Why both corporate M&A transactions and the energy transition can benefit from commercial due diligence

Would you buy a car without thoroughly checking it first? Probably not. You would rather carefully evaluate whether the vehicle meets your long-term requirements and go through reviews or tests performed by experts, i.e., “kick the tires”. Analogously, a savvy investor will scrutinize a company before acquiring it. M&A transactions can be significant in size and are often unique in nature. They differ from recurring purchase decisions, are resource-intensive (both in terms of deal sizes and transaction effort) and are not reversible. They can create or destroy value. Therefore, making well-informed investment decisions matters. This is where due diligence comes into play.

In this article, we will dive into a particular type of due diligence: commercial due diligence. We will discuss its (growing) importance in the cleantech space, the tangible benefits it offers to both investors and sellers, and elaborate on how Apricum’s philosophy and approach to CDDs sets us apart.

What is commercial due diligence?

Strictly speaking, due diligence is a procedural step in a transaction where an appraisal is conducted on a company or a part of it. It is performed as part of a capital raise, M&A transaction (sell- or buy-side), or initial public offering (IPO). Generally, a suite of different types of due diligence exists. They differ in scope and often require different types of qualifications or expertise (see the deep dive in Exhibit 1). Examples include legal due diligence, conducted by lawyers, financial due diligence, performed by accountants or commercial due diligence, delivered by advisors like Apricum.

Exhibit 1: Deep dive: the different types of due diligences that exist

The focus from here onward will be on commercial due diligence (CDD), a term that became more widely known in the mid-nineties[1]. Since there is no broadly accepted definition, in our perspective it is a thoughtful, fact-based and logical assessment of the company in focus, referred to hereafter as the “target”. Its core aim is to uncover deal-breaking elements or dyssynergies that might otherwise remain undetected and could lead to significant value destruction after a transaction. Conversely, it can also identify unrecognized opportunities or upsides and corresponding additional value-creation potential. Ultimately, it should adequately inform a decision to invest (or not to invest).

Why is commercial due diligence in higher demand than ever?

Over the past years, the importance and number of commercial due diligence mandates conducted in the cleantech space has substantially increased. Several overarching factors are at play:

- Deal volume: The cleantech sector has seen a surge in M&A activity over the past decade, with a particularly strong period from 2020 to 2022, during which deal volume grew by ~40%.[2] Although 2023 saw a decline in deal activity due to major macroeconomic factors (e.g., high interest rates and recession concerns) and geopolitical issues, it also brought a shift in focus. More recently, private equity firms and infrastructure funds are capitalizing on lower valuations by pursuing take-private deals (e.g., Brookfield’s bid for Neoen in May 2024, KKR’s bid for Encavis in March 2024). Meanwhile, other major investors (e.g., Blackrock) are increasing investments and strategic focus within their climate infrastructure teams, highlighting long-term commitment to the sector’s growth

- Deal size: As the industry matures [3], the trend is for average deal sizes to increase. This trend is expected to continue in the long-term, even though deal sizes may temporarily decrease in the short-term due to factors such as industry cyclicality and macroeconomic headwinds. This makes the case for CDDs, which are de facto a transaction cost, more economically viable due to the higher value at stake.

- Deal stakeholder volume: With the surge in capital deployed in cleantech, more players may become involved in each deal. Preparing and communicating insights to multiple potential buyers in a CVDD report is resource-intensive. A good CDD advisor will not only prepare high-quality deliverables but also manage the multitude of internal and external stakeholders (e.g., via ensuring alignment with the company’s leadership or via conducting Q&A calls with potential investors). This approach minimizes the diversion of management’s attention from the core business.

- Technology and business model complexity: More advanced and differentiated technologies are emerging, along with increasingly sophisticated business models and use cases. For instance, consider battery energy storage systems, which can flexibly charge, store and discharge electricity. This flexibility allows them to be deployed in a plethora of different use cases and can be monetized in multiple markets. As a result, investors are increasingly reluctant to depend on generalist CDD advisors and are instead seeking specialists with tailored expertise. With decarbonization now a mainstream goal across industries and stakeholders, CDDs can reduce complexity and benefit non-cleantech investors who may wish to enter the space to achieve their ambitions.

- Regulatory and macro-economic uncertainty: Although market-dependent and industry-dependent, there is a clear trend toward reduced regulatory economic support and a shift to greater market exposure, especially in Europe. The underlying fundamental is that established technologies (e.g., solar photovoltaics) have reached a level of competitiveness that enable them to compete with incumbent alternatives, driven by continued experience curve effects, large-scale global deployment and global manufacturing (over)capacities. This often results in higher complexity and risks, which can be effectively addressed through in-depth know-how and a thorough evaluation of the risk and their mitigants. A well-conducted CDD will provide both.

