- The global market for green data centers, focusing on sourcing power from renewable energy and reducing environmental effects, is predicted to grow at a CAGR of nearly 20% from 2022–2026[1]

- Innovative solutions to increase the sustainability of data centers are on the rise, such as highly efficient cooling technologies and data centers purely powered by solar energy

- While GCC countries account for less than 1% of the global data center market share (in terms of revenue in 2022)[2], the data center market in the Middle East and North Africa (MENA) is expected to grow at a CAGR of more than 20% during 2022–2028, with a total market volume of $2.7bn in 2022[3]

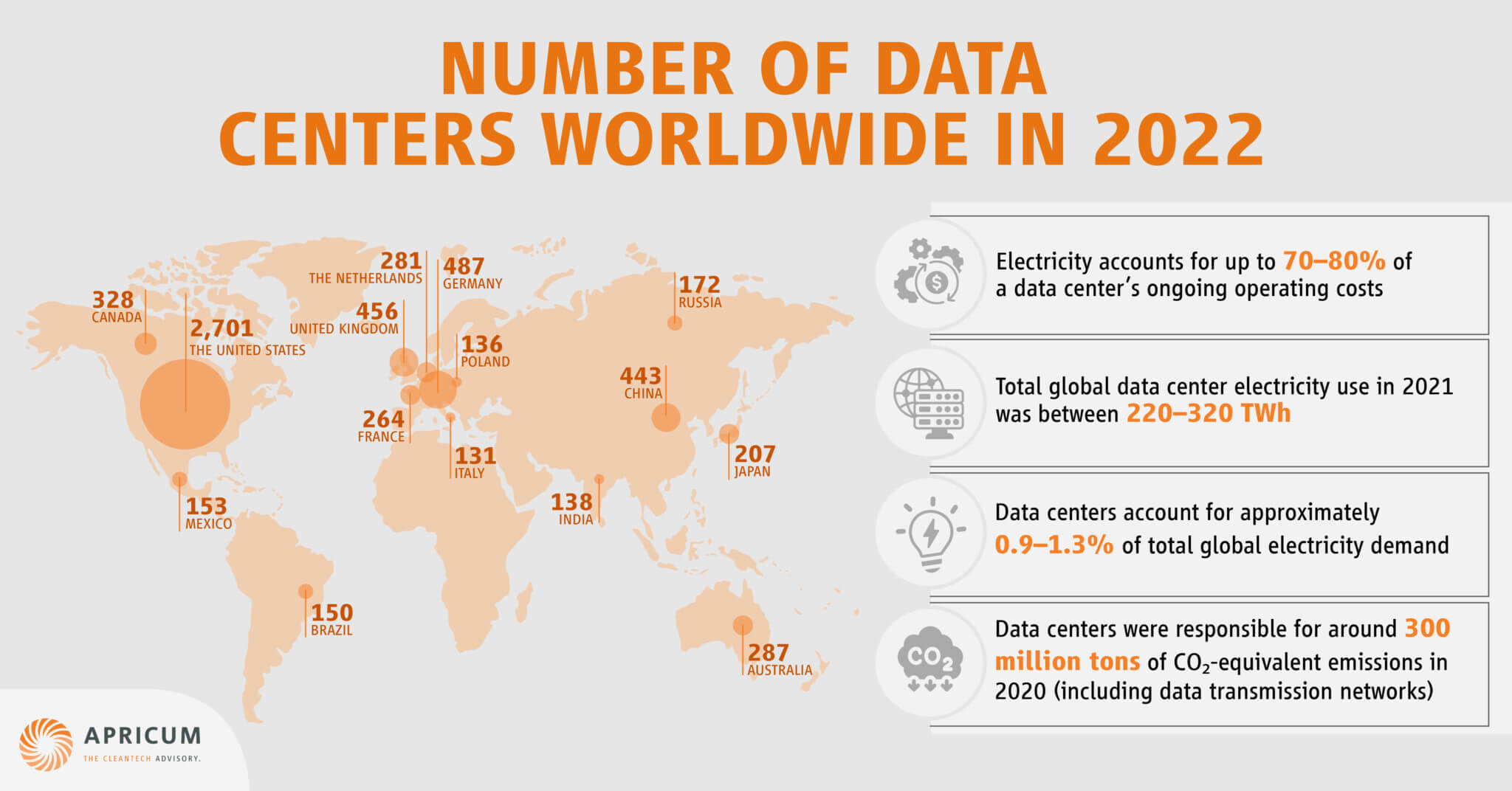

Data centers, large buildings that house the digital world’s physical hardware, have a voracious appetite for energy. The IEA (International Energy Agency) estimates the global data center electricity use in 2022 to have been about 240-340 TWh. This corresponds to around 1-1.3% of the worldwide electricity demand and is responsible for around 330 Mt CO2-eq in 2020 (including data transmission networks).[4] With the continuously increasing internet traffic and digitalization of services, that number is expected to increase further.

At the same time, electricity costs account for a large proportion (up to 70–80%)[5] of a data center’s ongoing operating costs. To save energy costs, data center operators are strongly incentivized to increase the efficiency of their data centers. In addition, using renewable energies, such as solar power, allows data center operators to reduce their carbon footprint and meet sustainability requirements.

Innovative solutions to increase the sustainability of data centers are on the rise.

The most popular metric to calculate the energy efficiency of a data center is power usage effectiveness (PUE). The PUE describes the ratio of the total facility power of the data center (the total energy consumption of the data center) to the required power for the IT equipment, which includes servers, storage, and telco equipment.[6]

The more efficient a data center is, the lower the share of electricity required for cooling, lighting or other electricity consumption not linked to power IT equipment. This moves the PUE closer to 1, which would be an ideal case. According to a survey of the Uptime Institute, the average annual PUE in 2022 was 1.55[7], while modern, state-of-the-art facilities centers achieve PUEs very close to 1, such as Google, with an average PUE of 1.1 for their data centers.[8]

