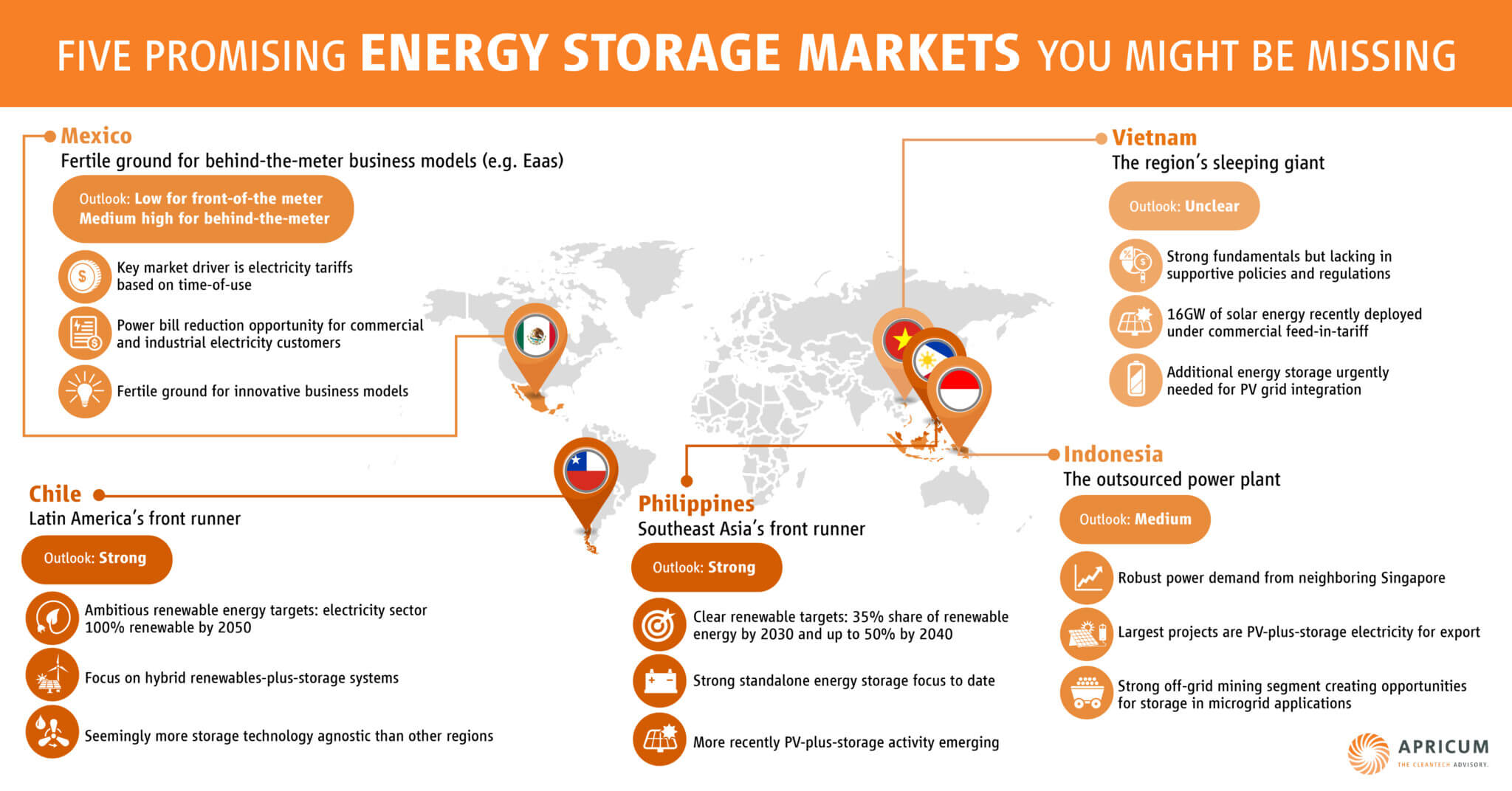

With all the impressive projects and gigawatt hours of energy storage being deployed in the big markets like the USA, China, and Europe, it’s easy to forget that energy storage is actually a global phenomenon.