- Value creation potential: CDDs can also improve transaction outcomes by securing better deal terms such as valuation. On the sell-side, i.e., when a CVDD is conducted, a neutral, third-party advisor who performs an impartial, fact-based and logical assessment can lend credibility and more effectively highlight the attractiveness of the offer. On the buy-side, i.e., when a CDD exercise is conducted, an additional external perspective can help counteract bias (e.g., confirmation bias, anchoring, sunk cost fallacy) and bridge knowledge gaps that might otherwise adversely affect the robustness of the investment decision. In summary, a well-conducted CDD can persuade investors who might not have otherwise made an offer and can lead to more favorable valuations/offers or provide good reasons for to not invest at all.

- Efficient capital allocation for the energy transition: This is not merely a moral argument. Governments and corporations have committed to achieving net-zero targets. A Euro or Dollar can only be spent once. If misallocated, it can delay progress these goals, resulting in opportunity cost for the investor and the energy transition. This also means missing out on more favorable investments that could benefit both parties. There is growing awareness of the importance of CDD as a lever to ensure efficient capital allocation and help achieve these objectives.

How does Apricum’s approach to commercial due diligence differentiate?

If one were to peek into the “engine room” of an Apricum CDD project, they would observe a rigorous, iterative process of carefully formulating and thoroughly answering a tailored set of core questions based on hypotheses. Relying on a standardized “due diligence checklist”, which is sometimes observed, is not advisable. Such an approach is likely to overlook important case-specific aspects and can divert attention and resources to less critical areas.

Apricum’s approach provides our clients with a competitive edge over commercial due diligence advisory services offered by more generalist CDD advisors in several ways:

- Depth of industry and technology know-how: Apricum has delivered over 400 projects and focuses exclusively on cleantech. Generalist CDD advisors may need to first get acquainted with the industry or technology in the early stages of a CDD. Without pertinent expertise, CDD advisors might struggle to prioritize the most pertinent areas of investigation and to ask the right questions from the outset. This could lead to either “boiling the ocean” (trying to cover everything) or “missing the point” (getting distracted by noise). In contrast, Apricum’s team can “hit the ground running”. Apricum can rely on pertinent and readily accessible knowledge base, proprietary in-house cleantech tools, such as our in-house PV market model, players databases and economic models, and access to our global and in-house expert network. This enables our clients to make the most of typically limited windows of opportunity to conduct a CDD.

- Meeting expectations of expert investors: Especially relevant for CVDDs, as savvy investors with war chests have become active in the cleantech market. This includes infrastructure investment firms (e.g., Blackstone, DIF Capital), private equity firms (e.g., Blackrock, KKR), and institutional investors (e.g., Saudia Arabia’s Public Investment Fund – PIF, Norway Government Pension Fund Global). They also bring pertinent experience from their portfolio companies and access to industry know-how. Potential investors expect well-structured insights that are on point, substantiated and preemptive of key information requests (and underlying critical questions/aspects). Apricum is accustomed to working with knowledgeable investors and understands their requirements, allowing us to anticipate their needs and address potential knowledge asymmetries effectively.

- Bespoke scope of work: The scoping of an Apricum CDD is always tailormade to our client’s requirements and specific context. However, we do always constructively challenge requested aspects that we believe would be less relevant to assess and make suggestions for alternatives or additional aspects to consider, whenever relevant. The corresponding dialogue held with our clients ahead of the project will shape the later mandate and will help to prioritize the right topics and key questions to answer from the outset

Furthermore, the scoping also depends on the stage of the transaction process. Simplified, there are two usual stages when conducting a CDD can be relevant.- Early stage: Selected (e.g., a high-level teaser only) or no company information and no access to management might be available, with only selected documentation. Typically, this is before a non-binding offer (NBO) is made

- Advanced stage: Broader access to inside company information is available (e.g., key documents such as an information memorandum or CVDD report and financial model). Typically, this is after a NBO is made, and there is access to the target’s management (e.g., to hold Q&A calls and request specific information

- Strategic mindset: Apricum believes that effective CDD does not just “point fingers” at potential risks or issues but should also be solution-oriented and provide strategic guidance. We always offer concrete and actionable recommendations on how to address issues and unlock further business growth, benefiting both the investor and the company under review even after a potential transaction. To train and embed this mindset, Apricum’s CDD team also regularly works on strategy advisory engagements.