THE RISE OF RENEWABLY POWERED DATA CENTERS IN THE GCC

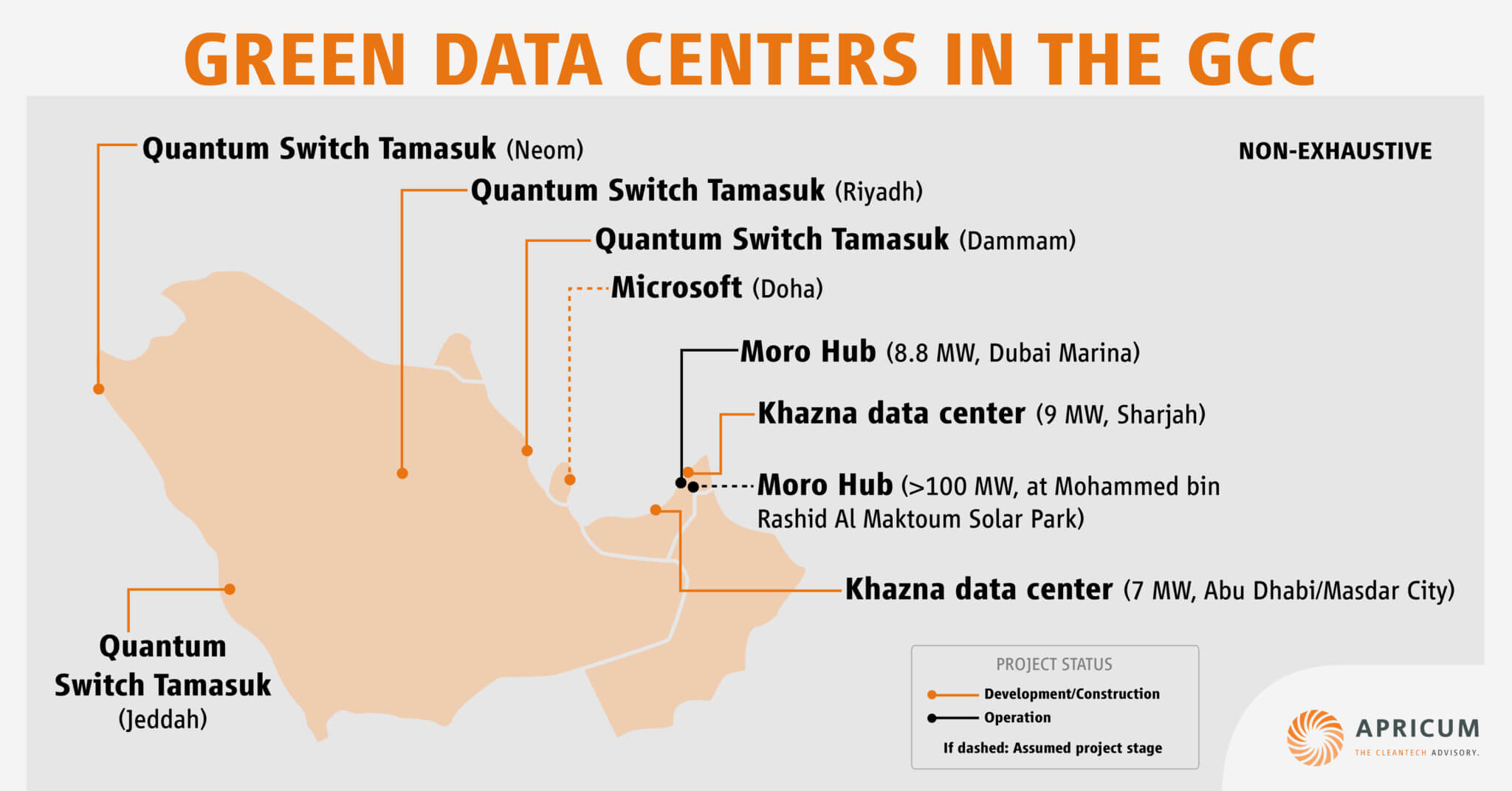

The demand for sustainably operated data centers is also gaining traction in the GCC region. An example of this development is the Moro Hub on the outskirts of Dubai, which is fully powered by solar energy and owned by Dubai Electricity and Water Authority (DEWA). The 100 MW data center is, according to Guinness World Records, the world’s largest solar-powered data center, based on its physical size of more than 16,000 m2. The required electricity for the facility is being sourced from the adjacent Mohammed bin Rashid Al Maktoum Solar Park, with a capacity of 3 GW from PV and concentrated solar power (CSP).[9]

One of the key challenges for developing green data centers in the GCC is the region’s hot climate that creates higher cooling requirements, and therefore further increasing energy costs. However, by using innovative and modern cooling technologies such as the use of nitrogen for cooling purposes or alternatively placing the data centers beneath the seabed, those challenges can be overcome. At the same time, the GCC region offers advantages due to its very high solar potential and associated low levelized costs of solar energy.

WHY SAUDI ARABIA IS AN ATTRACTIVE MARKET FOR DATA CENTERS

Unlike Asia or Europe, the GCC region does not have a fixed data center hub yet. Many reasons suggest that such a digital hub could be established in Saudi Arabia. The Kingdom has a strategic location between Africa, Europe, and Asia. The significant domestic demand, abundant energy resources, sufficient space, and political will are further supporting this trend. In October 2021, the Ministry of Communications and Information Technology of Saudi Arabia announced a series of initiatives to develop and build data centers across various regions of the Kingdom, primarily powered by renewable energy. The overall target of the initiatives is to build data centers with a total capacity of 1,300 MW before 2030. The Saudi Ministry of Communications and Information Technology expects this to result in domestic and foreign investments of over $18bn in data centers and renewable energy, in line with realizing the goals of Saudi Vision 2030.