- Korean and Japanese companies’ cleantech investment in Europe has been growing

- The European cleantech market offers attractive investment opportunities with various strategic benefits to Korean and Japanese investors.

- Successful foreign investment into European renewables requires a balance of foresight and local knowledge to mitigate risks.

Investment by Korean and Japanese players in the European cleantech space (e.g., solar, wind, energy storage, clean hydrogen, green mobility, smart grid, digital energy, heat pumps) has been growing. According to Pitchbook[1] the total transaction volume of deals in which Korean and Japanese companies invested in the European cleantech companies/assets was approximately €3bn in 2023, ~50% year-on-year growth compared to 2022. Investments were mostly made in Belgium, Germany, Ireland, Norway, Sweden, and the UK which together accounted for ~90% of the total. What is driving this trend? Why is Korean and Japanese companies’ cleantech investment appetite for Europe growing?

Apricum’s recent deepening of its Asian footprint has provided numerous opportunities to exchange with leading Korean and Japanese companies active globally in the cleantech space. Through face-to-face meetings and attending regional cleantech conferences in Korea and Japan like Smart Energy Week, InterBattery, and Green Energy Expo, we have identified trends, opportunities, and challenges for regional players considering entering/expanding in the European cleantech market via investment.

Europe’s attractive cleantech market

Europe has already established a leadership in its commitment to drive the global energy transition. This is supported by ambitious climate policies such as the European Green Deal[2], and a set of legislations under Fit for 55[3]. The importance of energy and supply chain independence urged the EU to introduce REPowerEU[4] and Net-Zero Industry Act[5]. The overall commitment by the EU and its climate policies have created a favorable regulatory framework and business environment for the cleantech industry.

Main benefits for Korean and Japanese companies investing in the European cleantech space

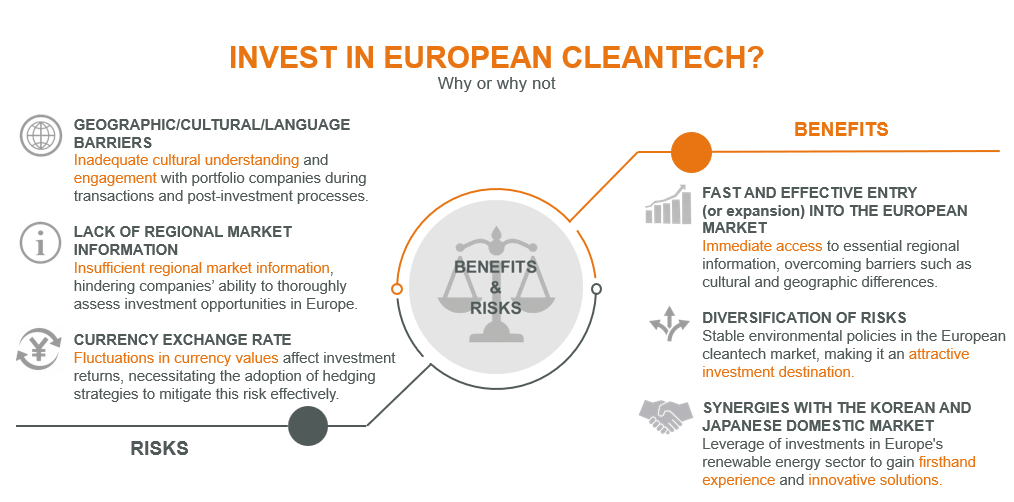

Investments can be a useful tool for achieving specific financial and strategic goals. According to our analysis, the main benefits that Korean and Japanese companies can expect from entering the European cleantech space via investments are:

- Fast and effective entry (or expansion) into the European market: Many Korean and Japanese companies often consider entering (or expanding in) the European cleantech space organically. While this can be an attractive option leveraging each company’s own experiences, existing structure, and cultures, companies often face challenges regarding speed and effectiveness as gaining on-the-ground knowledge about the market, players, technology, and regulations/policies takes time, especially, for fast-changing industries like cleantech. Entering/expanding in the European cleantech market via investment can provide immediate access to relevant regional information and help Korean and Japanese players overcome cultural/language/geographic barriers.

- Diversification of risks: Investing in the European cleantech space can provide a great way to diversify companies’ risk in existing business and investment portfolios. The cleantech industry is evolving at a fast pace globally. Although there are general uncertainties around which regions/companies would prosper in the long term, the European cleantech market environment is relatively stable and supported by ambitious climate policies. Europe is home to various attractive investment opportunities in the cleantech space fitting to the specific investment appetite/business needs of Korean and Japanese companies.

