- Demand for low carbon hydrogen is set to rise, but understanding the strengths and weaknesses of each electrolyzer solutions will be key to making smart investment decisions

Driven by the decarbonization needs of the industry, we project the global annual demand for low-carbon hydrogen to grow from less than 1 Mt in 2021 to 20‑30 Mt by the end of the decade. If supplied from renewable electricity (i.e., green hydrogen), this requires 160-240 GW of electrolysis capacity. Assuming the availability of sufficient renewable energy capacity, this is yet a challenging target considering today’s total project pipeline of ~130 GW and a projected total cumulative manufacturing output of 270 GW by 2030[1]. To achieve this, all stakeholders must move rapidly considering that less than 5% of announced projects have reached final investment decision (FID).

A key prerequisite to passing this milestone, however, is the selection of the most suitable electrolyzer technology, which is predominantly based on economic drivers, namely levelized cost of hydrogen. The technologies available provide different characteristics and their cost figures depend on their specific project set-up. Understanding how each’s distinct advantages and disadvantages fit into the future green hydrogen project landscape is key to identifying technology trends and facilitating the right investment decision.

This article elaborates on the differences between the four most mature electrolyzer technologies; alkaline, proton exchange membrane (PEM), alkaline membrane, and solid-oxide while also determines their optimal operation environments.

Key electrolyzer technologies and their role in the future green hydrogen project landscape

Source: Apricum

The work horse: alkaline electrolyzers provide low cost hydrogen when operated under a steady load

Alkaline electrolyzers produce hydrogen from a potassium hydroxide solution which enables the use of a low-cost, porous diaphragm-separator and abundant catalyst materials (e.g., nickel). This comes at the cost of limited operational flexibility: the diaphragm is permeable to gases dissolved in the electrolyte, limiting the lower operational load to ~20% of the nominal load[2] and requiring lengthy gas purging cycles during cold starts, which results in long start-up times. The low gas barrier of the separator does further limit the hydrogen output pressure of the electrolyzer. Today, alkaline electrolyzers are selected particularly for their record-low investment cost of 800-1400 $/kW for MW-scaled systems installed.[3] The ideal project environment for alkaline electrolyzers are large-scale industrial installations requiring a steady H2-output at low pressure levels. In this scenario, the electrolyzer is typically grid-connected and operated at high utilization and steady load. The levelized cost of hydrogen is dominated by electricity cost with a minor contribution from H2 transportation and electrolyzer CAPEX.

One example project is the 20 MW alkaline electrolyzer installed by Swedish steel manufacturer Ovako on its site in Horfors, used as part of an effort to replace fossil propane gas currently used in heating furnaces. The alkaline system is well-suited for minimizing levelized cost of hydrogen given the connection to the local electricity grid enabling stable operation and low pressure requirements. Another example is the 5 MW alkaline electrolyzer acquired by UK-based gas distributor SGN to replace the natural gas used in Scottish households with green hydrogen. The electrolyzer is largely powered by a local offshore wind turbine, however connected to the grid to enable a steady operation and hydrogen output. This in combination with the low target pressure of 30 bar make the alkaline system a well-suited technology.

The race stallion: proton exchange membrane (PEM) can flexibly react to variable renewable energy

In contrast to alkaline, proton exchange electrolyzers use a polymer electrolyte and produce hydrogen from pure water. The acidic environment of PEM entails the need for costly materials such as platinum- and iridium-based catalysts, a perfluorinated ion exchange membrane, and titanium-based electrodes – driving investment cost to 1200-1800 $/kW (installed system). The key advantages of PEM electrolyzers result from the membrane’s high gas barrier properties that enable elevated output pressures, a rapid cold-start, and a wide operational load window. Another benefit of using pure water instead of an alkaline electrolyte is the reduced stress it places on critical equipment (e.g., pumps, valves, tubing) resulting in longer service intervals and operational cost savings. The energy demand of PEM electrolyzers is 2‑3 kWh/kg higher due to ohmic losses of the stack, however, this is often compensated by a lower compression demand.

PEM electrolyzer are well suited for off-grid installations powered by highly variable renewable energy sources (e.g., wind turbines). The fast start-up and wide operational load window enables an increased utilization compared to an alkaline system. The co-location, close to the renewable power plant and dynamic operation mode, often entails a need for compression to transport and store hydrogen allowing monetization of PEM’s ability to produce hydrogen at elevated pressure levels of up to 50 bar. Levelized costs of hydrogen are mostly driven by electrolyzer CAPEX and hydrogen logistics making utilization and production pressure key cost levers.