While each market might be different, they all share similarities. For example, no matter where in the world you operate, the key purpose of nearly every energy storage solution is to provide flexibility. This key demand exists wherever and whenever there is a need to mitigate or manage the impact of variable renewable energy, deal with a mismatch between power demand and supply, or increase the resiliency of a power system.

So, with this in mind, let’s compare some of the globe’s more interesting, but lesser-known energy markets and gauge their potential value. The focus lies on the South-East Asian and Latin American regions.

“We need to bear in mind that how energy storage is applied depends on the individual needs of a specific country – when in Rome, do as the Romans do.”

The Philippines: Southeast Asia’s front runner

The Philippines has already outlined their specific targets for renewable energy. According to their National Renewable Energy Program announced at the end of last year, the country expects to have a 35% share of renewable energy by 2030 and as much as 50% by 2040 plus a moratorium on new coal power investments that should result in gigawatts of variable wind and solar power generation – and energy storage to ensure a smooth grid integration. This is particularly important when considering the limited connectivity of individual networks in a country that is made of 7,642 separate islands. Recent policy reforms such as the opportunity for 100% foreign capital participation in renewables has recently attracted international investments: Close to $14bn in solar, wind and energy storage have been committed in January by a group of nine Chinese companies alone.

The Philippines has already outlined their specific targets for renewable energy. According to their National Renewable Energy Program announced at the end of last year, the country expects to have a 35% share of renewable energy by 2030 and as much as 50% by 2040 plus a moratorium on new coal power investments that should result in gigawatts of variable wind and solar power generation – and energy storage to ensure a smooth grid integration. This is particularly important when considering the limited connectivity of individual networks in a country that is made of 7,642 separate islands. Recent policy reforms such as the opportunity for 100% foreign capital participation in renewables has recently attracted international investments: Close to $14bn in solar, wind and energy storage have been committed in January by a group of nine Chinese companies alone.

Storage market: To date, we have seen a strong focus on standalone energy storage. In the central Philippines, the San Miguel Corporation (SMC), one of the country’s largest and most diversified conglomerates is already in the advanced stages of realizing their ambition to build a 1GW/1GWh BESS pipeline with the help of industry heavyweights like Fluence, ABB, and Wärtsilä, to be completed by the end of 2023 and much more to come after that.

In addition, local energy company Aboitiz Power Corp aims to have 248 MW installed across 12 sites over the next ten years. Forty-nine MW of that was commissioned in November last year. On the non-battery side, 1.2 GW of pumped hydro energy storage will be provided by Anuhan Power by 2027.

However, more recently there are increasing activities around PV-plus-storage as well.

In early June, local billionaire Enrique K. Razon announced the construction of a 2.5-3.5 GW photovoltaic plant combined with a 4-4.5 GWh battery storage installation that would be one of the biggest in the world. It would be realized through a JV called Terra Solar to provide mid-merit power.

And already earlier this year the Philippine’s first-ever PV-plus-storage plant was switched on, pairing a 40MW/60MWh battery with the 120MW Alaminos Solar power plant. In parallel, the World Bank’s IFC and AbotizPower are assessing the possibilities of providing baseload with this kind of hybrid plant.

Outlook: In summary the outlook for energy storage deployment in the Philippines is quite strong. There is a strong need for flexibility based on the renewables expansion and a multitude of battery energy storage systems projects already completed – as of 2022, 80% of energy storage installations in the region were situated in the Philippines according to analyst BNEF.

Chile: Latin America’s front runner

In Latin America, Chile has announced renewable energy goals even more ambitious than that of the Philippines. This nation of 20 million people is targeting 100% renewables in its electricity sector by 2050 and at least 70% by 2030. In addition, it has committed to phasing out coal generation before 2040 and displacing renewable energy with electricity based on natural gas has actually been forbidden since 2021. Two-thousand MW of energy storage is expected to be required as a result.

In Latin America, Chile has announced renewable energy goals even more ambitious than that of the Philippines. This nation of 20 million people is targeting 100% renewables in its electricity sector by 2050 and at least 70% by 2030. In addition, it has committed to phasing out coal generation before 2040 and displacing renewable energy with electricity based on natural gas has actually been forbidden since 2021. Two-thousand MW of energy storage is expected to be required as a result.