- Synergies with the Korean and Japanese domestic markets: Europe’s ambitious renewable energy targets and technology deployment presents both opportunities and challenges. Korean and Japanese companies can utilize their European investment to gain first-hand industry experiences which can potentially be transferred to the domestic markets. For instance, the increasing adoption of distributed energy sources and the roll-out of electric vehicles have been causing grid issues in Europe, but solutions have emerged to maintain grid stability, such as increased participation of energy storage in ancillary services, smart grid technologies, and grid-forming inverters. By exploring these investment opportunities, Korean and Japanese companies can adopt proven and commercialized technologies from Europe and apply them to their domestic markets when similar issues arise.

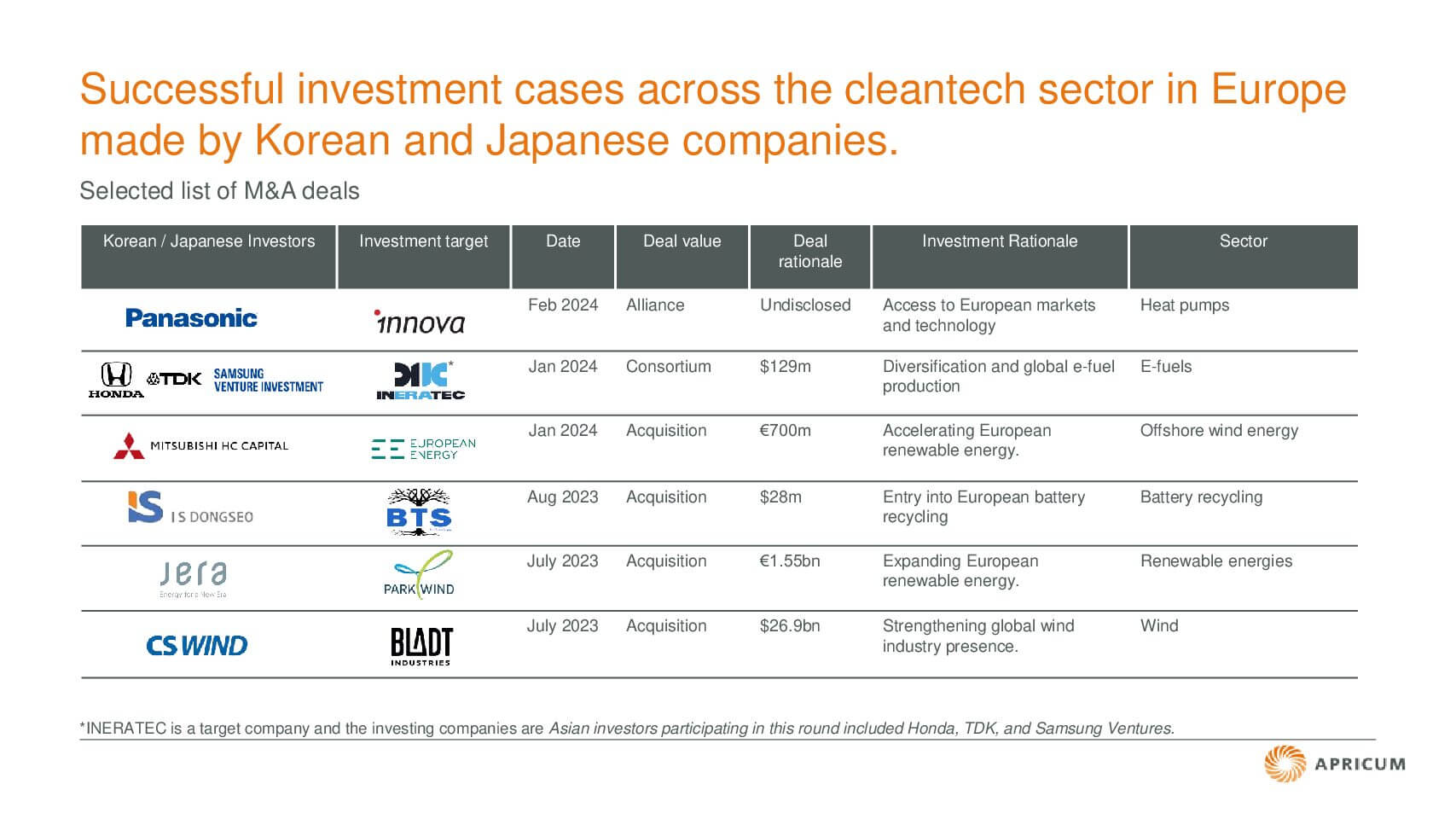

Successful investment cases

There are already a handful of precedent successful investment cases across the cleantech sector in Europe made by Korean and Japanese companies. Below are selected examples indicating a wide range of investment appetite with various rationales:

- Panasonic signed a capital and business alliance agreement with INNOVA in February 2024 to acquire a 40% stake in INNOVA. Through this deal, Panasonic earned access to INNOVA’s various technologies including heat pumps as well as its European market experience.