PEM electrolyzers are thus particularly well-suited for projects directly connected to intermittent solar PV plants: The 20 MW PEM electrolyzer acquired by Spanish utility Iberdrola co-located to a 100 MW PV plant in Puertollano to produce green fertilizers is one example. Another sweet spot for PEM electrolyzers are projects powered by intermittent wind power, particularly if the electrolyzer is located offshore: the high load variability combined with the demand for elevated output pressure, a small footprint and low maintenance needs, creates an ideal environment for this particular technology. Examples include the 1 MW-pilot project PosHYdon located on top of a gas platform in the Dutch North Sea and Siemens Gamesa’s SG14-222 DD offshore wind turbine coming with an integrated PEM-electrolyzer.

Cross country horse: solid-oxide electrolyzer and new colt: Alkaline membranes provide attractive advantages for niche applications

Solid oxide electrolyzers leverage high temperatures to increase the system efficiency above 80% and to enable the use of abundant low-cost catalyst materials. This requires a heat-resistant ceramic separator (solid-oxide) mediating the transport of ions at temperatures typically between 500-900°C. The high operating temperatures compromise flexibility and create additional stress on all heat-exposed materials limiting the lifetime. Solid-oxide electrolyzers require low-cost heat to maximize the conversion efficiency and to unfold a competitive advantage over PEM and alkaline limiting their commercial potential. The world’s first MW-scaled system was installed by Sunfire on-site at Neste’s refinery in Rotterdam using off-heat for pre-heating the water steam entering the electrolyzer.

Alkaline exchange membrane electrolyzers combine an ion exchange membrane with an alkaline electrolyte. This allows the combination of the key advantages of alkaline and PEM: a low-cost catalyst material and the operational flexibility resulting from gas-impermeable polymer membranes. The commercialization and industrial deployment of alkaline exchange membrane electrolyzers is still limited mainly by their low stack-lifetime as a result of limited durability of ion exchange membranes in alkaline environments.

PEM and alkaline dominate near-term project landscape with no clear winner in sight

