Summary

- The business case for Home Energy Management Systems (HEMS) and Virtual Power Plants (VPPs) has become very compelling, both for energy retailers and end-customers, while enabling a higher integration of renewables

- Effective solutions and products require high levels of sophistication and face many other challenges such as customer acceptance and engagement

- Early market positioning is crucial to secure a lasting competitive advantage. Energy retailers that position themselves late could face substantial customer outflows

Understanding the potential for flexibility in households

To start assessing the potential for flexibility in households, we should first understand what HEMS and VPPs are, including what is and what isn’t a flexible residential asset. The industry seems to agree on the following categorization of household electrical consumption:

- Always-on assets (e.g., refrigerators) that require constant power supply and cannot be adjusted for flexibility – typically consuming 200–600 kWh/year for a 2–3 person household

- Behavioral assets (e.g., televisions, computers, hairdryers), which depend on immediate consumer needs and are not responsive to price signals – typically consuming 100–400 kWh/year for a 2–3 person household

- Flexible assets (e.g., heat pumps, electric vehicles, home batteries), which can be controlled remotely and (automatically) adjust operation through a mobile phone app via the cloud or a HEMS based on price signals. These assets may also exhibit behavioral constraints, such as heating demands when occupants are at home. While heat pumps and EVs can consume up to 10,000 kWh/year for a 2–3 person household, batteries and EVs can also store energy and sell it back to the grid when appropriate. Retailers use VPPs to aggregate these assets, creating a combined pool of flexibility that can be deployed to capture market opportunities such as ancillary services or wholesale arbitrage

HEMS and flexible assets, an unmissable opportunity for households

HEMS or apps connecting to individual flexible assets thus enable households to take control of their flexible assets, but also present a unique opportunity to reduce costs and CO2 emissions as they can shift the power consumption patterns of those assets to lower price periods. Over the year and at current retail power prices in Germany, a 2–3 person household could see its electricity bill reach up to ~€3,000 with a standard tariff, while customers with a dynamic or VPP tariff can already save between €300 and €1,000

or 10–30% on their electricity bill if their assets are managed effectively. This substantial saving potential is expected to further increase by 2030, as Apricum does not expect the trend of negative prices to revert soon. This will be the case especially in key markets such as Germany, driven by high renewable installations outpacing BESS installations.

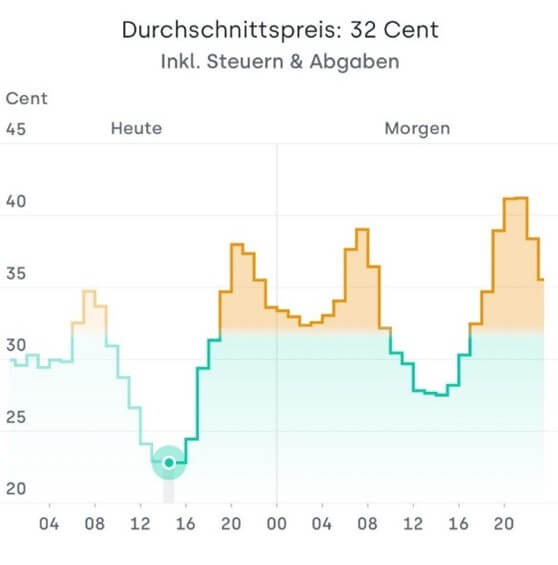

Figure 1: Illustration of a dynamic tariff. Source: Tibber

Next to that, as low power prices almost always correlate with low electrical grid carbon emissions, HEMS also indirectly enable households to lower their carbon footprint as they shift consumption patterns to low price time periods when the wind is blowing or the sun is shining. In carbon intensive grids such as Germany, this can make a big difference if we take an example of an EV: shifting the charging of an EV from a day of low renewables/higher price time period (e.g., at 500 gCO2/kWh for 50 kWh of charge) to e.g., a later point of the day with much higher renewables/lower prices (e.g., at 150 gCO2/kWh) would lead to a material reduction of 17 kg CO2. Extrapolating this over the year, smart charging of an EV simply by capturing low price points can help, in this case, save up to 500–700 kg CO2 per year.

As the sales of flexible residential assets grow and as retailers increase the maturity of their related products, the popularity of HEMS and VPPs will only increase. Flexible assets thus represent an unmissable opportunity, not only for the household, but also for retailers and the energy system. However, their management through HEMS or the cloud is complex and faces several challenges still today.

Challenges in scaling HEMS and VPPs: A complex path to commercial viability

Despite the relative high maturity of the VPP and flexibility market for B2B customers in a growing number of geographies, widespread implementation of HEMS and VPPs for B2C customers faces several more complex challenges. Key issues include:

- Cybersecurity: With numerous devices linked to a cloud, a HEMS or a mobile phone app, cybersecurity is paramount. While systems present today on the market do provide a certain level of security, retailers and VPP operators will need to cooperate closely with cybersecurity experts and companies to be constantly updated to avoid any breach which could impact thousands of households and destabilize the grid

- Compatibility and interoperability: Existing flexible assets vary widely in terms of technology and connectivity, posing challenges to create flexibility from older systems. For instance, a heat pump purchased 5–10 years ago might not yet be compatible with an advanced controller to enable its flexibility potential or with a HEMS solution. Key European players recently launched the Mercury Consortium to specifically tackle this challenge

- User acceptance and engagement: Many customers are still hostile to the idea of losing control of their flexible assets and having to manage them, even with the help of HEMS automation systems. Some retailers are trying to turn around this narrative by marketing the fact that customers would actually be taking back control of their assets. Favorable pricing schemes and lean user experiences are thus seen as a key enabler of adoption and engagement

