In this interview, we speak to Consultant Stefan Jannsen, Apricum’s expert for China, to find out more about this country’s solar operations and maintenance (O&M) market. During his multiple trips to China this year, he has had the opportunity to visit several desert PV installations and observe the impact of harsh climatic conditions on their operations first hand. His conclusions underscore not only the necessity of a suitable O&M strategy but hold implications for upstream material decisions and module procurement.

There is growing discussion around the effects of harsh climatic conditions on the O&M of PV plants. It’s not just an issue for China, is it?

No, definitely not. With cumulative global PV capacities reaching ~180 GW this year, the O&M market for solar PV installations worldwide is already substantial. Out of this total, more and more PV installations are operating under demanding climatic conditions, such as in deserts or in highly polluted areas, and this will increase in the future, especially in emerging markets. These challenging environments require module manufacturers and power generators to adapt their module design and O&M strategies accordingly, which is vital for plant profitability.

China is a rapidly growing PV market with vast desert installations. While some of the best practices established for O&M in more mature PV markets can be applied, China also has its own unique set of O&M circumstances that need to be considered.

What are the general concerns for PV operations under these conditions and what are the challenges for the PV industry?

50 MW desert solar installation in Gansu province, China

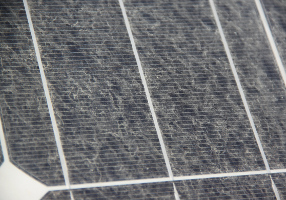

PV module durability is a huge concern in desert regions, where high operating temperatures and increased UV irradiation can accelerate the degradation of polymers for PV cell packaging such as encapsulants and backsheets. Many desert installations must also endure frequent sandstorms and abrasive airborne dust. Here, a higher level of abrasion resistance in backsheet materials or solar glass could limit module degradation. PV module manufacturers should consider these aggravated operating conditions in their material procurement. As well, fine dust which is pervasive in arid or polluted metropolitan areas collects on the module surface, causing power loss. Without adequate cleaning, the dust layer significantly lowers PV performance and consequently the generated cash flow of a PV power plant. PV system owners need to rethink their O&M approaches, particularly, in regards to cleaning, and according to local operating conditions.

What role does O&M play in China and how has the domestic market adapted to the harsh environment?

Dust accumulation on the PV module surface in a desert installation

Adjusting O&M strategies to maximize plant profitability is not yet the top priority in China’s still relatively young domestic PV market. The majority of PV installations in China to-date are situated in the northwestern desert provinces, where sand storms are frequent and airborne dust significantly affects system performance. However, O&M often follows standard approaches established in less demanding environments with few annual cleanings. As a result, many installations are covered with thick dust layers and concrete performance measurements or dust impact studies are hardly available. In many cases cleaning is only performed occasionally and ad hoc, mostly by generously hosing modules with pressurized water – consuming large quantities of this increasingly scarce resource.

On top of the dust-induced performance losses, accelerated degradation of PV modules in China’s desert installations is a threat to the domestic PV industry. Our site visits revealed degradation levels above the industry average and poor plant performance after only one year of operation. Plant constructions are often rushed through at year-end and tend to compromise on material and module quality to keep costs down in this highly cost-competitive market.

It seems that O&M is not a priority in China. Why is that the case? Shouldn’t maximizing power output be the key objective for generators?

Yes it should, however, there are three reasons why this is currently not the case. They are mostly due to structural challenges in its domestic PV sector. Firstly, many PV plants in the northwest are regularly curtailed by the grid companies so that any increase of generation is not remunerated. Secondly, at current FIT rates and high irradiation levels, most utility-scale projects enjoy generous nominal internal rates of return (IRRs), limiting the need for action. Thirdly, the general awareness of performance monitoring and the understanding of the various factors of performance loss are relatively low.

Also, consider the way in which the market developed. China’s PV market is still very young, with the bulk of capacity added during the past two years, mostly by large, state-owned entities. The central government mandated the utilities to invest in PV projects and set renewable portfolio quotas on a capacity basis, not a generation basis. PV system performance was not the primary concern.

How do you expect this will change in the future?

We see strong indications that China’s O&M business will mature during the coming years. There is a shift in ownership structures away from state-owned utilities towards privately-owned entities, which are looking for alternative investment opportunities in a cooling domestic economy. PV systems will increasingly be treated more as a financial asset whose risks should be minimized, thus PV system owners will be more inclined to place greater importance on durable components and optimizing lifetime performance with proper O&M. With the expected decrease of FITs, providing adequate plant O&M will become more important to guarantee profitable operations. Lastly, due to an increasing awareness of the financial industry, long-term durability and O&M strategies will be mandatory to gain access to cheap financing.

While PV system costs are falling, labor costs are increasing rapidly and water prices potentially will reflect China’s severe water scarcity in the future. As adequate PV plant cleaning can cause considerable costs, adjusting cleaning strategies and O&M for growing portfolios will become even more vital.

What business opportunities do you see for O&M in China?

There are many on offer. For example, independent service providers can offer third party O&M services such as performance monitoring or cleaning services to China’s large and growing regional centers with several GW of installations. Large portfolio managers, however, should consider internalizing O&M for their own installations. Other opportunities include reliable performance prediction including expected losses from dust accumulation and provision of monitoring solutions.

In the manufacturing industry, rising awareness of durability and performance optimization in the Chinese PV downstream industry will trigger a demand for durable PV packaging materials and solutions to mitigate the impact of dust. Finally, we see increasing demand for innovative cleaning equipment that can maintain high output levels cost effectively with reduced water consumption.

What recommendations do you have for system owners who are planning to install PV plants in desert or highly polluted areas?

Having a well-considered O&M strategy with an optimized cleaning approach on a plant or portfolio basis for markets with demanding environments is paramount. System owners and EPCs should also take care during the design and procurement phase for PV modules to select products with adequate quality and materials that can endure harsh climatic conditions and provide stable system performance over the lifetime of their PV power investment.

For questions or comments, please contact Nikolai Dobrott, managing partner.