[10] The growth is also accelerated by ongoing developments such as improved inland connectivity through increasing availability of 5G and Fiber-to-the-Home (FTTH) and has been further boosted by COVID-19.

The trend is underlined by another announcement made by NEOM Tech & Digital Company, which is responsible for the development of the IT infrastructure serving the NEOM megaproject: With the project ZeroPoint DC, a $500m JV of NEOM Tech & Digital Company with EdziTek, colocation and managed services for NEOM and the EMEA region will be offered. The hyperscale data centers are to be powered with 100% renewable energy.[11] For the first phase of the project, 3 data centers are planned with a total capacity of up to 36 MW from renewable sources. Furthermore, Oracle has been secured as an anchor tenant[12], which announced to invest “significant capital” in Middle East and Africa, considering the region as one of its top growth regions for adapting cloud services.[13]

Another factor driving demand for data centers in Saudi Arabia is increasing regulatory requirements: with the introduction of the Personal Data Protection Law (PDPL) and the Cloud Computing Regulatory Framework, several localization requirements have been introduced.[14],[15] According to these policies, data transfers outside Saudi Arabia are only permissible under certain circumstances and are largely prohibited for Saudi governmental data. Through these regulatory policies, other companies serving Saudi customers (in particular banks and insurance companies) may need to relocate their IT infrastructure to within the kingdom. This could be a massive driver of data center demand in the region, comparable with the developments in the European data center industry after the introduction of the General Data Protection Regulation (GDPR) by the EU.