So expansive and arid that it’s been used for Mars expedition simulations, Chile’s Atacama Desert region is a solar energy generation powerhouse and shows peak/off-peak power price spread that suggests merchant trading of electricity on the wholesale market.

In the usually heavily oversubscribed renewables auctions, hybrid projects involving energy storage are entitled to participate and create additional demand.

More recently, also opportunities for standalone energy storage are emerging after a major energy storage bill passed in October 2022 that ensures access to the grid and revenues from power dispatch.

Storage market: The Chilean renewable storage market focuses on hybrid renewables-plus-storage systems with a variety of projects already being realized.

For example, Chilean utility Colbún plans to deploy 800MW of energy storage overall in Chile. Included is a plan for a solar-plus-storage project with a 240MW/1.2GWh BESS in the Camarones commune. The first operational energy storage unit towards the target was the inauguration of a solar-plus-storage project with 32MWh BESS in the Atacama region at the end of 2022.

Furthermore, AES is building a 112MW/560MWh BESS (supplied by Fluence) paired with 253MW of renewable energy generation. Overall, AES plans for 300MW in Chile by the end of the year. Another example is Canadian Solar submitting a successful bid in Chile’s solar-plus-storage auction with 253MW of solar PV and 1GWh BESS. The project is expected to be operational in 2026.

Activity is not limited to front-of-the-meter installations only: Stem Inc. has developed South America’s first virtual power plant for which it will combine solar, wind and energy storage with a total targeted capacity of 1.5GW, comprising distributed behind-meter-facilities between 0.5 and 2MWh of storage capacity.

Beyond batteries, Highview Enlasa, a 50/50 owned JV between UK-headquartered liquid air energy storage technology provider Highview Power, and Chilean backup power generation company Energia Latina SA, is planning a 50MW/500MWh project also in the Atacama region. AES plans to convert a coal-fired power plant in north Chile into a molten salt battery storage facility with 560MW of power output.

Outlook: In short, the outlook in Chile is strong, due to a variety of drivers and an impressive, credible pipeline. Seemingly more technology agnostic than other regions, Chile also offers interesting opportunities for non-battery players.

Indonesia: The outsourced power plant

Indonesia: The outsourced power plant

Next to the Philippines, Indonesia is another South-East Asian player that offers and interesting market. Several JVs have been announced between international and local power producers seeking to deploy renewable energy and storage assets to export electricity via sub-sea cables to its neighbor the space-constrained Singapore. Furthermore, a vibrant off-grid mining segment is creating opportunities for storage in microgrid applications. The share of renewables in the generation mix is targeted to reach 23% in 2025.

Storage market: Indonesia’s largest projects are photovoltaic-plus-storage for export purposes. A good example is Ib Vogt GmbH (Germany) and Quantum Power Asia’s (Indonesia) 3.5GW renewables and 12GWh storage system that was recently announced. With completion stated for 2032, the facility will reduce reliance on liquified natural gas by providing 4TWh or up to 8% of neighboring Singapore’s annual electricity needs. Another project to supply energy to Singapore from Indonesia is a plan between UAE’s Masdar, Singapore’s Tuas Power, French EDF and Indonesian PT to provide 1.2GW of solar with the potential for storage.

On a similar note, Saudi Arabia’s ACWA Power and Indonesia’s main power generator and distribution company (PLN) signed a MoU to investigate feasibility studies for several energy storage technologies including a 600MW-800MW pumped hydro energy storage (PHES) facility, a potential 4GW BESS project, and a hydro-powered green hydrogen production facility, in addition to renewable energy projects.

Next to battery energy solutions, it has to be noted that Indonesia´s current storage pipeline features a large share of pumped hydro, totaling more than 4GW.

Outlook: Indonesia`s overall outlook as a storage market is good as domestic targets and clean energy demand from Singapore keeps driving the need for renewables in Indonesia and energy storage is well suited to optimize utilization of export cables, amongst other use cases it can also address.

Vietnam: The sleeping giant

In just one year, 16GW of solar energy has been deployed in Vietnam under a commercial feed-in-tariff program that was originally aiming for just 850 MW. Energy storage would be urgently needed for grid integration and avoiding curtailment for example by performing ramp rate control, frequency response, transmission and distribution grid infrastructure investment deferral or to time-shift energy from daytime when production is abundant, to evening peak times, when it is not.

