- The further electrification of buildings plays an essential role to decrease current dependence on fossil fuels and to meet climate targets

- Accelerated adoption of low-carbon heat pumps offers exciting opportunities for various stakeholders along the value chain

- EU heat pump market is expected to reach around €29 billion in 20301, more than twice its value in 2021

Space and water heating accounts for 28% of the total energy consumed in the EU.[1] With 75% of that energy coming from fossil fuels, decarbonizing this sector is crucial to reducing carbon emissions and reaching countries’ net-zero targets. While there are several low-carbon alternative heating solutions such as biomass pellet boilers, hydrogen or solar thermal, electrification of space and water heating systems is described by the International Energy Agency (IEA) as “one of the key milestones of the Net Zero Scenario”[2]. Heat pumps, which use a mature technology to electrify heating systems, are the most promising electric heating solution due to their low carbon emissions, high efficiency, low running costs, long lifespan, and limited maintenance requirements. In this article, we describe how they work, which dynamics are driving the European heat pump market and why now is the ideal time to enter or expand into this promising market.

How do heat pumps work?

Heat pumps work on the same principle as the refrigerators that we have using in our homes for decades. Heat pumps use freely available energy and move it to where it is needed – ideally using electricity which is generated from renewable sources. This process is highly effective reaching efficiency ratings of 300-400% meaning that for every 1kWh of electricity used, it can generate three to five times more heat compared to gas boilers, which can only convert 90% of the energy they use.[3]

Set to play a similar role in the decarbonization of buildings as PV has in the generation of renewable electricity, now is the time for companies to position themselves in the fast-growing heat pump sector.

There are different types of heat pumps. While all of them rely on the same general principle, the type of energy they use differs. The most popular are air-source heat pumps. They account for 85% of the heat pumps in the EU and use air from outside a building. Another type is ground-source heat pumps (~15% of the EU market) that tap into the heat from the earth’s core that lies deep beneath a building. These inputs are then used inside the building in the form of warm air – similar to traditional air-conditioners – or water in hydronic heating systems circulating through pipes for direct domestic use, into radiators, or underfloor heating systems for space heating.

(click to enlarge)

