG solar. Measures to stimulate the sector should thus be mainly directed at improving investors’ bottom lines. The following tables examine the latest legislative initiatives and assess their suitability and effectiveness in stimulating demand for DG.

Tax exemptions

| # | Instrument/measure | Impact on bottom line | Effectiveness |

|---|---|---|---|

| 1 | ICMS[3] tax exemption for net-metered DG electricity (introduced in 14 states) | Substantial cost benefit for DG solar system owners; improves financial viability of investment in DG solar | High |

| 2 | PIS/COFINS[4] exemption for net-metered DG electricity (federal, valid across Brazil) | Noticeable cost benefit for DG solar system owners; improves financial viability of investment in DG solar | Medium |

Overhaul of net-metering legislation

| # | Instrument/measure | Impact on bottom line | Effectiveness |

|---|---|---|---|

| 1 | Longer validity of credits for net-metered solar electricity | Hardly any impact | Low |

| 2 | Remote self-generation – DG power can be used to offset utility bill of several (remote) points of use if belonging to the same customer and distribution area | Cost reductions can be achieved through e.g., larger system sizes and ground-mounted installations | Medium |

| 3 | Net-metering on condominiums, sharing generated power among participating consumers | Small cost reduction can be achieved through e.g., larger system sizes | Low |

| 4 | Net-metering in consortia – a group of investors can share the electricity generated from a single system and reduce their respective utility bills | Small cost reduction can be achieved through cost-effective system design. Large impact on bottom line if consortia can meet requirements for BNDES loans | Medium – to high |

ProDG initiative

| # | Instrument/measure | Impact on bottom line | Effectiveness |

|---|---|---|---|

| 1 | Increase of solar reference value[5] to 454 BRL/MWh | Can encourage demand from distributors for DG electricity, but is not attractive compared to offsetting costly power from the utility | Low |

| 2 | DG electricity sales on the free market (under investigation) | Can provide alternative revenue stream for system owners, yet not attractive compared to offsetting costly power from the utility | Low |

| 3 | Installations on public buildings | Can help raise awareness and stimulate development of required installation and system integration services | Low |

All of these measures mean positive news for the distributed generation sector, however, they are likely not sufficient. While many of them are effective in increasing the total market size, customer base or system capacity, they fail to clear the financial roadblocks that have been hindering faster development of DG solar in Brazil – access to long-term lending at an acceptable cost and lower solar system costs. Lowering taxes and charges on net-metered electricity to improve the financial attractiveness of solar electricity is a step in the right direction, but likely not enough to tip the financial balance. Under the umbrella of the ProDG initiative, a working group has been created to identify means for improved credit access, yet has not delivered tangible results so far.

Consequently, investments in distributed solar systems are unlikely to become financially compelling for a broad share of potential investors as a result of the new regulation. The introduced measures are well suited to expand the market reach of DG solar in principle, but will only achieve its full impact once economic viability has been attained. A true leap forward for the DG segment would be to provide the target group for DG solar with access to long-term loans at acceptable interest rates.

What industry can do

In the short-term, the evolution of a mature financial sector with efficient long-term lending in Brazil is unrealistic. Hence, if the government is serious about its deployment targets, it should consider making existing BNDES credit conditions available also to home owners, small and medium commercial enterprises and other potential investors.

Unfortunately for players in Brazil’s solar industry, the ability to directly influence debt interest rates is limited. But it’s not all bad news, there are some actions that solar industry players can take, in addition to continuous communication with the authorities in Brasília, e.g., to prepare the ground for an effective disbursement of debt once conditions improve. Here are some examples:

- Develop business models and solar products eligible to access available BNDES funding (e.g., through consortia)

- Liaise with the financial sector and raise awareness for the low risk profile and securitization measures for solar systems

- Cooperate with utilities, mobile phone providers and credit card companies to develop a quick and cost-effective process for the evaluation of creditworthiness of solar loan applicants

- Work with commercial banks to standardize loan application and disbursement processes

Ironically, the largest incentive for the distributed sector in Brazil may have inadvertently come from the government via the substantial hike in electricity prices set by the federal regulatory body. Tariff increases of ~50%[6] for residential and commercial customers make investments in solar self-generation much more attractive and will probably be the main driver of growth for the distributed solar segment in Brazil. To tap the true potential of distributed solar, however, solving the financing puzzle is the key.

For questions or comments, please contact Apricum Project Manager Martin Mitscher.

[1] Source: ANEEL

[2] Source: EPE (PDE 2024)

[3] Brazil VAT

[4] Social contribution tax

[5] value that distribution companies can pass on to consumers for electricity procurement

[6] Source: Banco Central do Brasil –

Regulated Price Index household electricity 2015-01-01–2015-12-31