- DSO registration requirement for VPP assets: In some markets such as Germany, VPP operators need to register customer assets through a lengthy process to the DSO relevant to the customer that can take up to 3–4 months

- Operational complexity for operators: VPP operators or energy retailers face a host of technical challenges to optimize diverse flexible assets in real-time while capturing market opportunities. To capture the best market opportunities, state-of-the-art modelling of prices & revenues is key. Additionally, retailers need to adapt their existing complex processes to capture the value of HEMS and VPPs

To address these challenges, initial market efforts have often focused on new-builds, which offer greater control and fewer legacy integration issues. New builds also serve as pilot projects, allowing suppliers to refine technologies and business models before scaling to existing buildings and legacy systems. One key capability that retailers need to master to unlock attractive value pools is tackling the operational complexity challenge. Here, two main strategies have emerged to enable customers to make the most of their flexible assets:

- Price signals and dynamic tariffs: This approach incentivizes customers to shift their energy consumption by offering rewards or flexible pricing based on hourly market rates. By using their HEMS/flexible asset to (automatically) respond to dynamic tariffs, customers can effectively capture attractive energy prices. While this approach is technically less complex for the retailer than VPPs, as it only requires them to forecast customer demand patterns to procure sufficient energy on the markets, it is not suited for all customers as some may prefer a more stable energy price, less engagement and less exposure to price spikes (such as experienced this past summer/autumn in Germany with the market decoupling event and the “Dunkelflaute”)

- Direct control agreements and VPPs: In this model, VPP operators gain partial contractual control over flexible assets such as heat pumps, EV chargers, and home batteries. In exchange, customers receive more favorable, long-term energy tariffs. While this strategy can create more value for the retailer, the customer and the grid, it also requires more state-of-the-art aggregation, prediction and optimization capabilities to account for behavioral factors (e.g., EV use patterns)

For energy retailers, the choice of strategy will depend on the level of sophistication they are comfortable investing in and their risk profile. A stepwise approach can also help to build capabilities and knowledge gradually while minimizing risks and investments.

About Apricum’s Digital Energy practiceApricum brings its market leading expertise in digital energy to bear in both its transaction and strategy advisory services. Our past clients include players in digital energy, materials and manufacturing, energy and utilities, and investment firms, such as E.ON, Octopus Energy, HV Capital, Haniel and Solytic. Key references include a commercial due diligence on the highly successful company 1Komma5° for a consortium of investors, transaction advisory support for the sale of smart grid solution provider Depsys and the DER management solution provider Upside Energy to Octopus Energy Group, and the conception and creation of a multi-party global joint venture of leading EV OEMs to create a platform to manage the flexibility of EVs. |

The first-mover advantage and long-term market positioning

With the market for HEMS and VPPs still emerging, early positioning is vital for energy retailers looking to gain and maintain a competitive edge. As a high barrier to entry type of market, those who establish their footprint now stand to benefit from greater market share, deeper customer insights, and enhanced predictive accuracy. Companies can thus develop a refined understanding of customer behavior, enabling them to better anticipate consumption patterns and maximize flexibility.

As HEMS and VPPs mature and customer awareness grows, the competitive landscape will shift. Utilities and suppliers who fail to invest in early-stage market entry or technological alignment may face significant customer outflows due to attractive customer propositions from successful players. The value proposition of HEMS and VPPs lies not only in cost savings but also in the environmental benefits they offer, and customers are expected to gravitate toward options that offer the best of both. Over the coming years, those with a proven track record in HEMS and VPP management will be positioned to provide the most competitive, attractive energy tariffs on the market.

How we can help you

Navigating the complex and evolving landscape of HEMS and VPPs requires expertise in both energy markets and customer behavior. Our advisory services are tailored to help utilities, hardware suppliers, and software vendors effectively enter and position themselves in this high-growth market. We provide:

- Strategy development and market entry support: Our team works with clients to analyze market opportunities and develop tailored entry strategies and business models taking into account both regulatory environments and customer demand patterns. We offer insights into both the technological and operational requirements of deploying HEMS and VPP solutions.

- Technology assessment and partner selection: With numerous hardware and software options on the market, selecting the right combination of technologies is essential. We assist clients in evaluating solutions that best align with their operational needs and growth strategies, ensuring compatibility and interoperability across systems.

- M&A and commercial due diligence: organic growth is not the only way to market entry. Our team is highly experienced in M&A process support, whether on the buy-side or sell-side, and has also extensive experience in commercial due diligence, including in the HEMS and VPPs space

- Process development and implementation PMO: When integrating technologies and services from third party partners, your company might require expertise to review existing processes and/or develop new ones. Our experienced team can provide support tailored to your needs

Our strategic and transaction advisory teams offer a comprehensive approach to ensure that utilities, suppliers, and software/hardware vendors are well-prepared to navigate the HEMS and VPP market, empowering them to capture market share and position themselves for sustained growth.

Conclusion

The shift toward HEMS and VPPs marks a transformative moment for energy utilities and technology providers, offering a path to a win-win situation for the grid, customers and retailers. By proactively positioning in this market, players can seize a first-mover advantage that will prove crucial as competition intensifies and customer expectations evolve. Our expertise in strategy, market analysis, and transaction advisory equips clients to make informed, forward-thinking decisions that drive growth in this critical sector.

If you’re ready to explore the opportunities in HEMS and VPPs, contact Apricum Managing Partner Nikolai Dobrott to learn more.

This article was written by former project manager Henri Bittel.