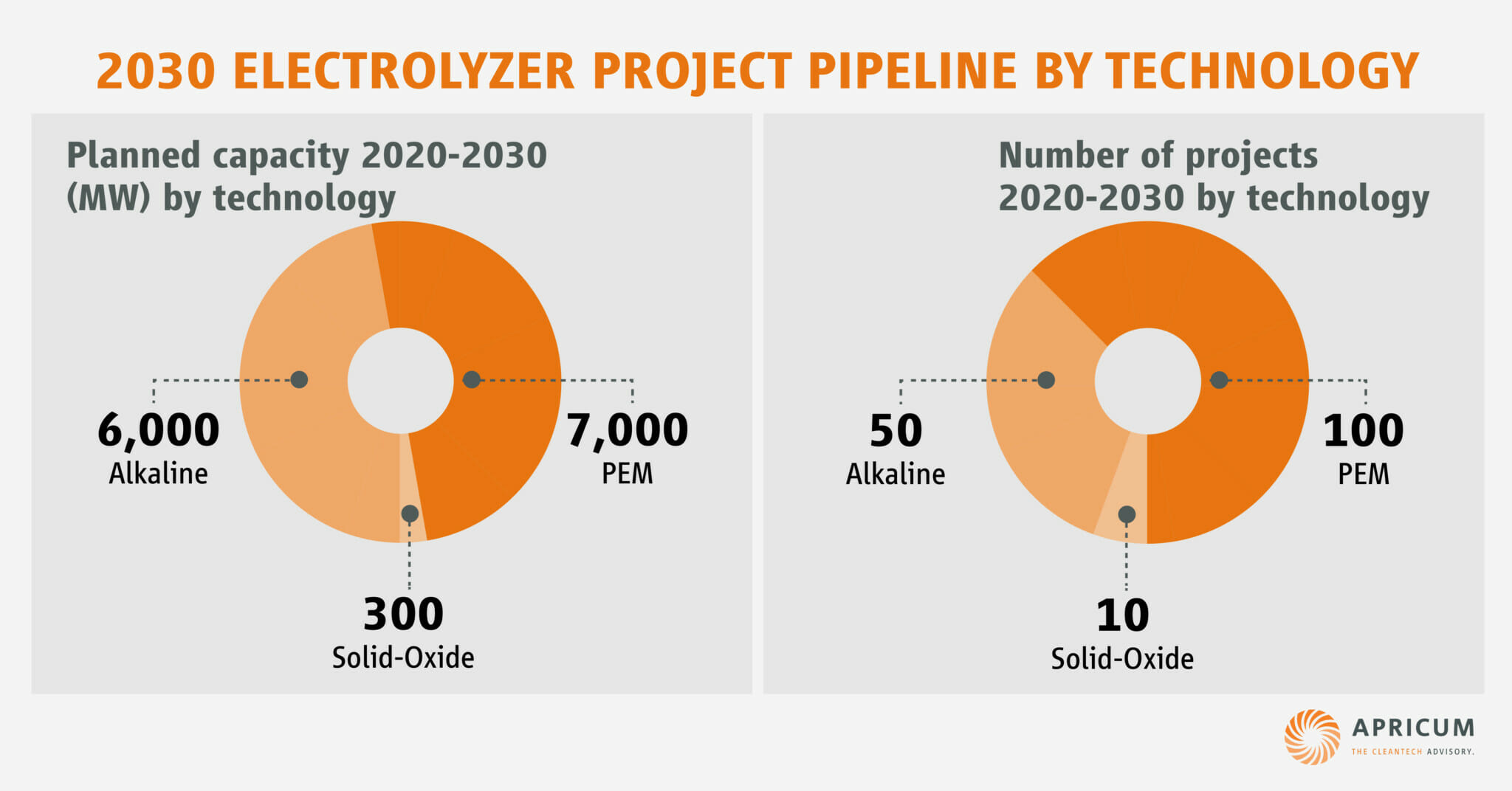

Approximately 10% of projects of the ~130 GW project pipeline for 2030 have selected and announced the type of electrolyzer. Alkaline and PEM are projected to split the total market potential almost equally while solid-oxide maintains a niche technology.

Source: Apricum electrolysis project database 2022

Alkaline electrolyzers are planned to be deployed with a ~2x larger average project size (120 MW), while PEM electrolyzers appear more distributed with an average project size of ~70 MW. This trend can be explained by the specific technological characteristics of both technologies. As mentioned above, alkaline electrolyzers are well suited for large-scale industrial H2-supply often located close to the demand center with no need for high compression and a connection to a stable power source.