- INERATEC, a German pioneering e-fuel company secured over $129m in Series B funding in January 2024 from a consortium led by Piva Capital to scale up INERATEC’s power-to-X plants worldwide and advance its e-fuel production. Asian investors participating in this round included Honda, TDK and Samsung Ventures.

- Mitsubishi HC Capital, a Japanese global financing and leasing service provider, announced its plan in January 2024 to invest ~€700m in acquiring a 20% stake in European Energy, a Danish renewable energy developer with its main activities in Europe and over 3 GW of accumulated renewable energy project development track record. Via this investment, Mitsubishi HC Capital was able to accelerate its renewable energy development business in Europe as part of its long-term growth strategy.

- IS Dongseo, a Korean waste management company, acquired a 79% stake in BTS Technology, a Slovakian battery recycling company for 37.5 billion KRW ($28m) in August 2023. With this acquisition, IS Dongseo was able to enter the end-of-life battery recycling market in Europe.

- CS Wind, a leading Korean manufacturer of wind turbine towers, acquired a 100% stake in Bladt Industries, a Danish supplier specializing in offshore tower substructures, for ~$27m in July 2023. Via this deal, CS Wind expanded its product offering combining both companies’ technology/market expertise to consolidate its leading position in the global wind industry.

- Reactive Technologies, a smart grid solution provider, raised over $15m in Series C funding from renowned investors including BGF, Breakthrough Energy, Eaton, and Toshiba in 2021/2022. Apricum was the exclusive financial advisor to Reactive Technologies in this transaction.

Primary risks to consider for Korean and Japanese companies investing in the European cleantech space

Successful investment abroad demands specific skills and a deep understanding of regional dynamics. Below, we outline some of the primary risks that Korean and Japanese companies should consider when investing in the European cleantech industry:

- Geographic/cultural/language barriers: Throughout the transaction process and beyond, understanding the cultural differences between Asia and Europe (e.g., business communication) and adequate engagement and involvement in portfolio companies is essential in a successful investment. As often perceived as major barriers by Korean and Japanese companies, risks arise when sufficient and effective regional understanding/interface is not present.

- Lack of regional market information: Before making an investment decision, investors need to evaluate the overall market conditions thoroughly (e.g., growth drivers, competitions, technology development trends, and policy development). As Korean and Japanese companies’ investment experiences abroad differ a lot, this can be a big risk in adequately assessing investment opportunities.

- Currency exchange rate: Korean and Japanese companies may be exposed to foreign exchange risk by investing in Europe due to exchange rate volatility. Fluctuations in currency values may affect investment returns and thus, companies are advised to mitigate this risk by adopting a hedging strategy to effectively counteract exchange rate volatility.

Acknowledging the above risks in considering investment opportunities and proactively mitigating them is crucial to ensuring a successful investment in the European cleantech space. Engaging with advisors who have in-depth regional and cleantech expertise and can facilitate smooth transactions and portfolio management can be an effective way to mitigate these risks.

How Apricum can help

Apricum is a strategy consulting and investment banking boutique exclusively focused on renewable energy and cleantech. Europe has been Apricum’s core market since 2008 with its headquarters in Berlin and offices in London and Paris with expansion to Amsterdam planned in 2024. With our experience in more than €3.3bn of renewables and cleantech transactions, Apricum can support Korean and Japanese investors to develop investment strategies in Europe, identify suitable targets, conduct due diligence, and successfully close various types of deals (e.g., fundraising, M&A, project financing, joint ventures). If you would like to learn more about how we can support on transactions and investments in Europe, please contact Nikolai Dobrott.

[1] Accounting only for known deal sizes;

[2] A package of policy initiatives launched by the European Commission in Dec 2019 aiming to set the EU on the path to reach climate neutrality by 2050;

[3] A package of legislation supporting all sectors to meet the net greenhouse gas emission reduction of at least 55% by 2030;

[4]Introduced after Russia’s invasion of Ukraine to reduce EU’s dependence on Russian fossil fuels by reducing energy waste, producing clean energy and diversifying its energy supply;

[5] Proposed on 16 March 2023 to strengthen the European manufacturing capacity of net-zero technologies to improve the competitiveness of cleantech industrial base and improve EU’s energy resilience

This article was written by former Apricum associate Solbin Kim.