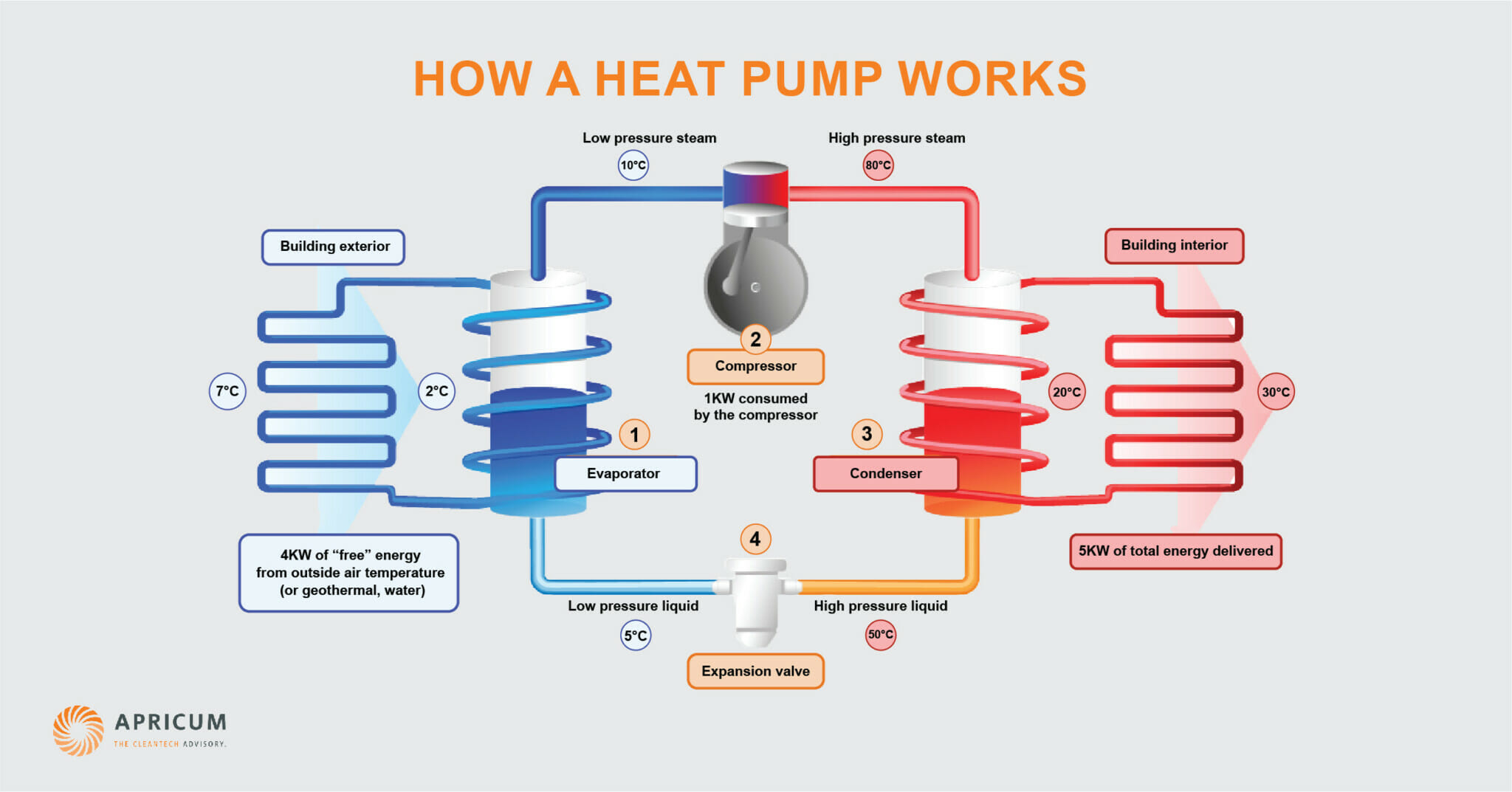

How a heat pump generates heat from the air[4]:

- Outside the building, an evaporator collects heat from the environment, which warms a refrigerant such as ammonia or propane inside a circuit. The refrigerant is heated under low pressure until it converts from a liquid into a gaseous state.

- The gas is then compressed in a chamber, substantially increasing its temperature.

- The heated gas is then fed into a condenser inside the building, which heats the air or water. With this done, the heat can then be used to warm the building’s interior space or water. During this process, the refrigerant slowly loses its heat, causing it to begin liquefying.

- When the refrigerant finally passes through an expansion valve to decrease its pressure, it returns to its initial liquid state and the cycle starts again.

What dynamics are shaping the European heat pump market?

The heat pump sector is booming as never before. In 2021, heat pump sales increased by more than 13% globally. With a total market value of $14.1 billion (2021)[5], out of the global $54 billion, the European Union is the fastest growing market with sales growth of 35% in 2021 (compared to +7.4% in 2020)[6] and largest markets being France, Italy, and Germany. In terms of growth, the EU is followed by the USA (+15%), Japan (+13%), and China (+13% for air-source heat pumps).[7] Apricum expects this trend to continue to accelerate as market players have forecasted growth rates of 50% or even up to 70% in 2022.[8] This dimension is further underlined by the 17 million heat pumps installed in the EU in 2021, a number expected to grow to nearly 60 million by 2030.[9]

All these trends indicate that heat pumps are set to play a similar role in the decarbonization of buildings as PV in generating renewable electricity. With this in mind, Apricum is convinced that now is the time for companies to position themselves in the fast-growing heat pump sector.

The market dynamics seen in the heat pump market are driven by several factors:

- Demand: The current energy crisis in Europe that has led to further rising gas prices and surging heating costs is worrying end-consumers. This economic incentive combined with the desire to become more energy-independent, increasing climate change awareness, and increasing calls for climate change action, all drive demand for heat pumps.

- Technology: Technological improvements have widened the addressable market by allowing heat pump systems to be used in less-insulated houses. Additionally, the increasing number of better-insulated houses, improved acoustics, and more sustainable refrigerants are additional technological advancements favoring greater heat pump adoption.

- Regulation: European governments have sped up mass adoption by implementing heat pump-favoring policies. At the European level, the Fit for 55 policy includes, among other things, an obligation for member states to increase renewable energy use in heating. Additionally, the European Commission announced in its REPowerEU strategy a plan to double the deployment rate of heat pumps in the EU. On a national level, examples include Austria phasing out gas in new buildings by 2023, Germany targeting installments of 500,000 heat pumps annually from 2024 onwards, and France banning installments of oil boilers in new and existing buildings in July 2022.

Market players are positioning themselves by building capacity organically and inorganically

Growth forecasts are accompanied by rising investments to ramp up production capacity to meet surging demand, shown by a record growth of 25% in heat pump investments registered in 2021.[10] Investment announcements accelerated over the last months including Viessmann and Daikin investing €200 million and €300 million respectively in heat pump production capacities in Poland, or Stiebel Eltron announcing their planned investment of €600 million in their heat pump branch over the coming years. Furthermore, Mitsubishi Electric announced in May 2022, its plans to invest $113 million into its production plant in Turkey to increase production capacity by 100,000 units to 300,000 air-to-water heat pumps in total.[11]

The European heat pump market is fragmented with major Asian players like Panasonic, Mitsubishi, Daikin, and Midea, strong players from Europe such as NIBE Industrier, Viessmann, and Stiebel Eltron and a lot of SMEs being active across the residential, commercial, and industrial segments. We also see companies from the HVAC and electronics industries entering the market, leveraging their current core competencies (e.g., air conditioners or refrigerators using similar or the same technologies).