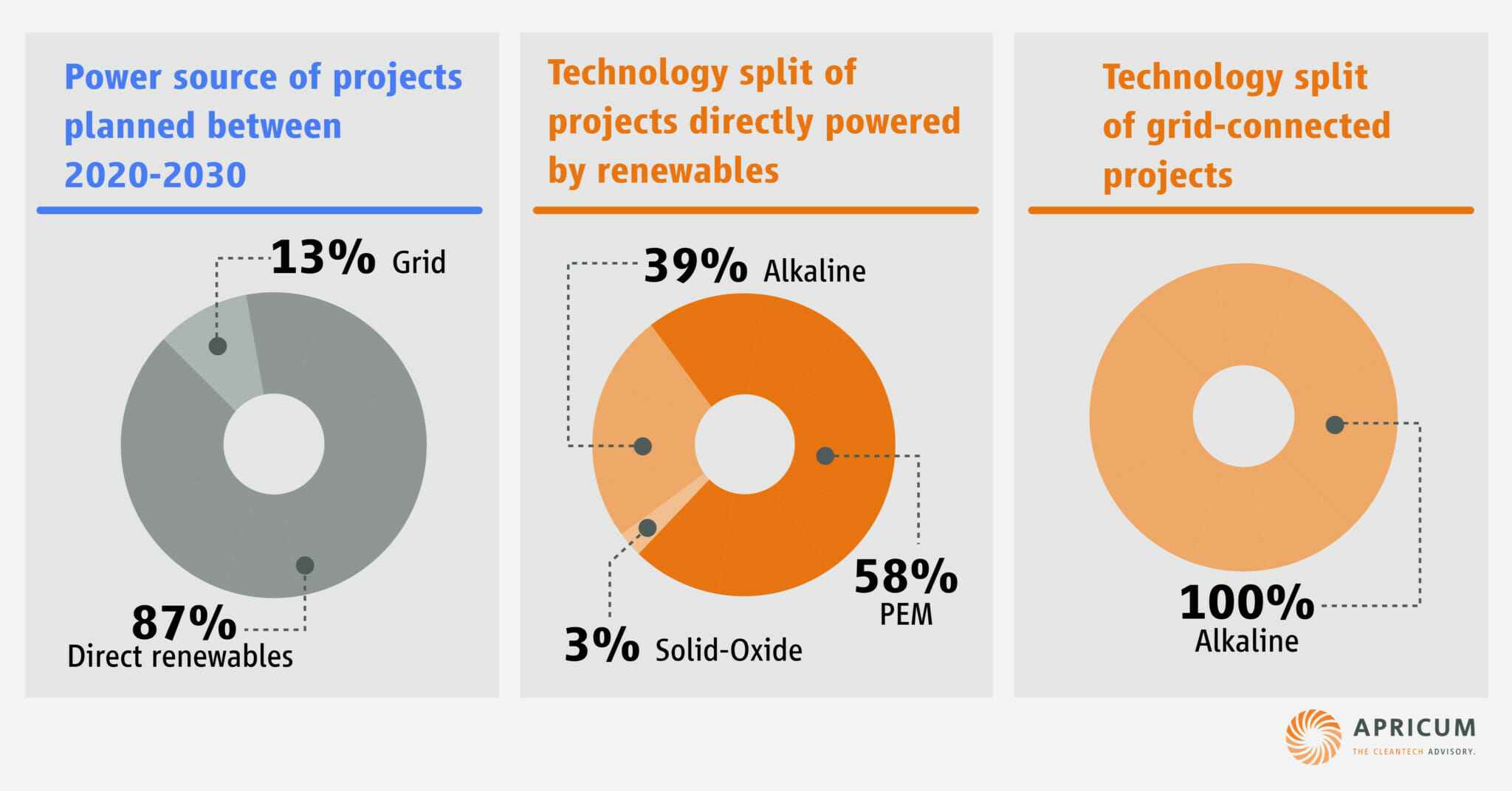

Looking at the future project landscape, alkaline electrolyzers have been selected for all projects connected to and powered by the grid. In contrast, PEM provides a potential cost advantage when directly connected to distributed intermittent renewable energy sources. ~60% of the announced projects operating with a direct connection to renewables (either installed onsite or offsite via physical PPAs) selected PEM electrolyzers and ~40% alkaline.

Source: Apricum electrolysis project database 2022

Favorable electricity costs and regulatory frameworks provide strict definitions for green and low-carbon hydrogen (e.g., Europe’s delegated act[4]) and drive the share of projects with a direct connection to renewable power plants to ~90%. This supports the growing need for flexibility and the potential competitiveness of PEM despite its high investment cost.