Switching to renewable electricity can bring hard economic benefits for data center operators: Saudi Electricity Company charges around SAR 0.3/kWh (about $0.08/kWh) for commercial consumers.[16] In contrast, the cheapest bids for PV tender in the world, also achieved in Saudi Arabia, have been offered at a world record low of only $0.0104/kWh for a 600 MW project.[17] Even though the bid price is not fully comparable to the utility tariff as it does not include other taxes or fees, it gives an idea of how enormous the potential for the direct supply of green electricity for data center operators can be. Through green PPAs, data center operators can simultaneously take advantage of the high solar irradiation in the kingdom and decrease the carbon footprint of their business model. At the same time, the risk of future electricity price increases can be reduced by locking in prices for a longer period.

Saudi Arabia’s goal of becoming a data center hub for the region is ambitious. Achieving it will require having competitive energy prices, strong PPA frameworks and supporting local academia in developing new cooling methods.

The authors would like to thank Daan Terpstra for his valuable contribution to the article.

HOW APRICUM CAN HELP

Apricum is a global transaction and strategy advisory firm dedicated to renewable energy and cleantech with offices in Berlin, Paris, London and Dubai and representatives around the world. We have exceptional experience and knowledge about cleantech in MENA, covering both the up and downstream value chains. Our unique blend of strategy consulting and transaction advisory helps clients with both direction and execution and over 15 years we have delivered over 350 successful projects in 30 countries.

With regards to data center infrastructure in MENA, we can assist in a complete spectrum of services from conducting market analysis on the best use of energy sources for data centers, conducting partner search (connecting interested foreign investors with local renewable energy providers in the MENA region), assisting in creating the JV between the partners followed by creating a business plan for the JV and support you with any investment banking services (including corporate and asset M&A, debt and equity fundraising).

If you would like to learn more about how we can support your company in expanding your activities in KSA, please contact Kris Ignaciuk or Nikolai Dobrott.

[1] https://www.researchandmarkets.com5653705/green-data-center-global-market-report-2022/reports/

[2] https://www.statista.com/outlook/tmo/data-center/worldwide#revenue

[3] https://store.rationalstat.com/store/middle-east-north-africa-data-center-market-analysis-forecast/

[4] https://www.iea.org/energy-system/buildings/data-centres-and-data-transmission-networks

[5] https://cyrusone.com/wp-content/uploads/2018/04/CyrusOne_ER-007-2016_Build-vs-Buy.pdf

[6] https://www.techtarget.com/searchdatacenter/definition/power-usage-effectiveness-PUE

[7] https://uptimeinstitute.com/resources/research-and-reports/uptime-institute-global-data-center-survey-results-2022

[8] https://www.google.com/about/datacenters/efficiency/

[9] https://www.datacenterdynamics.com/en/news/guinness-world-records-confirms-dubais-moro-hub-is-worlds-largest-solar-data-center/

[10] https://www.mcit.gov.sa/en/news/saudi-arabia-expands-plan-develop-digital-infrastructure-build-and-enable-mega-data-centers

[11] https://cognitive.neom.com/assets/NEOM%20Tech%20Digital_FAQ_Oracle%20EzdiTek.docx

[13] https://www.thenati#_ftnref12onalnews.com/business/technology/2022/11/13/oracle-plans-significant-investment-in-middle-east-as-cloud-competition-intensifies/

[14] https://iapp.org/news/a/how-to-prepare-for-saudi-arabias-personal-data-protection-law/

[15] https://www.dlapiper.com/en-om/insights/publications/2021/04/saudi-arabia-releases-version-3-of-its-cloud-computing-regulatory-framework

[16] https://www.se.com.sa/en-us/Customers/Pages/TariffRates.aspx

[17] https://www.pv-magazine.com/2021/04/08/saudi-arabias-second-pv-tender-draws-world-record-low-bid-of-0104-kwh/