Leading renewable energy players to observe potential synergies and consider heat pumps a complement to building and selling complete energy systems that including PV, energy storage, electric vehicle charger and heat pump – all controlled and managed by an energy management system software as consumers continue to demand fully integrated systems. With new players entering the market and increasing competition, leading players are responding by trying to develop economies of scale as a competitive advantage while others are starting to differentiate their offerings by diversifying business models. While classic business models such as selling heat pumps to businesses and end-customers are still dominant, innovative service-based business models such as Heat as a Service (HaaS) – renting-out heat pumps and managing their proper operation and maintenance – or heat pump leasing, are all gaining further attention. Examples include the German company Thermondo offering heat pump leasing for a fixed monthly price starting as low as €209 since June 2022.[12]

In early 2022, leading players announced several M&A activities and consolidation is likely in the coming years in the still fragmented European heat pump market. In January 2022, the Viessmann Group announced a partial acquisition of Pacifica Home Services, the largest service and installation platform in the UK for HVAC solutions with a focus on heat pumps.[13] Later on this year, in April 2022, Octopus Energy acquired the heat pump manufacturer RED in Northern Ireland.[14]

Activity has also seen in Southern Europe, already one of the more mature regions for heat pumps. NIBE Industrier, a major European player, acquired 50% of the Italian heat pump manufacturer and distributor Argoclima in May 2022[15] while Spanish heat pump manufacturer Hitesca became part of BDR Thermea at the end of 2021.[16]

While large players expand their activities in the European market, smaller companies are also gaining investors’ attention. Czech company Woltair announced the closing of their €16.3 million Series A funding round at the end of September 2022. Founded in 2018, they offer customers the option of being guided through the entire heat pump purchase process; from researching and selecting the appropriate heat pump, to site auditing, installation and completing the final subsidy applications.[17]

Summary

Heat pumps are an essential part of the energy transition. They are also a key pillar in the transition to sustainable buildings, a topic Apricum’s Senior Advisor Joachim Rupp reflected on in detailed in his article on sustainable building policy from December 2021. Recognized by politicians, investors and thought leaders in the cleantech field and driven by the outlined trends, the heat pump market growth is accelerating. We see companies positioning themselves in the market by growing their capacities organically and inorganically. To succeed in this respect requires a deep understanding of market dynamics, technologies and regulations in the heat pump space. Apricum has extensive experience and knowledge in the renewable energy and cleantech sector including the heat pump segment covering the full up- and downstream value chains. We offer a full spectrum of services in strategy consulting (such as market screening and assessment, value chain/portfolio strategy or business model/plan development) and transaction advisory (e.g., M&A, debt and equity fundraising, due diligence). If you like to learn more about how we can support your company in entering or expanding your activities in the heat pump market, please contact Nikolai Dobrott.

[1] https://www.euractiv.com/section/energy/opinion/eu-must-end-fossil-fuel-heating-by-2025/

[2] https://www.iea.org/reports/heating

[3] https://heatable.co.uk/boiler-advice/heat-pumps-vs-gas-boilers

[4] https://sauermanngroup.com/en-INT/insights/heat-pumps-how-do-they-work-and-how-maintain-them

[5] https://www.gminsights.com/industry-analysis/europe-heat-pump-market

[6] https://www.businesswire.com/news/home/20210906005045/en/2021-European-Heat-Pump-Market-and-Statistics-Report-EU-Policy-Trends-Industry-Trends-and-Data-from-21-Countries—ResearchAndMarkets.com

[7] https://www.iea.org/reports/heat-pumps

[8] https://www.cleanenergywire.org/news/stiebel-eltron-invest-600-million-euros-expand-heat-pump-production-capacity

[9] https://www.ehpa.org/about/news/article/repowereu-heat-pump-strategy-required-to-help-sector-deliver/

[10] https://www.iea.org/reports/heat-pumps

[11] https://www.mordorintelligence.com/industry-reports/heat-pumps-market

[12] https://www.pv-magazine.com/2022/06/08/german-heating-solutions-provider-offers-heat-pump-leasing/

[13] https://www.viessmann.family/en/newsroom/company/viessmann-acquires-largest-service-and-installation-platform-in-the-uk-for-integrated-climate-solutions-in-buildings

[14] https://www.hvnplus.co.uk/news/octopus-energy-acquires-heat-pump-manufacturer-red-12-04-2022/

[15] https://www.mordorintelligence.com/industry-reports/heat-pumps-market

[16] https://www.bdrthermeagroup.com/en/stories/bdr-thermea-group-welcomes-hitecsa-as-deal-wraps

[17] https://www.ctvc.co/heat-pumps-are-hot/