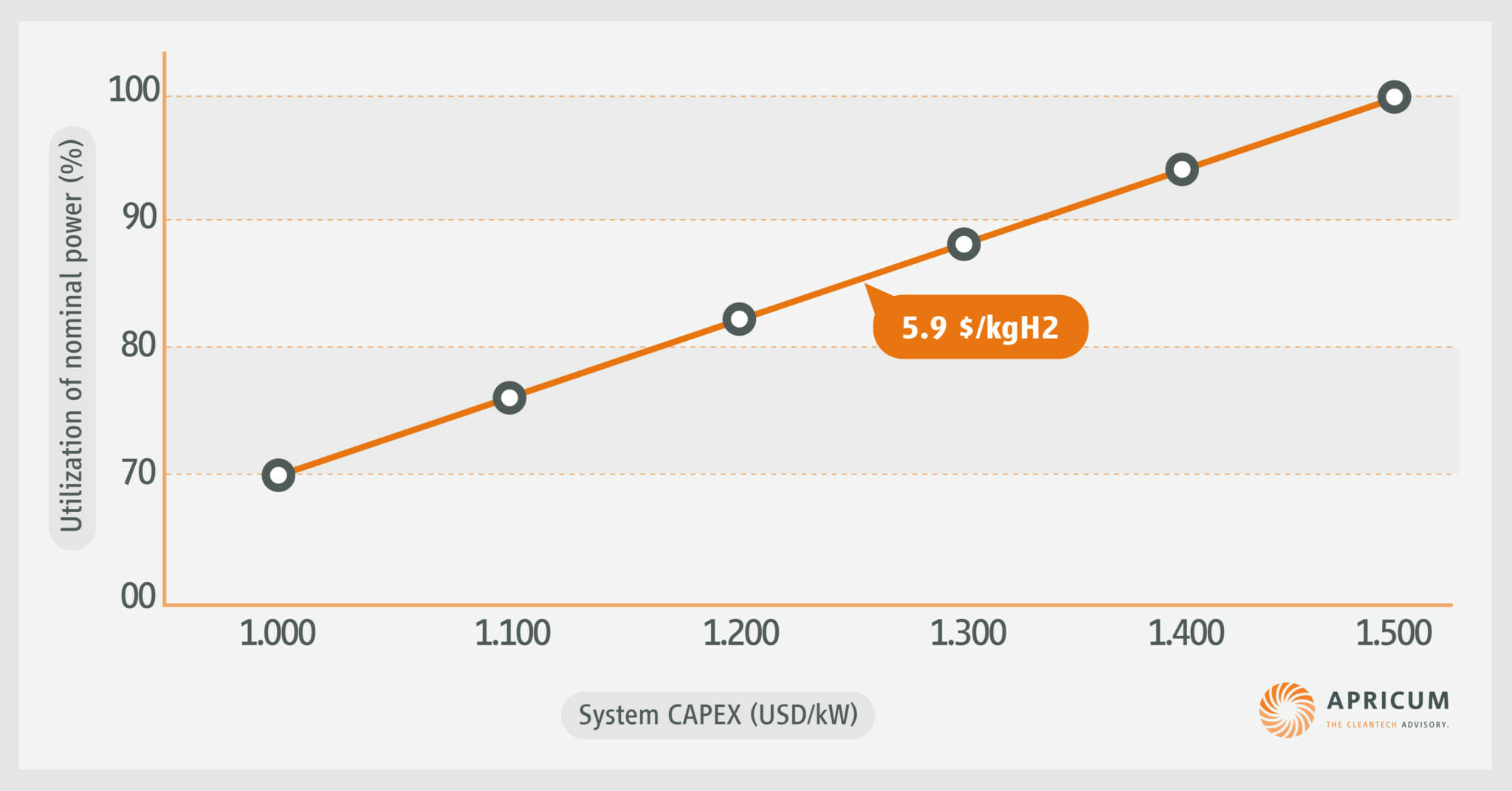

Whether or not PEM enables a reduction of levelized cost of hydrogen compared to alkaline depends on the project-specific size and value of the utilization benefit. This can be illustrated by an iso-cost curve for different utilization-rates and system CAPEX. A utilization benefit of ~10% points can justify higher investment cost of up to 15-20% points for a 10 MW reference project with a baseline utilization of 70% and a system CAPEX of 1,000 $/kW to maintain the levelized cost of hydrogen at 5.9 $/kg.[5] The maximum CAPEX difference which can be off-set by utilization would be 50% for the same reference project.

Source: Apricum Levelized Cost of Hydrogen (LCOH) model

To defend its market potential, PEM must maintain its flexibility advantage and reduce its investment cost in line with alkaline in the future. However, significant improvements can be expected for both technologies: Future advanced alkaline electrolyzers will provide extended load ranges and shorter start-up times by incorporating next-generation separators with improved gas barriers and enhanced electrolyte circulation protocols. At the same time, future PEM electrolyzers will likely be able to operate with lower amounts of platinum-group metals reducing their investment cost.

For the next decade, both technologies are projected to coexist given their complementary advantages. In the long-term future, hybrid systems are expected to be introduced combining alkaline-based electrolysis stacks operated with a baseload with additional PEM stacks to absorb temporary power peaks. Stakeholders must carefully follow the further development of technologies, regulatory frameworks and hydrogen applications to identify technology trends – and to decide which horse to bet on.

How Apricum can support

Apricum provides advisory services along the entire hydrogen value chain, leveraging a unique blend of expert strategy consulting, investment banking proficiency and deep technology & market know-how. Our support helps drive the global renewable energy transition by answering the key strategic questions faced by both established market players and new entrants with market assessments, strategy and business model development and review, competitive screenings, fund raising, M&A (sell-side, buy-side), due diligences and project finance.

This article was written by former Apricum Senior Consultant Dr. Fabio Oldenburg.

[1] Global manufacturing capacities are projected to reach 65 GW per year by 2030 based on company announcements

[2] The operation below the load limit would result in safety-critical gas mixtures

[3] Including cost for balance of plant, engineering, procurement and construction and delivery; lower range corresponding to selected Chinese manufacturers

[4] E.g., the EU’s delegated act (update published on 20 May 2022) requires green hydrogen to be produced from renewable energy sources either via a direct (physical) line, via an off-site physical PPA in which the electricity is produced and consumed simultaneously (within one-hour period). Hydrogen produced in a grid-connected operation mode is only considered green if >90% of the electricity share of the grid is renewable.

[5] Assuming a project lifetime of 20 years, 8% discount rate, 58 kWh/kgH2 energy consumption, 1% annual efficiency degradation and a 7-year stack replacement interval