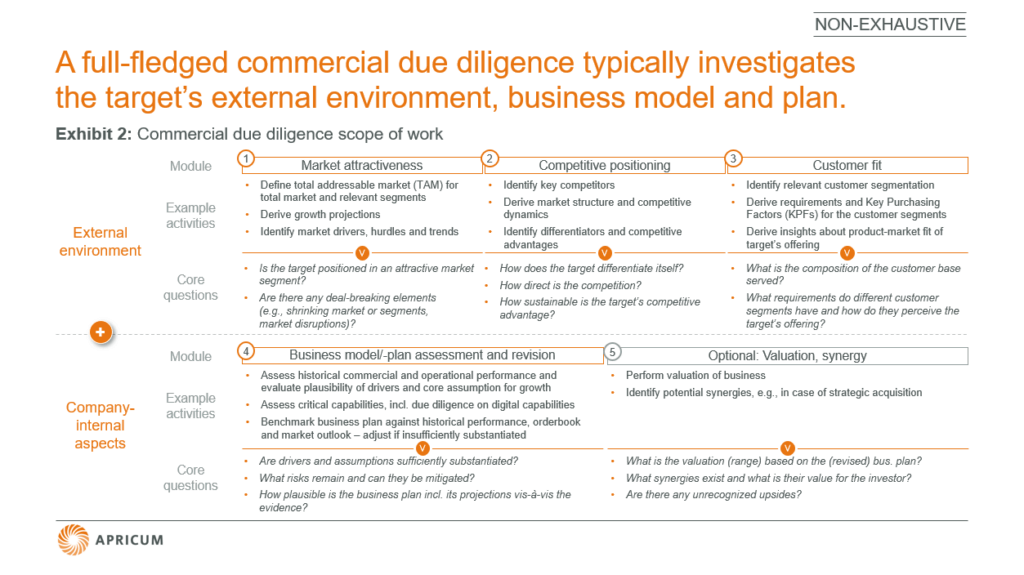

In an early stage, a limited scope focusing on the external environment, (especially the attractiveness of the market and competitive positioning and landscape) can be meaningfully assessed to identify red flags or deal breakers in the market and industry environment — a “red-flag CDD”. In an advanced stage, elements such as the company’s business model and business plan, core parts of a complete assessment, can and should also be assessed. Hence, this would be a “full-fledged CDD”. Exhibit 2 gives an overview of the typical scope of work, i.e., modules, of a full-fledged CDD.

Exhibit 2: Commercial due diligence scope of work

The modules usually have strong interdependencies. For instance, assessing the plausibility of a company’s growth projections (e.g., project pipeline) is most robustly done when considering and triangulating both external factors (e.g., market outlook for growth, competitive dynamics) and internal factors (e.g., historical performance, order book underpinning revenue projections). If not the case, this would merit an adjustment of the business plan to safeguard its credibility toward potential investors.

In a recent CDD that Apricum conducted on a European lithium-ion cell battery manufacturer, its manufacturing plant’s ramp-up plans were confirmed to be in line with realistic industry benchmarks for availability, performance and quality. On the other hand, the company’s ambitious offtake ambitions were adjusted to align with growth projections in relevant market segments and the actual orderbook. Overall, this led to a more fact-based, robust and reliable (and thus investable) business plan.

Selected examples of recent engagements delivered by Apricum CDD team include:

| Client | Type | Industry | Impact |

| Consortium of investors | CDD | Solar photovoltaics | Enabled more than €200m fundraising from a consortium of investors (Target: 1KOMMA5°) |

| European mounting structure company | CVDD | Solar photovoltaics | Enabled undisclosed investment by global private equity firm |

| European battery cell manufacturer | CVDD | Energy storage | Enabled double-digit €m equity investment by a consortium of investors |

| Investor | CDD | Heat pumps | Enabled double-digit €m investment by a consortium of investors. (Target: European heat pump player) |

If you would like to learn more about how our services and CDD team can support your commercial due diligence, get in touch with Apricum Managing Partner Nikolai Dobrott.

“Apricum combines a truly differentiating understanding of the new technologies driving the energy transition with the best-in-class quality of legacy consulting firms. We couldn’t have made a better choice, and the value added was tangible. In the past, before learning about Apricum, we hired some of the traditional consulting firms for our processes, but they lacked the flexibility and speed to

ramp up their expertise in new industrial verticals, and that came at the cost of our clients and processes. Going forward we will continue recommending Apricum as our top pick for any of our clients seeking to hire a commercial advisor for maximizing the success of its process.”

Alessandro Frangi, Executive Director, UBS

Sources:

[1] Niederdrenk & Müller, Commercial Due Diligence 2012

[2] GlobalData (2024)

[3] Industry maturity is well-reflected by the overall, global investment in the deployment of electricity generation assets. According to the IEA World Energy Investment 2024 report, in 2023 investments in solar photovoltaics (PV) alone of ~$475 bn surpassed all investments in other generation technologies. This includes fossil (oil, coal, gas, nuclear and renewables (wind) of ~$400 bn. The gap is expected to widen further.

This article was written by former staff members Florian Mayr, Giovanni Sturiale, and Gretta Nikkare.

Photo credit: Eric Jacob on Unsplash