In just one year, 16GW of solar energy has been deployed in Vietnam under a commercial feed-in-tariff program that was originally aiming for just 850 MW. Energy storage would be urgently needed for grid integration and avoiding curtailment for example by performing ramp rate control, frequency response, transmission and distribution grid infrastructure investment deferral or to time-shift energy from daytime when production is abundant, to evening peak times, when it is not.

Storage market: Despite strong drivers, the country’s latest National Power Development Plan does not include energy storage. There are only a few storage pilots so far, mostly running on foreign grants, such as a 15MW / 7.5MWh battery energy storage system which is paired with a 50MW solar farm in Vietnam’s Khanh Hoa Province.

Outlook: Right now, Vietnam´s energy storage outlook remains unclear. While strong fundamentals are in place, Vietnams is still lacking the supportive policies or regulatory mechanisms, which means that industry players must proactively educate market regulators and grid operators about energy storage and the best ways to facilitate its role in their energy systems. However, that challenge can also be seen as an opportunity, making Vietnam an interesting regional player to keep an eye on as it develops.

Mexico: The behind-the-meter opportunity

One of Mexico’s key market drivers is electricity tariffs based on time-of-use during the day, as well as demand charges, which incur higher costs for use of power from the grid during peak times. This arrangement creates a power bill reduction opportunity for commercial and industrial electricity customers.

One of Mexico’s key market drivers is electricity tariffs based on time-of-use during the day, as well as demand charges, which incur higher costs for use of power from the grid during peak times. This arrangement creates a power bill reduction opportunity for commercial and industrial electricity customers.

Storage market: Traditionally, difficulties around interconnection agreements and mandatory generation licenses are holding back Mexico`s front-of-the-meter energy storage market. A first sign of change could be the planned Puerto Peñasco Photovoltaic Power Plant, a state-owned solar-plus-storage megaproject in Sonora state combining 1GW of PV with 190MW of BESS. The project was proposed by the Federal Electricity Commission (CFE) and due for completion by 2028. However, the biggest opportunities for storage players are behind-the-meter applications for commercial and industrial customers. This includes the possibility to apply innovative business models: Fotowatio Renewable Ventures (FRV), US-based energy analytics and software company Energy Toolbase, and Mexican developer Ecopulse are offering 480kW/960kWh systems based on an energy-as-a-service, no-money-down business model. In addition, System integrator Quartux will deploy Mexico’s largest behind-the-meter BESS unit and largest commercial and industrial system in Latin America with a 25MWh energy capacity. The client is a large hotel resort.

Outlook: Right now, we judge Mexico’s storage market potential as low to medium for front-of-the-meter deployments due to the relatively low penetration of renewable energy and only fist signs of political will to expand compounded by underdeveloped frameworks for integrating energy storage to the grid. However, the outlook for behind-the-meter deployments is medium-high due to unreliable power supply and favorable tariff structures.

(click to enlarge)

Summary

All around the world energy storage is an increasingly attractive option to provide flexibility and is thereby a key enabler for the continued expansion of renewable energy and a reliable power supply – and this includes lesser-known local players. Yet we need to bear in mind that how energy storage is applied depends on the individual needs of a specific country – when in Rome, do as the Romans do.

The outlook for storage deployments depends largely on the status of local regulatory frameworks and access for storage to monetization schemes (e.g. wholesale and flexibility markets or tenders). However, over time and guided by local frontrunners, the barriers that are currently preventing storage from adding its merits in emerging countries will eventually be removed – as it was, and is still happening, in today’s dominating storage markets like the US, China and Europe as well.

Apricum is a global transaction and strategy advisory firm dedicated to renewable energy and cleantech. We offer the alternative energy industry an integrated suite of growth-oriented consulting services for companies and investors. Backed up by the energy storage field’s top minds, deep local networks, and proven financial experience, we can maximize the value of your participation in the global energy market. Let us prepare and execute your next business transaction or design a specialized high-impact business model that drives the energy transition while creating growth and profitability for your organization and its stakeholders. Reach out to Apricum Partner Florian Mayr to learn more.

NOTE: This article was updated in May 2023 to reflect recent market developments